The FTSE Finish Line - August 20 - 2024

FTSE Energy & Miners Weigh, Breaking The Winning Streak

Energy and copper mining sectors caused the UK's FTSE 100 benchmark stock index to fall by 0.76% on Tuesday; however, gains were limited by hopes that the U.S. Federal Reserve may decrease interest rates in September. The benchmark's largest losers were energy equities, which fell 1% as a result of a decline in oil prices. Major industry players BP and Shell both had 1% declines.

UBS has lowered its price objective for Segro Plc, a warehouse specialist, from 1,045p to 985p and downgraded the company from "buy" to "neutral." UBS analysts attribute the downgrade to a worse outlook for growth in logistics renting. Although the forecast rental value for H1 was lower than anticipated, they had originally anticipated rental growth to approach the upper end of the guiding range. Segro Plc shares fell as much as 2.8% to 870.6p after the session's losses, ranking the company among the FTSE 100 index's top percentage losers. The stock is down about 2% so far this year.

With Israel's acceptance of a plan to resolve differences impeding a cease-fire agreement in Gaza, Middle Eastern supply disruption worries were allayed, and oil prices dropped. After rising on Monday, O/R Real Estate and Real Estate Investment Trusts stocks were among the worst losses, down 0.2% apiece.

Following a surge in copper prices during the previous session, short-covering caused industrial metal miners to teeter 0.3% lower. After the Chilean miner reported a 5% increase in half-year profit, Antofagasta saw a slight increase in value. Conversely, while gold prices remained close to record highs, precious metal miners saw a 0.5% increase. Investor attention is currently focused on Fed Chair Jerome Powell's address later this week at the annual Jackson Hole economic symposium in Wyoming. Given that recent remarks from Fed officials and economic data solidified expectations for an impending rate reduction, it is widely anticipated that the policymaker will accept the case for a September reduction. In a week with little to no data, purchasing managers index (PMI) figures for the US and the UK as well as the minutes of the Fed's most recent meeting, are also of interest to the market.

