Stocks

Trade CFD Stocks on top corporations with competitive trading conditions

Why TRADE CFD Stocks and ETFs with Tickmill?

Explore opportunities in top-class stocks and exchange-traded funds across multiple industries and benefit from:

- Reliable trading on our powerful MT5 platform.

- No Commissions.

- Dividend payments.

- 0.20s Average execution speed.

- All trading strategies enabled.

- Leverage up to 1:20

HOW-TO

Trade CFD Stocks and ETFs

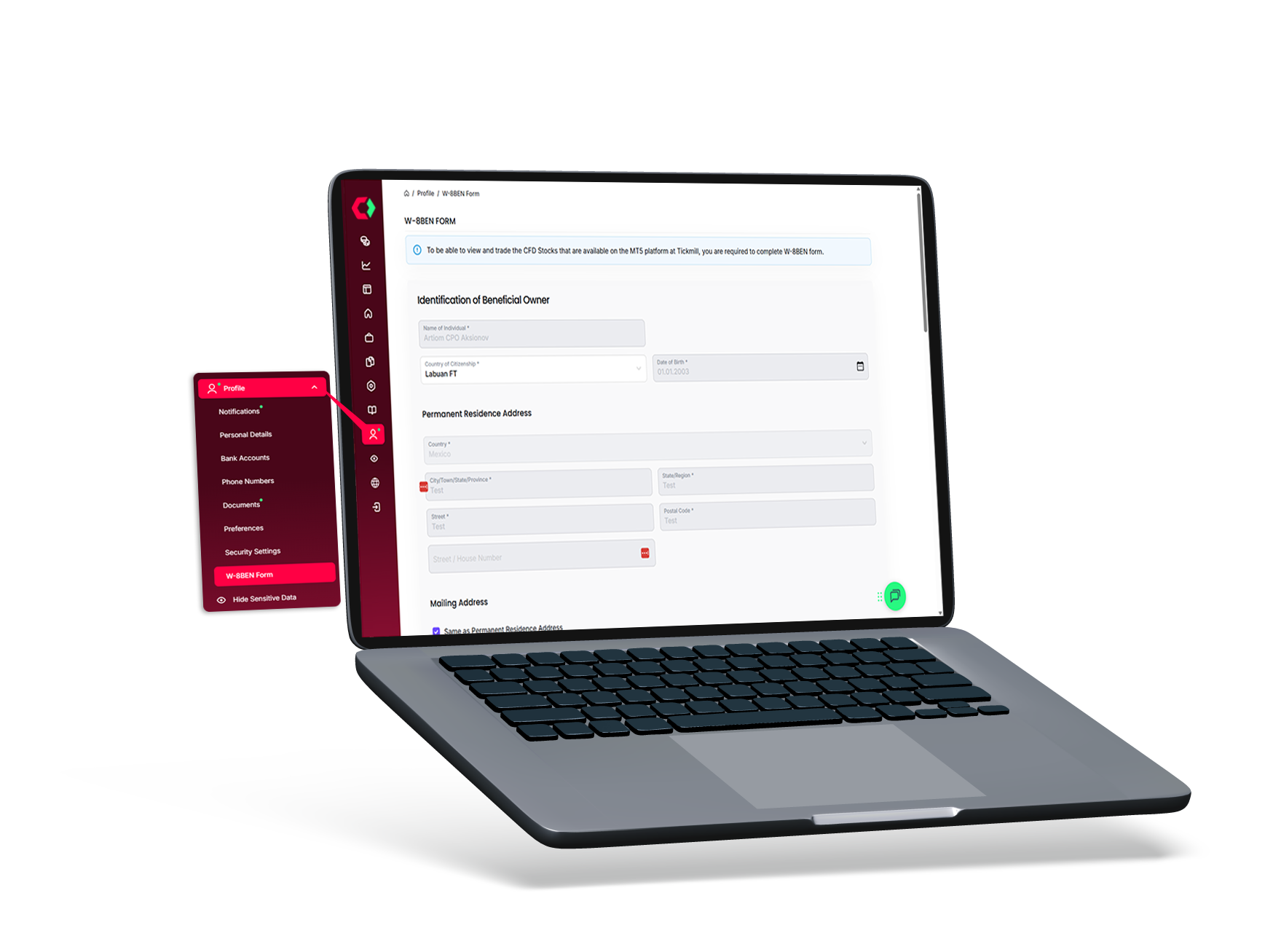

To trade CFD Stocks and ETFs, you are required to complete the W-8BEN form that is available in the Client Area.

