The FTSE Finish Line - November 19 - 2024

FTSE Softens As Geopolitical Tensions Soar

London's main stock indexes gave up early gains and turned lower on Tuesday, with the midcap index hitting a more than three-month low as geopolitical tensions between Russia and the United States over Ukraine flared up. The export-focused FTSE 100 dropped 0.4% after touching a one-week high earlier in the session. Banks were the biggest drags on the large-cap index, with Barclays, Lloyds, and HSBC down over 1.1% each. Globally, safe-haven assets such as gold and the U.S. dollar traded higher after Russia updated its nuclear doctrine by lowering its threshold for a nuclear retaliation, and reports said that Ukraine used long-range U.S.-made missiles for the first time. The attention this week will be on Wednesday's inflation data, after Bank of England Governor Andrew Bailey stated that upcoming interest rate increases should be more gradual, following tax changes in the recent government budget, which retailers have indicated could contribute to price pressures.

Single Stock Stories:

Vesuvius, a British steel and foundry specialist, saw its shares rise 7.8%, making it the top gainer on the FTSE midcap index. The company has launched a new 50 million pound ($63.18 million) share buyback program, and its three-year cost-savings program is proceeding as planned. Jefferies analysts note that while end-markets have been challenging heading into the second half of the year, Vesuvius has managed costs well, keeping its full-year core profit expectations in line with market estimates. However, the company expects its trading profit for the 2024 fiscal year to be slightly below the 2023 fiscal year on a constant currency basis. Despite the session's gains, the stock is still down 17.4% year-to-date.

Shares of Imperial Brands, a cigarette manufacturer, have risen by 2.9%. The stock is the top gainer on the FTSE 100 index.The company reported a 4.6% rise in adjusted operating profit to £3.91 billion ($4.95 billion), exceeding analysts' expectations of a 4.3% increase. The company expects operating profit to grow close to the middle of its mid-single-digit range next year. The company remains on track to deliver about £10 billion in capital returns over the next five years.The stock has gained 32.9% year-to-date as of the last close.

Diploma Plc, a provider of technical products and services, saw its shares decline by 3.9%, marking the biggest loss on the FTSE 100 index. The company reported FY revenue of 1.36 billion pounds ($1.72 billion), missing analysts' estimates of 1.37 billion pounds. Additionally, the company's FY adjusted operating profit of 285 million pounds fell short of the estimated 282.61 million pounds. However, Diploma Plc expects an organic growth of around 6% at constant currency for FY25. According to LSEG data, eight out of the 12 analysts covering the stock have a "buy" or higher rating, while four rate it as "hold," with a median price target of 4,850p. The stock has seen a year-to-date increase of approximately 26.63%.