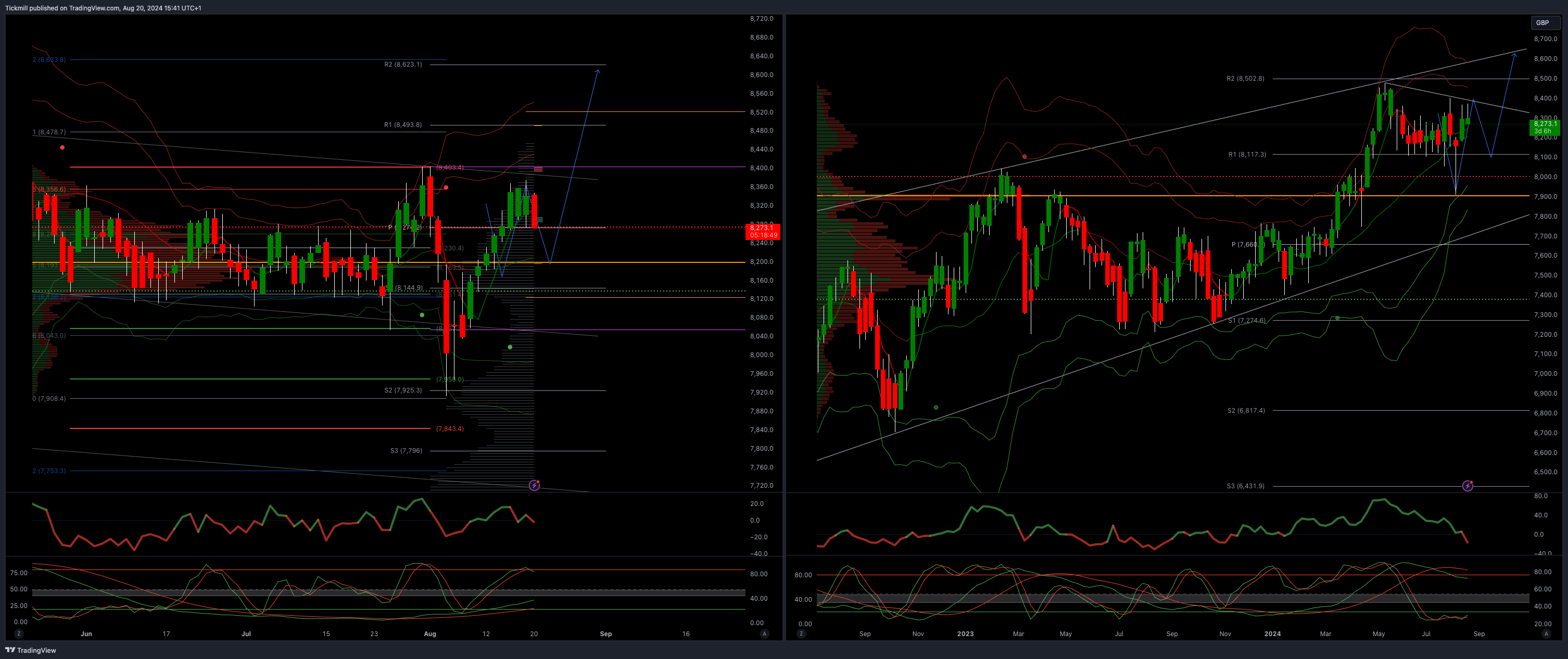

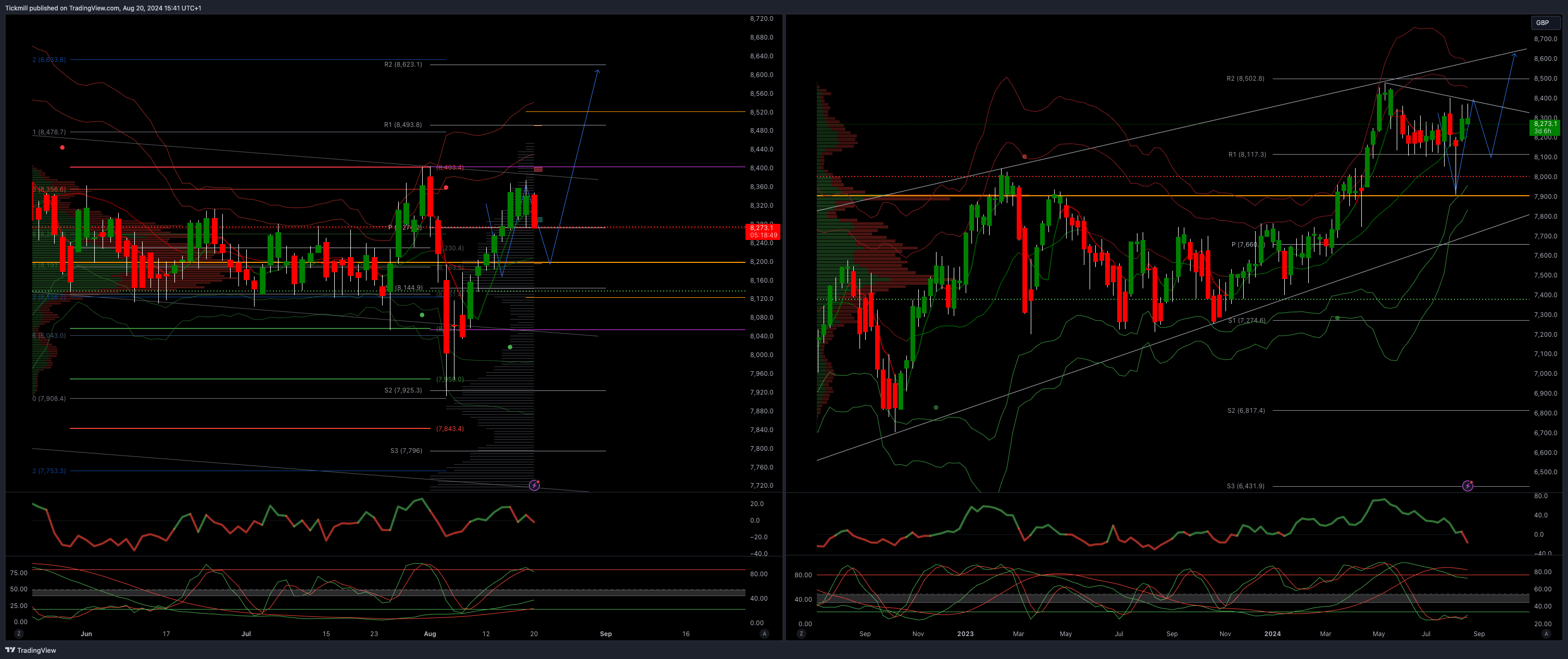

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!