To complete the W-8BEN Form follow these simple steps:

- Login to the Client Area.

- Click on the drop-down menu where your name is displayed.

- From the drop-down menu select ‘W-8BEN Form’.

- Complete the form and sign it (the name and signature of the account holder must match) and press ‘Submit’.

Once the form is successfully submitted, a pop-up window will notify you that you can trade stocks and you will view all the stocks that are available on the MT5 platform. When you next login to the MT5 trading platform, make sure to right-click in the ‘Market Watch’ window and select ‘Show All’ in order to be able to view all available CFD Stocks and ETFs.

*Corporate clients are required to complete the W-8BEN-E form available here and upload it through Document management in Client Area.

What are Stocks?

Stocks represent an asset class that allows an investor to own a part of a company and even have voting rights depending on the type of shares issued. Shareholders receive part of the company’s profits based on the amount of shares they hold.

Stocks are usually sold on the stock market. Companies go public and issue stocks as a means to build capital and grow their business. Investors on the other hand, buy stocks to diversify their portfolio and seek to gain profit from stock price movements.

By trading CFDs on Stocks with Tickmill, you may go long or short on a range of individual stocks of renowned companies including Apple, Amazon, Goldman Sachs, Nike and McDonald’s and take advantage of market movement without owning the underlying asset.

What are Stocks ETFs?

ETFs (Exchange-Traded Funds) are investment funds which track the performance of multiple stocks or other financial products. That means that by trading CFD ETFs you can get immediate exposure to more stocks or even multiple sectors.

Many investors trade ETFs to get a better diversification, as trading baskets of different stocks doesn’t expose them to one single stock or sector, but to different stocks with different performances.

Some of the most popular ETFs include the SPY (SPDR S&P 500 ETF Trust), the QQQ (Invesco QQQ Trust, Series 1), and the TQQQ (ProShares UltraPro QQQ ETF). The first one is based on the S&P500 Index, while the other two are based on the Nasdaq-100 Index.

What are Dividends?

Shareholders receive dividends. Dividend payment represents the amount shareholders receive from the profits of a company in which they hold shares, and this is determined by the board of directors of a company. Stay informed about key financial events and earnings reports with our Earnings Calendar.

Although CFD traders do not own the underlying shares, they are still affected by certain corporate actions, such as dividends. In the case of dividends, these corporate actions trigger adjustments to CFD positions. These adjustments are not dividends in the traditional sense but are designed to offset the price changes that typically occur on the ex-dividend date. For long positions, a positive adjustment is credited to the account, whereas short positions incur a deduction.

The dividend is usually stated in terms of monetary value, for example, how many dollars each share will yield, but can also be referred to as a percentage of the market value of the share, a term also known as dividend yield.

Ex-Dividend

When it comes to dividend payments, it is important to follow the dates on which payments are scheduled, as these determine the shareholders who are eligible for the next dividend payment.

The date on which the dividend eligibility expires is called the ex-dividend date. If an investor owns shares the day before the ex-dividend date, they receive the next dividend payment. For long positions in share CFDs, the dividend payment is subject to a reduction based on the applicable withholding tax rate.

Important Note: During times of significant increase in market volatility on single stocks due to upcoming earnings reports and/or corporate actions, leverage may drop to 1:5 to protect clients from higher exposure.

Stocks Trading Hours

Trade popular CFDs on stocks on our world-class MT5 platform!

GMT TIME

Monday – Friday 13:35 - 19:55 (GMT time)

*Note: Trading hours are subject to change without prior notice. Liquidity Providers may adjust trading schedule as necessary, depending on market conditions.

START TRADING with Tickmill

It’s simple and fast to join!

Full Name

Country

Client Type

Email Address

REGISTER

01

REGISTER

Complete registration, log in to your Client Area and upload the required documents.

Create account

Account Type

Currency

Leverage

CREATE AN ACCOUNT

02

CREATE AN ACCOUNT

Once your documents are approved, create a Live Trading account.

Deposit 1

Select Account

Deposit 2

Select Deposit Method

MAKE A DEPOSIT

03

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.