Shutdown Fears & Fed Expectations

USDJPY has come under heavy selling pressure through early European trading on Monday. The US Dollar is slipping ahead of a potential US government shutdown this week which will take effect on Wednesday unless a last-minute deal can be agreed ahead of US fiscal year-end tomorrow. The uncertainty is feeding into negative Dollar sentiment and runs the risk of delaying Friday’s jobs report. Given the importance of this upcoming labour market data in determining the likelihood of a further Fed rate-cut in October, traders are exiting USD out of caution this week fuelling a rise in safe havens such as JPY and Gold, which has broken out to new all-time highs today.

Hawkish BOJ Expectations

Alongside the uncertainty and dovish Fed expectations weighing on USD, JPY is also rising as traders continue to project furtehr BOJ tightening to come. With inflation still high in Japan and BOJ governor Ueda noting the resilience of the Japanese economy against US tariffs, traders continue to expect further easing. Speaking recently Ueda warned that a tightening job market is expected to push wages up further, keeping inflationary pressure entrenched. The clear divergence between the Fed and the BOJ means that USDJPY has room to fall lower near-term. Should a US government shutdown emerge this week, the sell-off in USDJPY is expected to deepen.

Technical Views

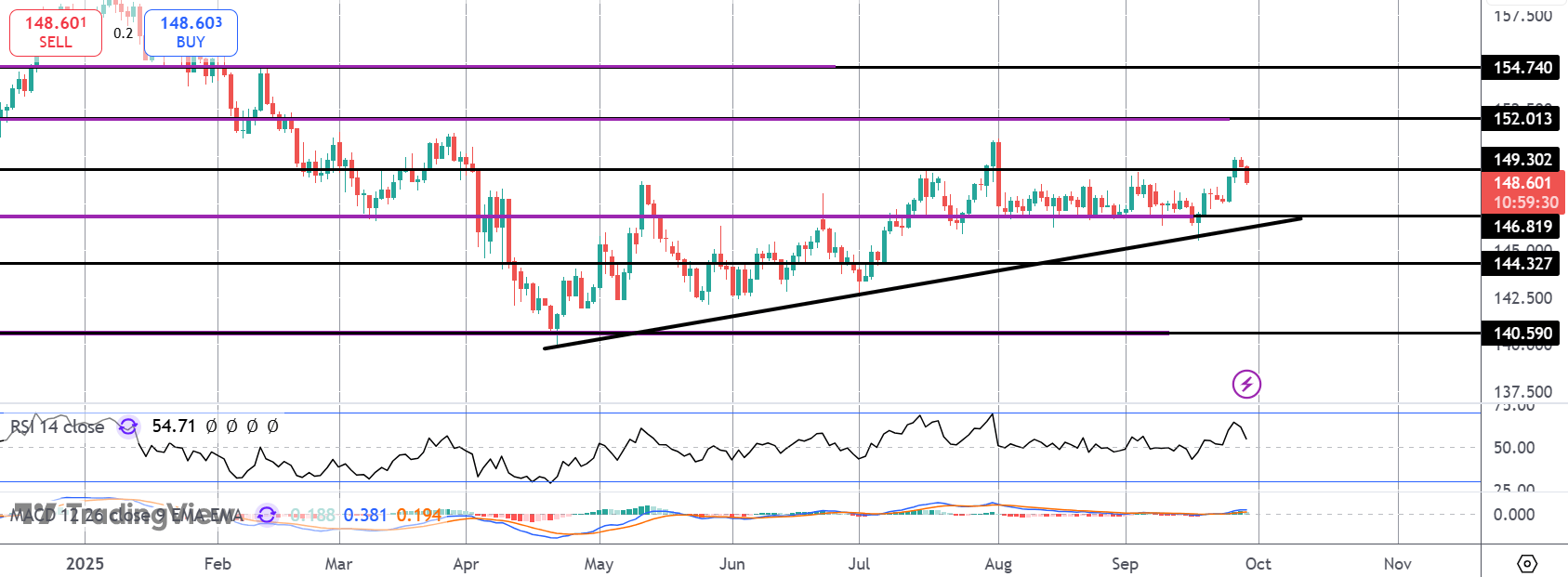

USDJPY

The rally in USDJPY has stalled for now with price slipping back under the 149.30 level. While 146 .81 and the bull trend line hold as support, however, the focus remains on furtehr upside with 152.01 the next objective for bulls. Should current support break, however, 144.32 is the next support level to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.