Daily Commodity Coverage: 26 Sep, Thursday

Asia stock market are poised for a bounce after U.S. stock market ended in gains. The S&P 500 dropped 0.62%, ended a three-day losing streak. Yields on US 10-year Treasuries rose toward 1.75%.

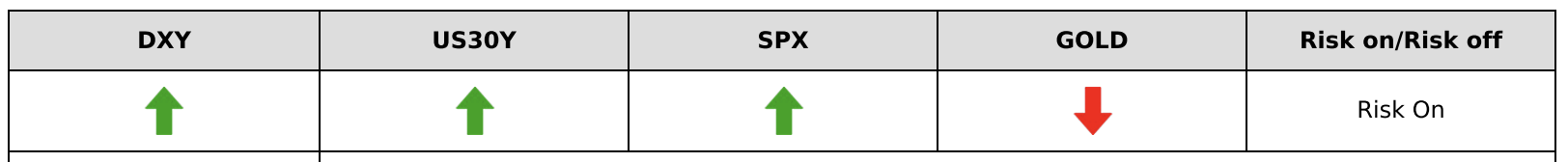

Market turns risk-on after U.S.-China trade tensions ease. Trump said a trade agreement with China is getting “closer and closer” and there’s a “good chance” a deal can be reached. Beijing is starting to make big purchases of items such as beef and pork, the president added. Meanwhile, A summary of a July phone call on Wednesday showed Trump hadasked Ukrainian President Volodymyr Zelenskiy to investigate Biden and a company that employed his son. As the impeachment turmoil escalates, investors see more optimism in the trade deal. As Trump may face pressure from domestic political tensions, he may have more incentives to reach a deal with China. As market is laser-focused on the trade tensions, it becomes a good news to investors. The risk-on sentiment may persist for a while before more details are released on the trade front.

USDCHF

Technical Analysis:

Fundamental Analysis:

USDCHF | Bearish ↓ | ★☆☆

26 Sep: CHF is likely to continue the fall as optimism grows over the trade deal. Domestically, the Credit Suisse in Sep came -15.4, better than -37.5 in August. Financial expectations keep on falling from -7.7 in April 2019 to -37.5 in August 2019. The Credit Suisse Economic Expectations is a leading indicator of economic health – investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity. Although the number is still negative, but it seems the economy isrecovering from recent bottom. In a data light day, CHF is likely to follow the risk sentiment and drop from recent high.

NZDUSD

Technical Analysis:

Fundamental Analysis:

NZDUSD |Neutral | ★☆☆

26 Sep: With yesterday's RBNZ's rate decision of keeping things unchanged, the Kiwi rallied however the rally was short lived as NZD pulled back against the US Dollar erasing all of the gains made after the announcements. Despite US President Trump's speech mentioning that China would like to make a deal (previously, he also mentioned that there could be an earlier than expected trade deal), it seems that Wall Street Journal's news report mentioned that US levied further sanctions on a few top-tier Chinese firms for importing oil from Iran. Further threats to impeach President Trump are still very much alive. The focus now is more on trade and politically linked events. We turn neutral on NZD for now.

USDCAD

Technical Analysis:

Fundamental Analysis:

USDCAD | Neutral | ★☆☆

26 Sep: As expected, the Loonie drifted further sideways but still holding above it's key support against the USD at 1.324. According to action economics, global markets however remained volatile and events driven. Canada's close neighbour, US, is currently under going an internal dispute on concerns about the impeachment of their US president. However the risk appetite picked up as the impeachment of President Trump seems unlikely as of now as the Ukraine transcript shows nothing condemning. Also, there was hardly any change in oil prices causing the movement of the CAD to be muted. Looking forward, there will be a average weekly earnings news later today. We expect little to no change for earnings release. As such, we remain neutral on CAD.

USDNOK

Technical Analysis:

Fundamental Analysis:

USDNOK | Neutral | ★☆☆

26 Sep: NOK moved sideways during Asia's trading session as there was no fresh news and the price of oil also moved sideways. Domestically, while unemployment has been falling over the last few years and labour market looks to be stabilising, yesterday's LFS unemployment data came out higher than expected. Unemployment has slightly increased from 3.6% to 3.8%. This news release was seen as marginal as investors are more concerned about the global economy as a whole. We remain neutral on NOK but are ready to turnbearish on it should there be any adverse news shock.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Desmond Leong runs an award-winning research firm (The Technical Analyst finalists 2018/19/20 for Best FX and Equity Research) advising banks, brokers and hedge funds. Backed by a team of CFA, CMT, CFTe accredited traders, he takes on the market daily using a combination of technical and fundamental analysis.