The FTSE Finish Line - September 11 - 2024

The FTSE Finish Line - September 11 - 2024

FTSE Falls Into The Red, Reversing Early Gains On US CPI Concerns

Wednesday saw a further decline in London stocks, investors were cautious as traders reacted unfavorably to U.S. inflation statistics, and markets quickly repriced a lower probability to a 50 basis point rate decrease at the Federal Reserve meeting next week.

Throughout the session, the blue-chip FTSE 100 was down 0.5%. Rightmove Plc's shares fall by almost 2% to 657.80p in single stock stories, placing it among the top percentage losses on the FTSE 100 index. Australia's REA Group made a buyout offer of 5.6 billion pounds ($7.32 billion) in cash and stock, but Britain's leading real estate web Rightmove turned it down, saying the offer undervalued its future. At A$ 197.99, REA shares are down 2.2%. Even with the session's losses, Rightmove's stock has increased by about 15% so far this year.

The stock price of British pest control business Rentokil Initial fell by 20%, the lowest since April 2020. Both the pan-European STOXX 600 index and the main market index in London had the lowest performance for the company. At first, Rentokil warned of impending downturn in its biggest market, North America, and revealed plans to reduce employment. The company said that its cost-cutting efforts were meant to address cost overruns as it moved past the peak season, but it did not indicate how many positions would be affected. July and August sales for Rentokil Initial in North America fell short of expectations, and the company projects 1% organic revenue growth from the business in the second half of the year. Jefferies analysts voiced concerns on the early stage of branch integration progress and the absence of growth recovery despite further expenditure.

On the positive side of the ledger the asset manager Intermediate Capital Group's shares increased by 4.1% to 2,190p, making it the highest gainer on the FTSE 100 index. The company's flagship direct lending strategy, Senior Debt Partners (SDP), was effectively funded at $17 billion, surpassing its initial target of $11 billion to $12 billion. The European direct lending market remains attractive for investment through various economic cycles, as emphasized by Peter Lockhead and Mathieu Vigier, co-heads of SDP, in their commentary on the development. ICGIN shares have increased by approximately 30% year-to-date.

