The FTSE Finish Line - June 28 - 2024

The FTSE Finish Line - June 28 - 2024

FTSE Hits Four In A Row

The leading stock index in Britain started the day with gains on Friday but has not managed to maintain the momentum and is now rotating around the flatline, however, the FTSE is heading towards its fourth consecutive quarterly increase, as stronger-than-expected local economic growth figures outweighed investor concerns. Official data revealed that Britain's economy expanded by 0.7% in the first quarter of the year, surpassing the previous quarter's growth of 0.6%. These numbers come as the country prepares for parliamentary elections on July 4, where polls indicate a potential leadership change with Labour Party leader Keir Starmer potentially replacing Conservative Prime Minister Rishi Sunak.

UK sportswear retailers experienced a decline in their stock prices following a warning from Nike regarding their sales forecast for 2025. Shares in JD Sports and Frasers have dropped by approximately 6% and 2% respectively. JD, the largest sportswear retailer in Britain, saw a significant decrease of up to 6.6% to 118p, making it the top percentage loser on the FTSE blue-chip index. Frasers, which is a retailer for Nike and owns various sportswear brands, also experienced a decline of up to 2.2% at 862.5p. This comes after Nike's surprising forecast of a drop in revenue for 2025 due to weak demand, as consumers are showing a preference for newer brands such as On and Hoka. Following this news, Nike's shares fell by about 12% after the bell on Thursday. JD's stock has decreased by 28% and Frasers' by approximately 5% so far this year.

Auction Technology Group's stock price dropped by 10% to 50 pence after private equity firm TA Associates sold 6.1 million shares in an accelerated bookbuild at 525 pence per share, which is a 5% discount to the previous day's closing price of 556 pence. This caused the shares to fall to their lowest level since May 16. Following the completion of the share placing, TA Associates will hold approximately 12.6% of ATG's issued share capital.

Safestore Holdings Plc, a British self-storage firm, experienced a 3.2% decrease in its stock price, falling to 757 pence. This decline came after Morgan Stanley downgraded the company to "equal-weight" from "overweight" and reduced its price target to 850p from 980p. The downgrade was attributed to cost pressures that significantly impacted Safestore's first-half earnings, which are expected to take time to recover due to delays in the development pipeline. The report also highlighted that the earnings will be most affected in 2025, with nearly 900,000 sq ft scheduled for completion and a peak negative contribution to Safestore's profit and loss. Morgan Stanley noted that equity markets tend to penalize companies with irregular development contributions, and Safestore is beginning to fall into that category. The stock has declined by approximately 14% year-to-date, including the losses in the current session.

