The FTSE Finish Line - July 9 - 2024

The FTSE Finish Line - July 9 - 2024

BP Earnings Disappointment Weighs On The Blue Chip Benchmark

On Tuesday, London's FTSE 100 showed little movement as a drop in the stock of energy company BP was balanced out by broader gains. Investors are monitoring Federal Reserve Chair Jerome Powell's testimony before the U.S. Congress. The main FTSE 100 index was down 0.6%, while the FTSE 250, which was in focus after the Labour Party's election victory, also decreased. The energy sector was a drag on the market with a 0.7% decrease, driven by a drop in BP's stock. In 2024, BP's stock gains were erased by a 3.4% slide following a warning about Q2 performance. The company expects lower refining margins and subdued oil trading to negatively impact Q2 earnings, with an anticipated $500-$700 million hit from refining margins and $1-$2 billion in impairment charges. Additionally, BP projects that Q2 upstream production will be roughly flat compared to Q1. As a result, the stock is now down 1.6% for the year, reversing the 1.8% gain as of the previous close and making it the top loser on the FTSE 100 index.

Vistry, a UK-based company, experiences a rise in its stock value by up to 2.8% to 1,329p, making it one of the top percentage gainers on the FTSE 100 index. The British housebuilder anticipates a 7% increase in its half-year profit to reach 186 million pounds ($238.2 million), driven by strong demand for its affordable homes from housing associations and the rental segment. Vistry also reaffirms its 2024 targets for homebuilding of over 18,000 units and predicts profits to surpass the previous year. According to Investec, the company's strategic decision to focus on partnerships seems well-timed given the new government's priorities. The stock has increased by approximately 41% year-to-date as of the last close.

Capita, a British outsourcing firm, is set to sell its standalone software business, Capita One, for 200 million pounds to a unit of U.S.-based MRI Software. This news has caused Capita's shares to jump by 20.6% to 18.7p, reaching a more-than-four-month high. Before the deal is completed, Capita will receive a cash dividend of 4.8 million pounds from Capita One. The proceeds from this sale will be used to help the company reduce its debt. Despite a 15% year-to-date decrease in CPI stock, the company maintains its medium-term guidance for the continuing group.

Later in the week, the U.S. will release consumer price index figures and Britain will release its GDP data, which could potentially impact the direction of future interest rate cuts in both economies. In corporate updates, Indivior Plc experienced a sharp decline of 36.7% after announcing plans to reduce its workforce by about 130 employees and revising its profit outlook for the year. Additionally, Recruiter PageGroup saw a significant drop of 11.2% in the FTSE 250 index due to a warning of lower annual profit, attributed to weaker hiring activity in June and a more cautious outlook for the second half of the year.

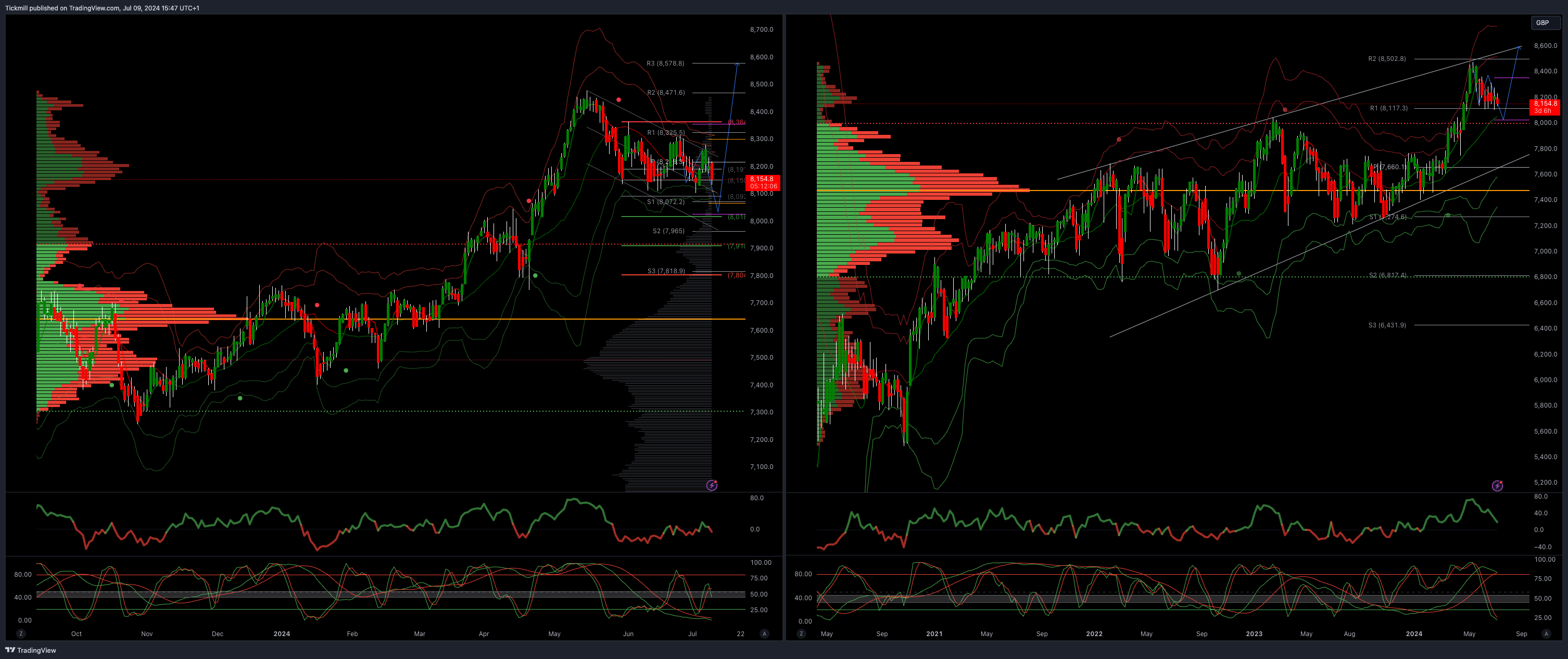

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bullish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!