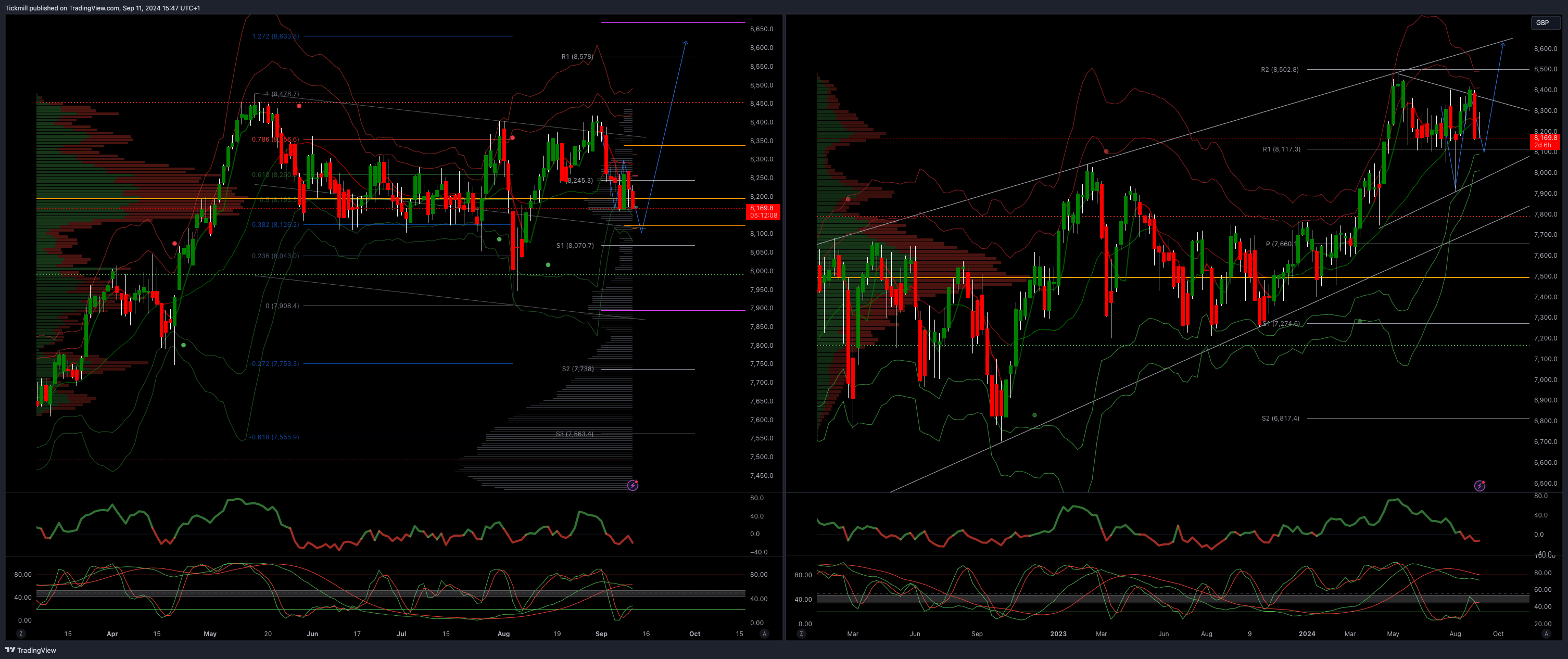

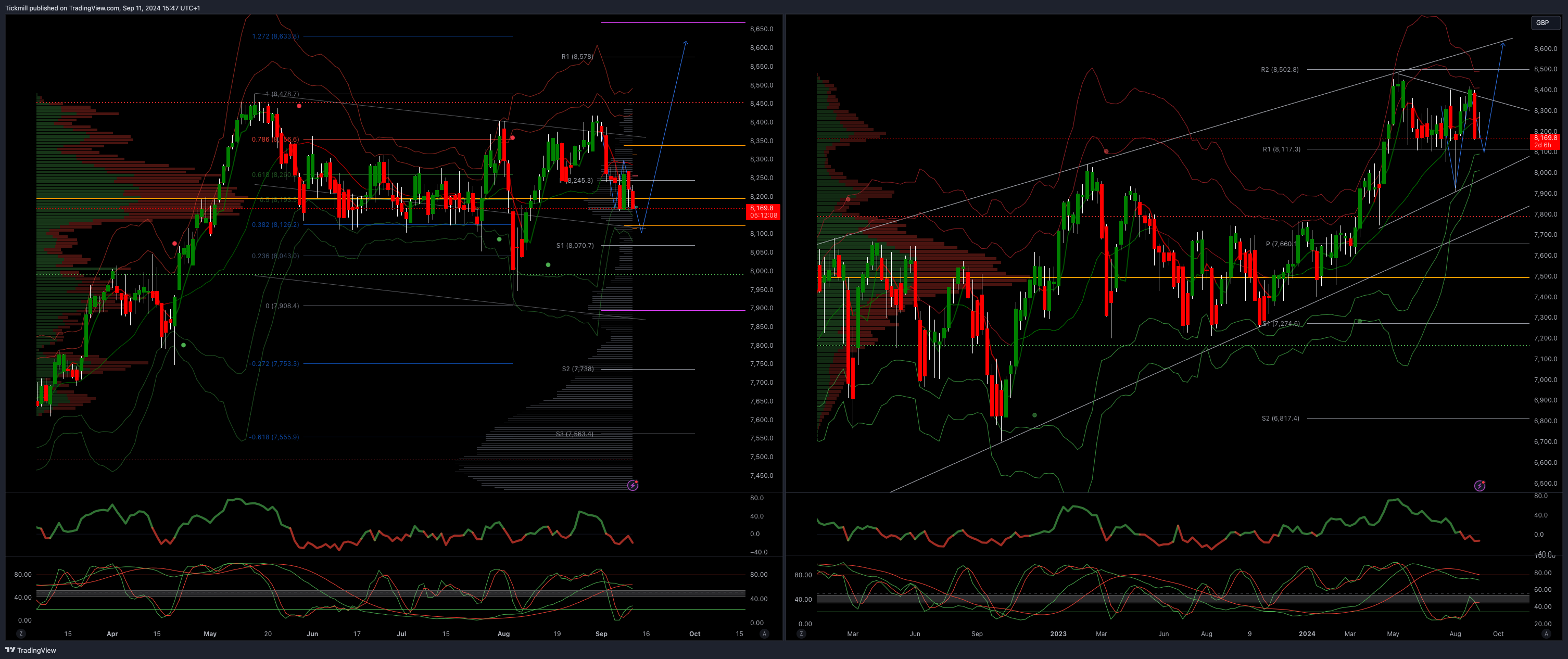

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!