Oil Traders Cut Longs Again

The latest CFTC COT institutional positioning report shows that oil traders cut their net long positions for a second consecutive week last week. The total upside position was reduced to 239.7k contracts from 252k contracts prior. The reduction in upside exposure has been well reflected in price action with crude futures falling around 13% from the week’s highs and down more than 20% from the November highs. Crude prices are now back at their lowest level since December 2021, having fallen to fresh lows on the year this week.

Key Factors

There is plenty going on for oil traders. The big driver this week has been the return of recessionary fears which are weighing on the demand outlook for oil. Recent data surprises in the US have fuelled a shift in perspective with regard to the Fed’s likely course of action over the coming months. Traders now fear that while the Fed might slow the pace of its tightening, it is still some way off from pausing rate hikes. With this, growth fears have swung back into focus, seeing stocks falling this week, again hurting the demand outlook for oil.

China Reopening Optimism

Indeed, the slide in oil prices this week comes despite burgeoning optimism around the China reopening story. On the back of the protests and clashes seen over the prior week, the Chinese government this week announced a large scale easing of many covid restrictions, marking the biggest change in covid policy since the pandemic began. If the government can continue along this trajectory and markets get a greater sense that a proper reopening is coming, this should certainly help lift oil prices near-term.

Focus on FOMC Next Week

Looking ahead for oil, the key focus will be the FOMC next week and the latest US CPI reading just ahead of it. If inflation was seen higher again in November, the Fed is likely to focus on the need to keep going with rates, which is likely to pull oil prices lower still into year end. However, if inflation was seen cooling again, this should allow the Fed room to be more neutral with its tone, increasing the chances of a coming pause in Q1. With focus then likely reverting to the China reopening story, oil prices should get some lift in this scenario.

