Dollar struggles to rise amid positive sentiment in US stock market

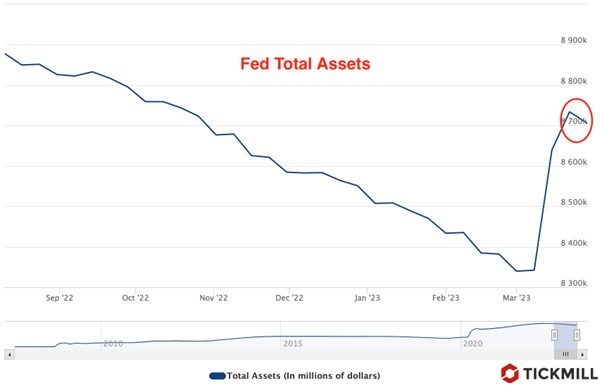

On Tuesday, the dollar is struggling to rise, consolidating around the 102 level. Positive sentiment in the stock market and stress indicators in the US banking system suggest that the potential for further dollar decline is growing. For example, the Fed's balance sheet, which has reflected bank demand for liquidity in recent weeks (due to a new emergency lending channel), is declining again:

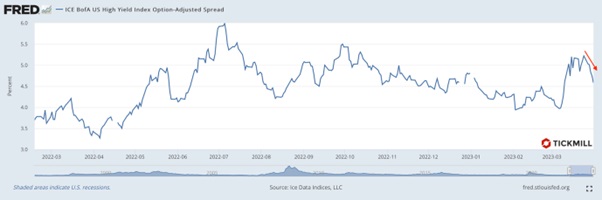

Credit spreads between AAA and high-yield bonds continue to narrow after a brief spike in mid-March, indicating that demand is shifting from defensive instruments to higher-yielding assets:

The technical picture also points to risks of the dollar breaking through the 102 level and moving towards the February low of 100.50:

In March, US manufacturing activity was weaker than expected, with the corresponding index falling to 46.3 points, according to yesterday's report from the ISM. Today, the market is focused on the JOLTS job openings report, with the number of open vacancies expected to fall from 10.8 to 10.4 million. The Fed has previously noted that the JOLTS job openings indicator is among the labour market indicators taken into account. The higher it is, the stronger the labour market deficit in the US, and the more negative consequences there are for inflation. Among the Fed's goals is to achieve unemployment and labour growth rates that will ensure moderate consumer inflation. When there is a shortage of workers (labour supply), an unwanted overheating of the economy can occur.

On Thursday, data on activity in the services sector will be released, followed by the US labour market report (NFP) on Friday. The main risk is strong indicators that will push the Fed back to its previous aggressive position (before the events at SVB Financial). Markets have largely revised the potential for Fed tightening this year (up to a 25 bp hike and then a subsequent pause) as a result, indicating that risks are tilted towards a downward market correction if the economy continues to demonstrate resilience. However, the technical picture of the dollar shown above suggests the opposite: markets are counting on a surprise in the form of weak indicators.

Отказ от ответственности: предоставленные материалы предназначены только для информационных целей и не должны рассматриваться как рекомендации по инвестициям. Точка зрения, информация или мнения, выраженные в тексте, принадлежат исключительно автору, а не работодателю автора, организации, комитету или другой группе, физическому лицу или компании.

Прошлые результаты не являются показателем будущих результатов.

Предупреждение о рисках: CFD-контракты – сложные инструменты, сопряженные с высокой степенью риска быстрой потери денег ввиду использования кредитного плеча. 72% и 73% розничных инвесторов теряют деньги на торговле CFD в рамках сотрудничества с Tickmill UK Ltd и Tickmill Europe Ltd соответственно. Вы должны оценить то, действительно ли Вы понимаете, как работают CFD-контракты, и сможете ли Вы взять на себя высокий риск потери своих денег.

Фьючерсы и опционы: торговля фьючерсами и опционами с маржей несет высокую степень риска и может привести к убыткам, превышающим ваши первоначальные инвестиции. Эти продукты подходят не для всех инвесторов. Убедитесь, что вы полностью понимаете риски и принимаете соответствующие меры для управления своими рисками.