Stocks Rebound Mid-Week on Dovish Fed Shift

Equities Rallying

Following a sharp drop lower on Friday as risk sentiment recoiled in response to fresh tariff threats from Trump on China, equities are rebounding midweek. A pullback in the US Dollar following dovish comments from Fed Powell, alongside a strong set of US bank earnings, is helping bolster sentiment and push equities higher again.

Trump/China Threats

On Friday, Trump caught markets off-guard as he threatened to slap 100% tariffs on China in frustration at lack of progress on trade talks and what he deems ‘hostile’ acts form China, such as not buying US soybeans. China refused to back down and refused to enter into any fresh negotiations on the back of those threats, prompting furtehr threats from Trump. Despite initial weakness in risk assets, markets have stabilised since with many taking the view that this is another instance of Trump making threats which will ultimately be revoked as a negotiating tactic.

Powell Comments

Dovish comments from Fed chairman Powell this week have seen USD retreating from recent highs, creating further support for stocks. Powell warned that the time was nearing when the bank will bring QT to end. Given the easing forecasts in place over the remainder of the year, these comments have created a bearish shift in sentiment for USD which should keep stocks supported further near-term.

Technical Views

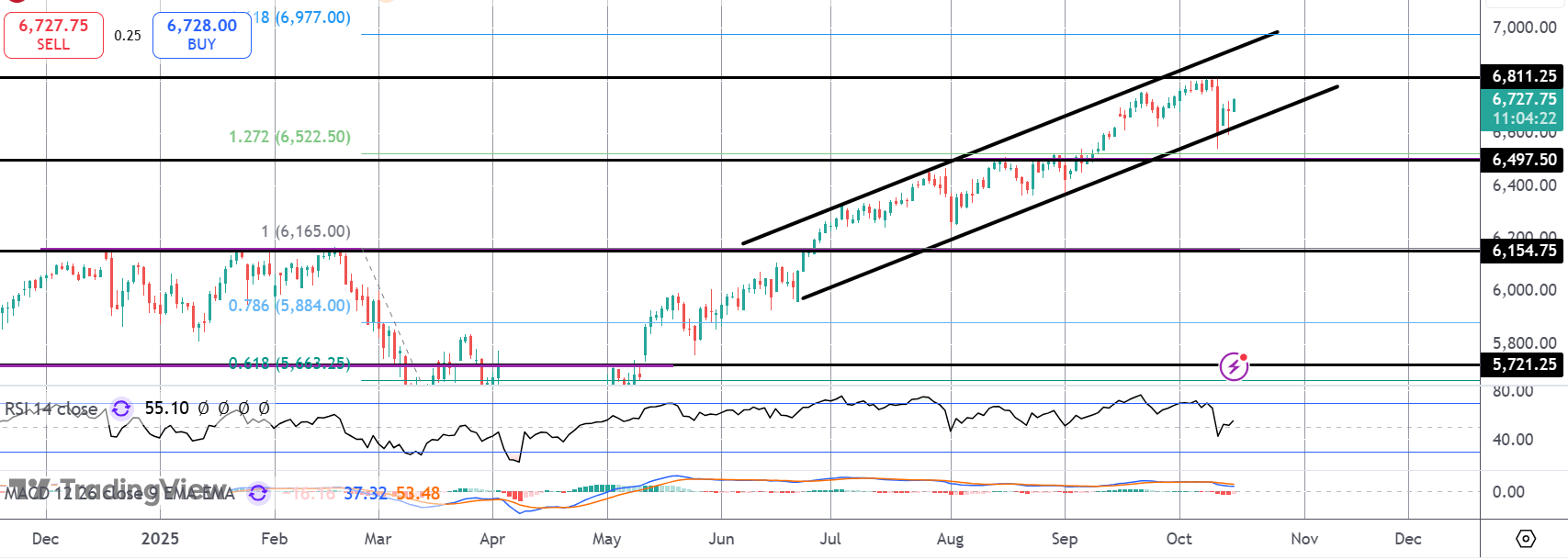

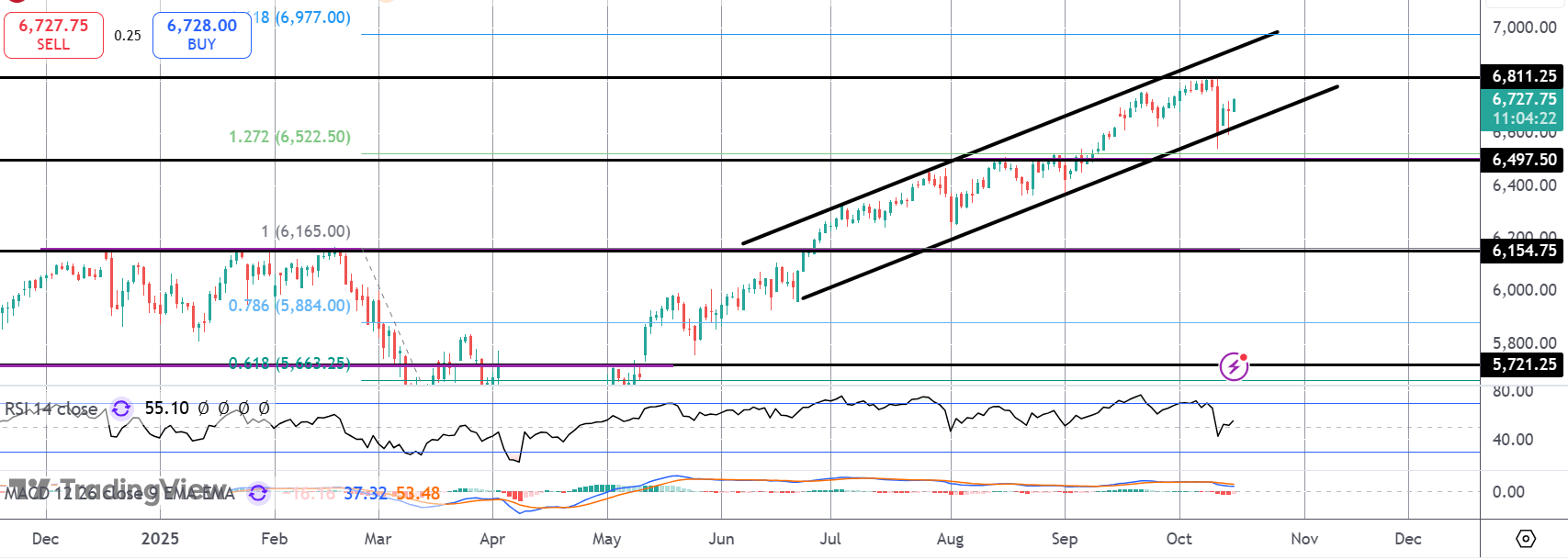

S&P 500

The correction lower from the 6,811.25 level found strong support into the bull channel lows. While above the 6,497.50 level focus is on a continuation higher with the 1.61% Fib level (from Feb – April retrace) at 6977 the next bull target, with the bull channel highs there also.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.