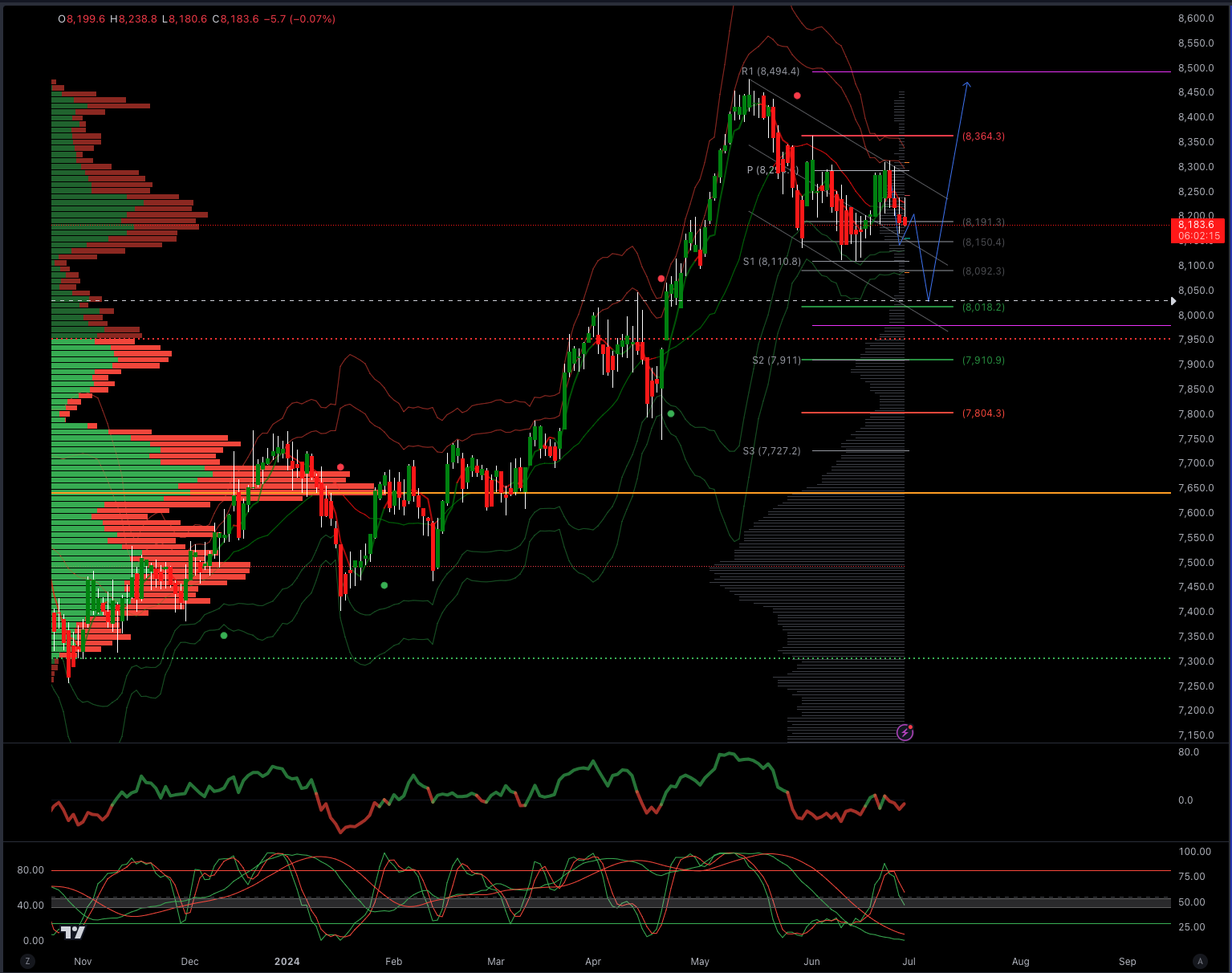

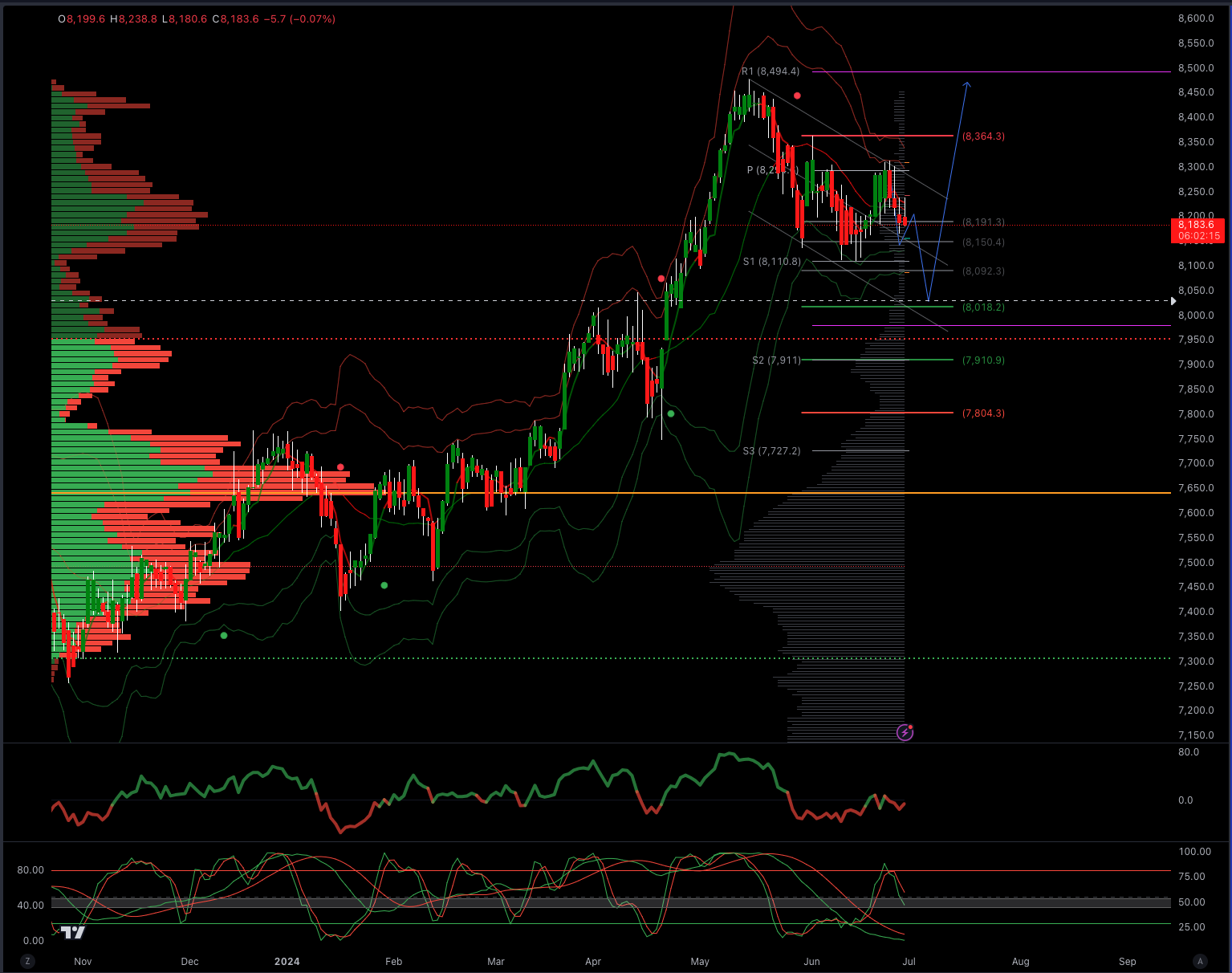

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8300

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bearish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!