Technical Views

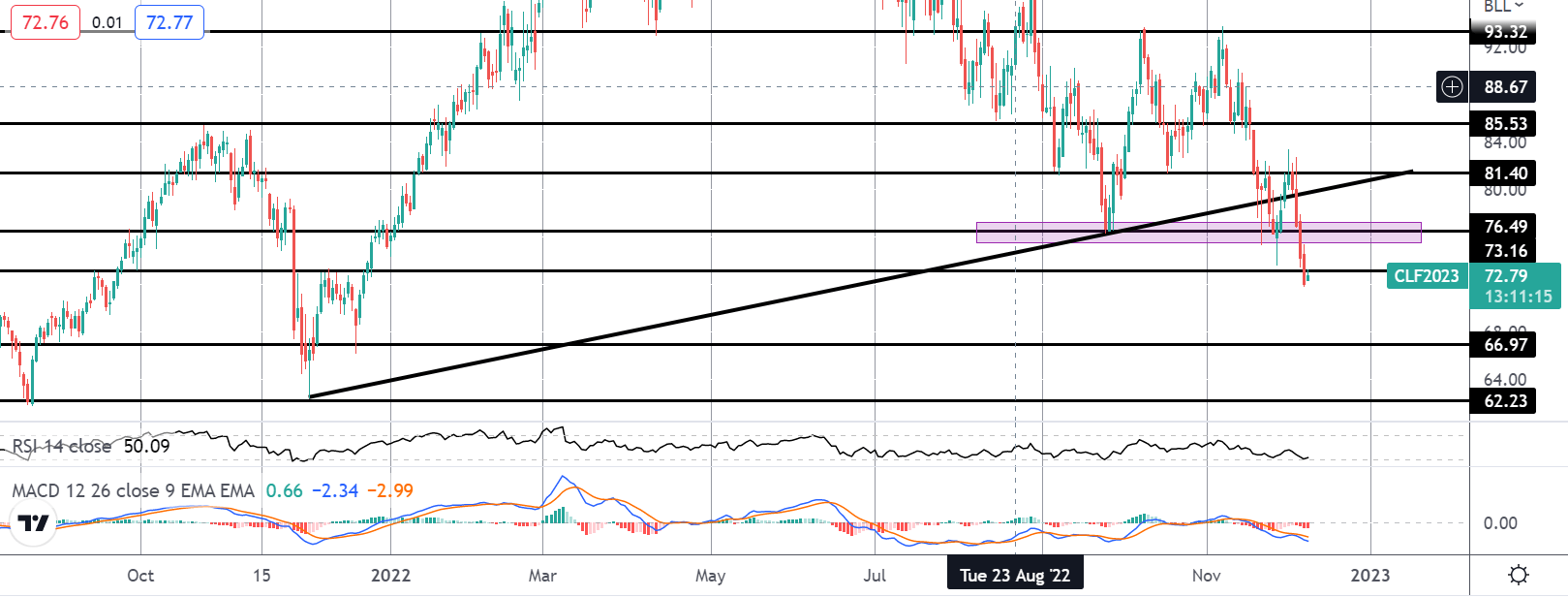

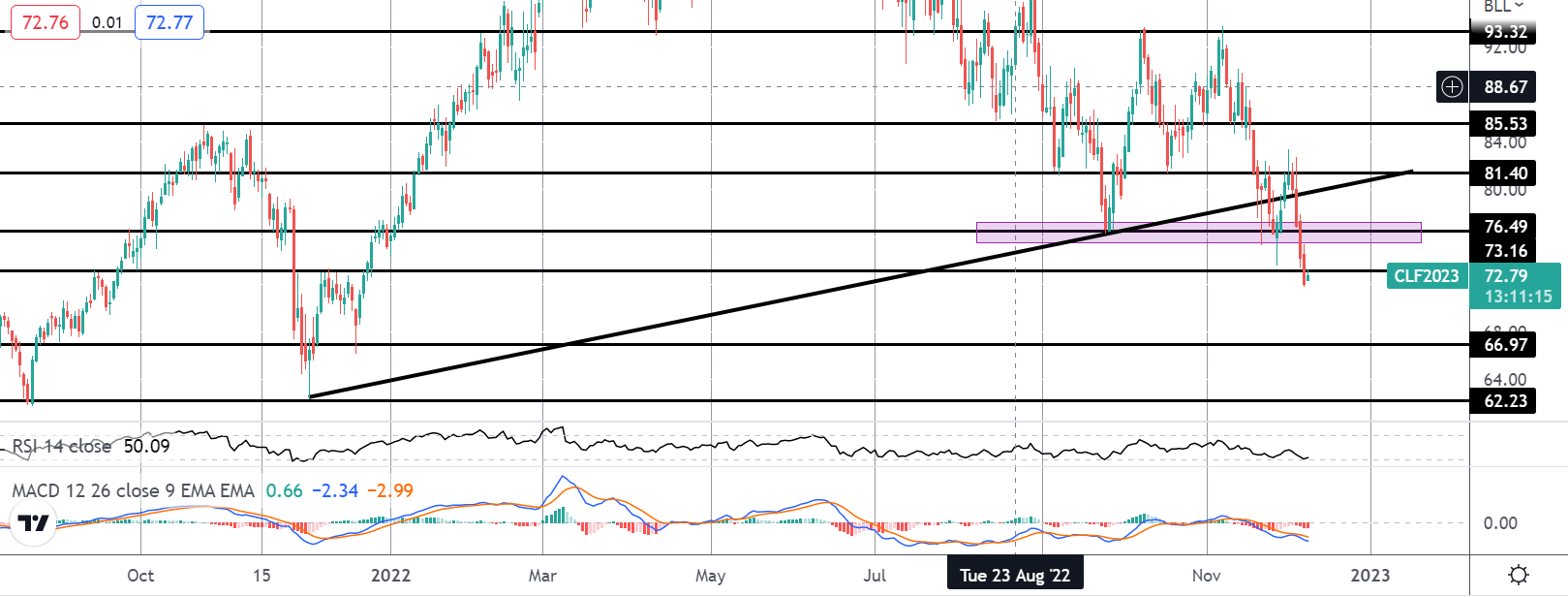

Crude Oil

The breakdown below the rising trend line has seen oil prices breaking through lows around the 76.49 mark. This is a key area for price and while below here, the focus is on a further push lower towards the 66.97 level next, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.