Technical & Trade View

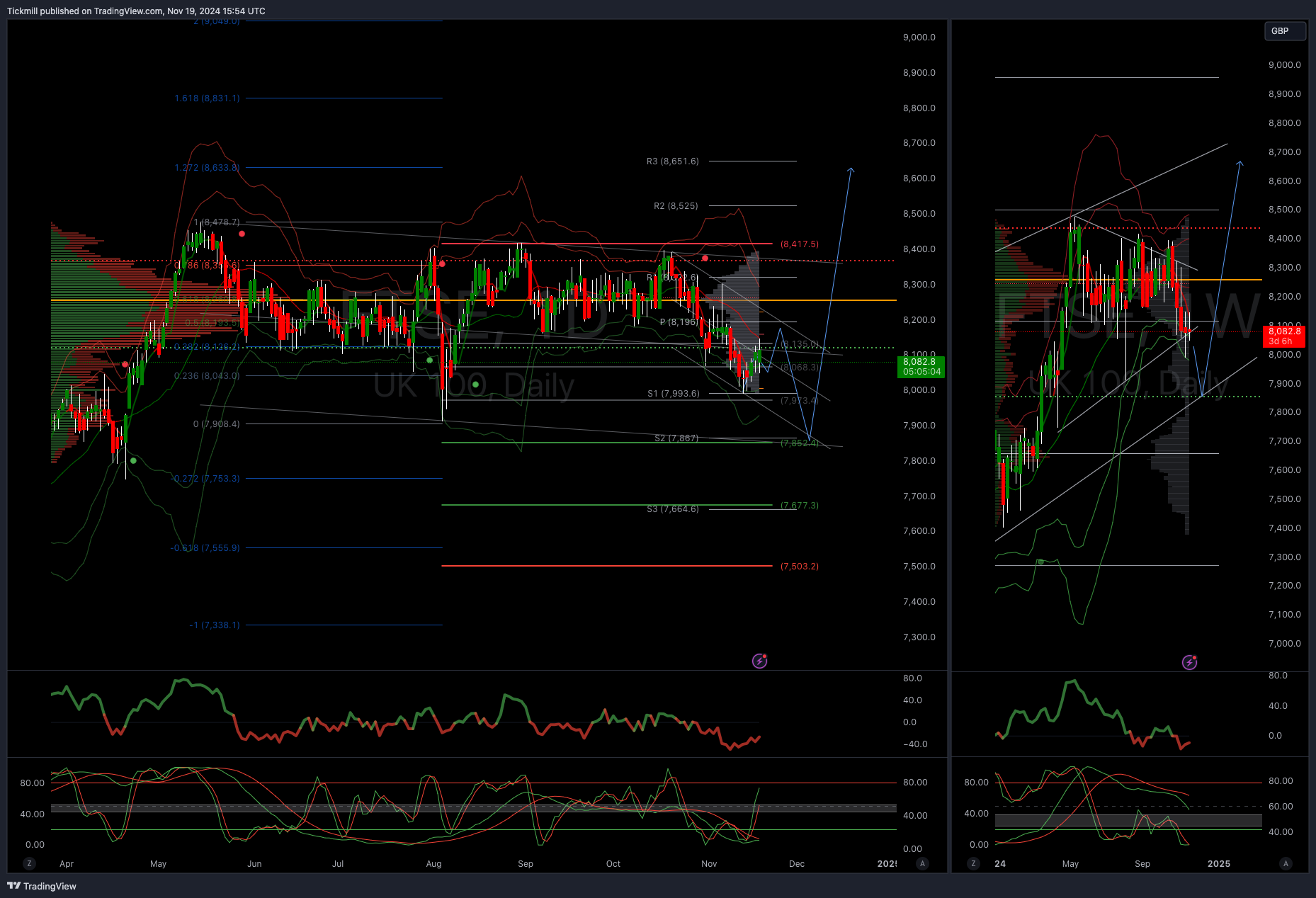

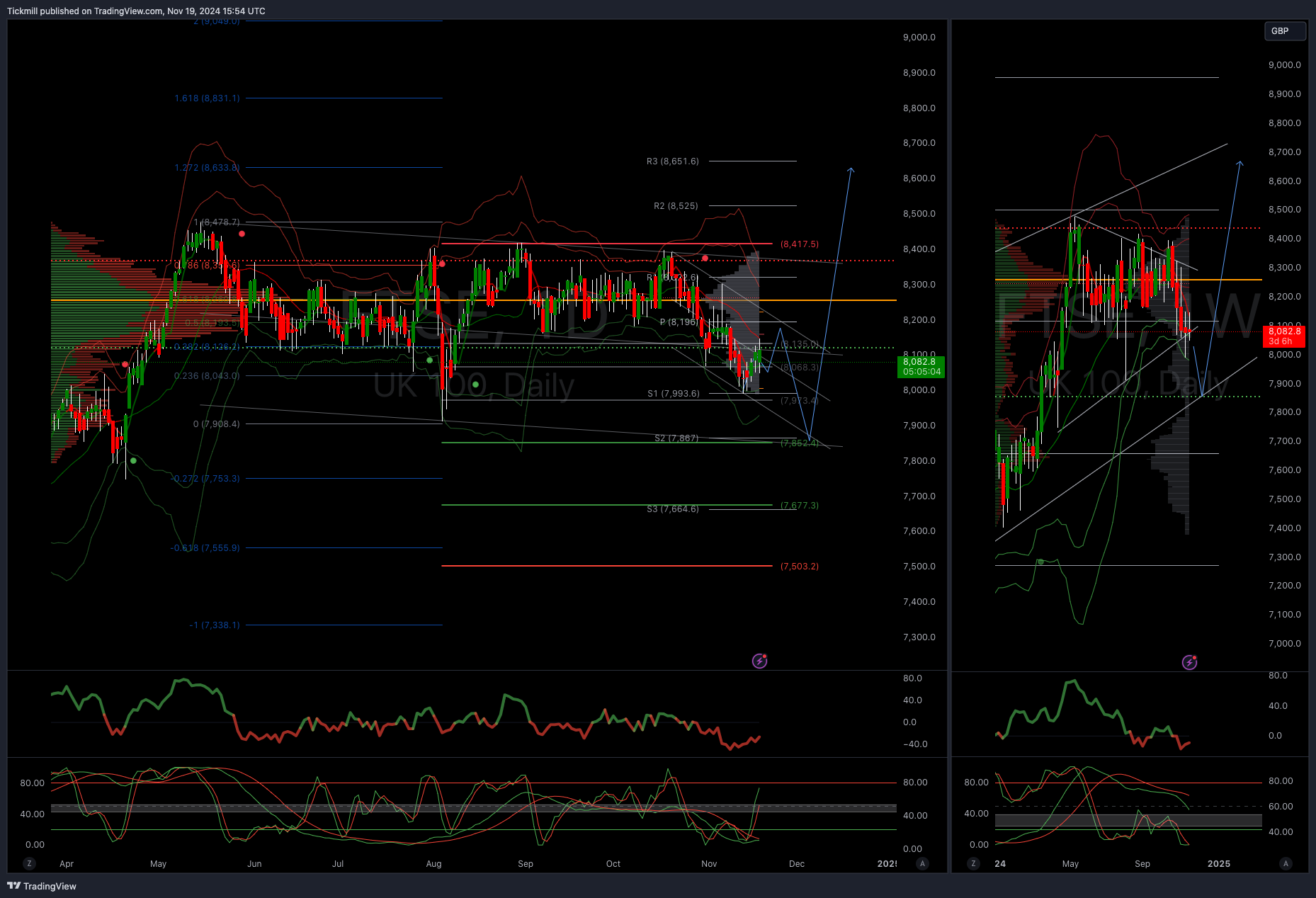

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!