Bitcoin Battling Around Key Level

Choppy Price Action

Bitcoin remains on watch ahead of the weekend as the futures market continues to battle around the $108,855 level. Uncertainty around US/China trade relations remains the key driver for bitcoin prices. Volatile headlines this week, oscillating between optimism and pessimism have been well reflected in the choppy price action we’ve seen through the week. An initial push higher on news that trade talks had been scheduled this week ultimately faltered as Trump downplayed the likelihood of a meeting between himself and Xi next week in Korea.

US/China Trade Talks

However, with trade talks underway in Malaysia tomorrow there is hope that deal can be agreed ahead of Nov 10th. BTC is higher today on that exact viewpoint. If talks progress well tomorrow and we see positive headlines through the weekend, this should help bolster risk appetite into next week, lifting bitcoin prices. However, if talks stumble and the weekend brings negative news flow, this cold see BTC gapping lower at the open on Sunday. As such, plenty of two-way risk near-term for the market.

Corporate Demand

Away from US/China trade news, the broader backdrop remains encouraging for BTC. We’re seeing news of an increasing number of corporates adding BTC to their treasuries, reflecting growing mainstream demand. It was reported this week that Tesla booked profits of $80 million in Q3 on its BTC holdings, a headline expected to feed into increased corporate demand through year end as companies look to position for an expected rally as the Fed continues easing into next year.

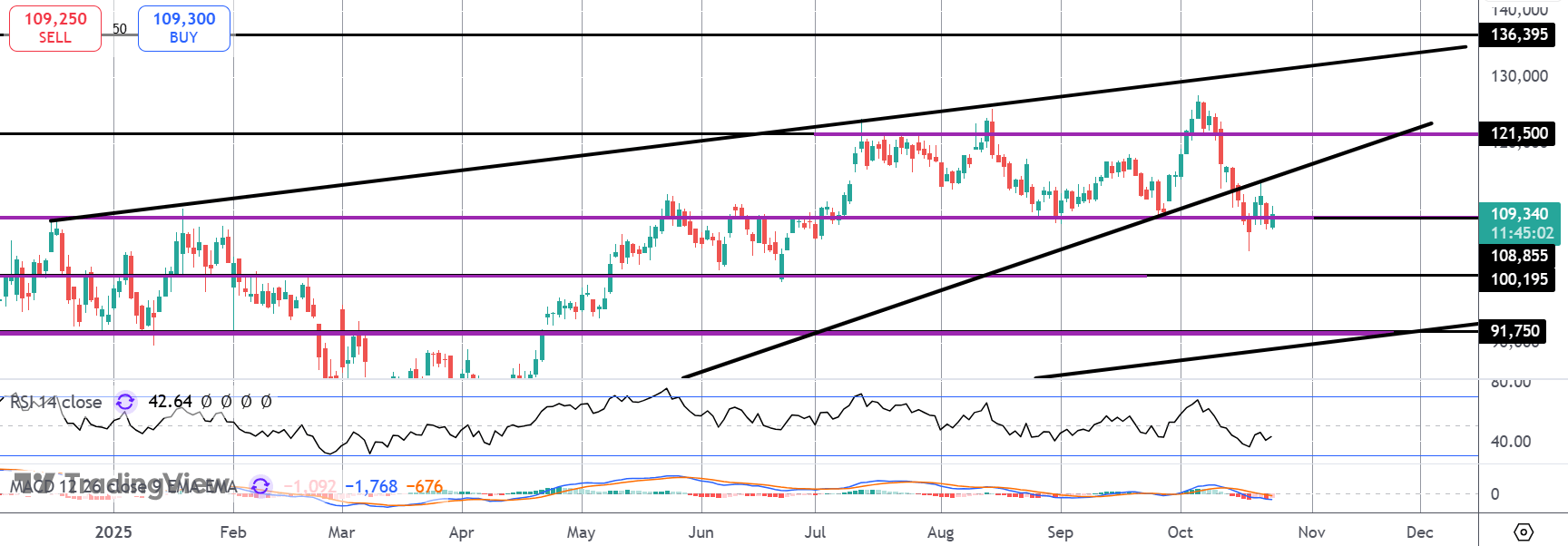

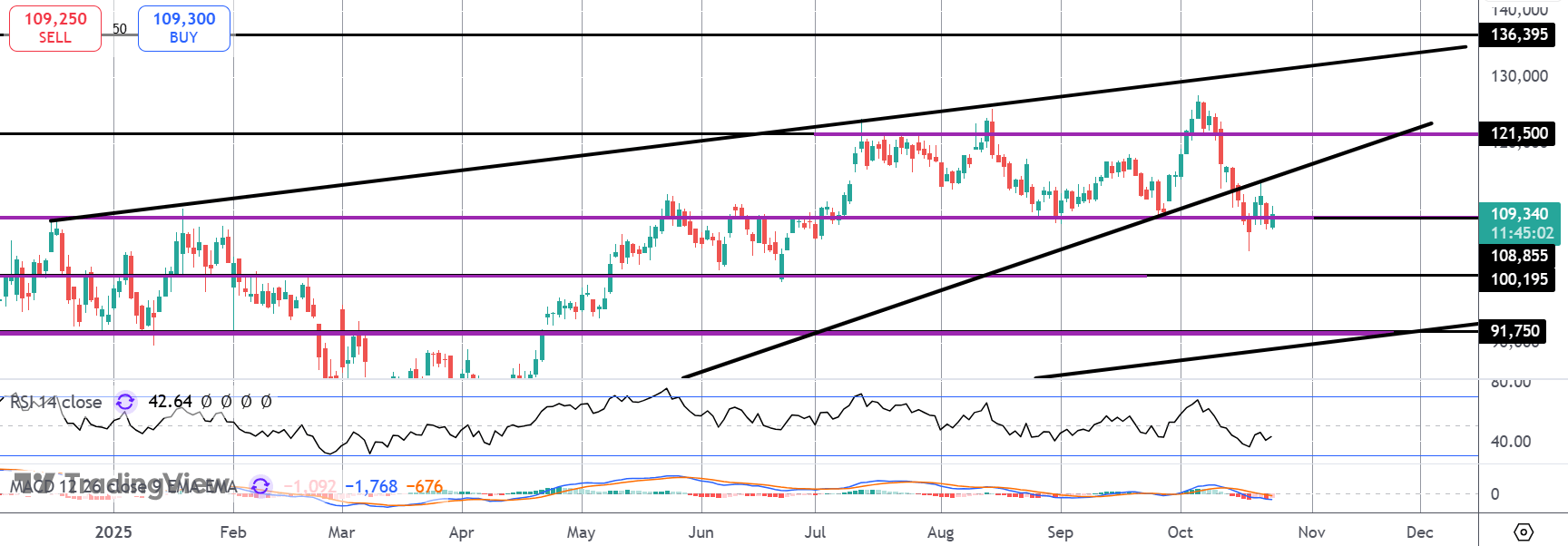

Technical Views

BTC

For now, BTC continues to fight it out around the $108,855 level. This is a key pivot for the market with bulls needing to hold above here to keep focus on furtehr upside near-term. Below, the $100k mark is the next key support to watch. For now, the outlook remains bullish though sideways action is likely to persist awhile longer before upside resumes.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.