What's Driving Crude Prices Higher?

Summer Demand Expectations

Crude prices are shrugging off the impact of a stronger US Dollar and weaker China data this week with crude futures seen pushing up to fresh highs for the month. The market has rallied firmly off the 72.61 level and is now up almost 8% off the June lows. The key driver behind the move has been the increased demand expectations at the start of the summer driving season in the US and Europe. Jet fuel demand is also typically seen higher over the coming months which is expected to help pull the market into a deficit. Indeed, in a note released this week Goldman Sachs said that its tracking of global stocks and OECD commercial stocks shows that deficit is already beginning to show after two months of surplus.

US Data & Fed Commentary

Looking ahead this week, alongside the focus on demand expectations (crude inventories on Thursday will be key to watch), traders will also be tracking movements in USD. The latest US retail sales due later today alongside US PMIs later in the week will be the key data focus. We also have a slew of Fed speakers due across the week, beginning later today. Any fresh upside in USD in response to bullish data or hawkish commentary might create headwinds for crude. However, should we see any USD weakness, this should amplify demand for crude in near-term.

Technical Views

Crude

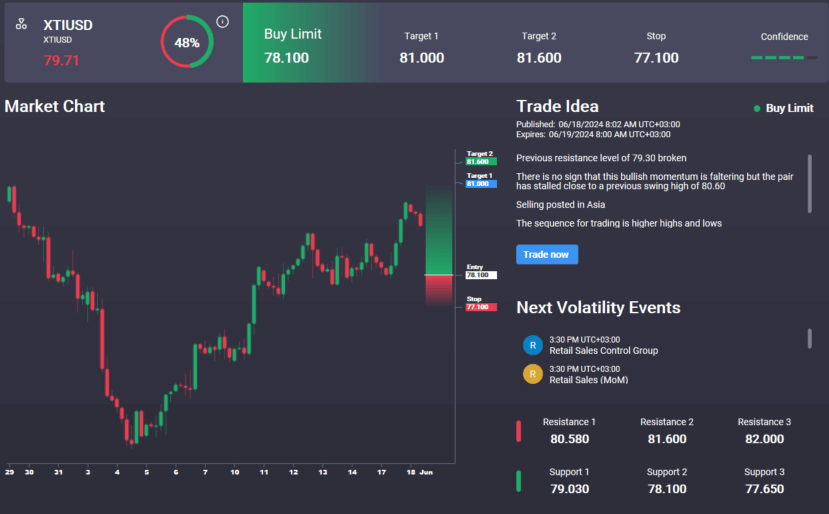

The rally in crude has seen the market breaking out above the recent bear channel and above the 77.64 level. With momentum studies bullish, focus is on a continuation higher near-term and a fresh test of the 82.59 level and retest of the broken bull trend line off last year’s lows. In the Signal Centre today we have a buy limit set at 78.10, suggesting a preference to buy into any dip from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.