The Crude Chronicles - Episode 7

Oil Falls On Easing Middle-East Tensions & Global Growth Fears

The CFTC COT update for the week ending September 24th showed net long positions in WTI crude futures were lower by -2,943 contracts, taking the position to 424,162 on the week. Speculative long positions fell by -1,864 contracts while short positions increased by +1079 contracts.

The reduction in net long positions is largely a reflection of the easing tension in the Middle East which had been supporting oil prices recently. Over the last quarter, increasing tension between the US and Iran as well as Saudi Arabia and Yemen were keeping prices supported via expectations of supply disruptions. This was headlined by the drone strike on a Saudi oil site in Mid-September. However, over the last fortnight, a ceasefire between Saudi Arabia and Yemen, as well as chatter regarding a potential easing of US sanctions on Iran, has helped oil prices cool off.

Investor risk appetite is also having an unhelpful impact on WTI movement this week as traders are town between positive input from optimism ahead of US – Sino trade talks this month but a weaker global outlook for growth on the back of serious data misses.

Headlines ahead of the next trade talks, due to take place on October 10th in Washington, have been generally positive with both sides making concessions over recent week. Some pessimism remains given China continues to insist that all trade tariffs be removed in order to do a deal. However, the notion of a partial deal (which could see concessions from both sides) is providing the most hope at this point. If the US and China were able to strike a temporary deal, paving the way for further negotiations towards a more permanent solution, this could help WTI prices recover in the near term.

The outlook for the global economy is still a big threat, however. With manufacturing readings from around the globe sinking into negative numbers, the risk of recession is growing each month. As a result, the demand outlook for WTI remains subdued and this has been clarified by OPEC which recently slashed its demand forecasts for 2019 and 2020 once again.

US Inventory Levels Increase Further

Against a tricky fundamental backdrop, the latest industry data has also increased investor appetite for selling WTI. The EIA’s latest update showed US crude inventory levels rising again last week by 3.1 million barrels. This latest increase marks a third consecutive week of inventory increases. The EIA is due to release its latest Short-Term Energy Outlook next week which will be closely watched given the higher revisions to US crude production seen last time. Worth noting that US crude production was actually seen lower by 100,000 barrels per day last week though at 12.4 million barrels per day, is still pushing the market towards a surplus.

Technical & Trade Views

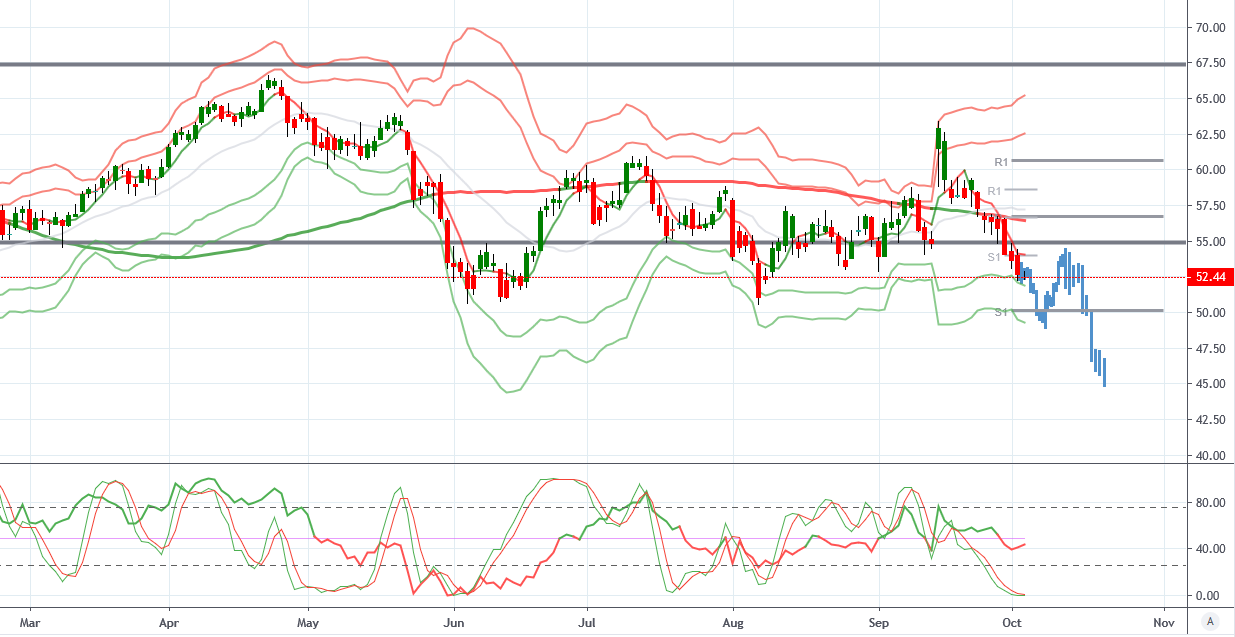

WTI Crude (Bearish below $55, targeting $45)

WTI From a technical and trade perspective. Price has now broken through the yearly pivot at $55 with longer-term VWAP now turned negative. The monthly pivot at $50, in line with previous swing lows, might see some initial bids, however, I will be monitoring a retest of the pivot from beneath to position for a break lower towards $45.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!