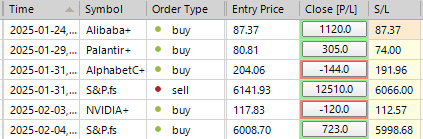

SP500 LDN TRADING UPDATE 4/02/25

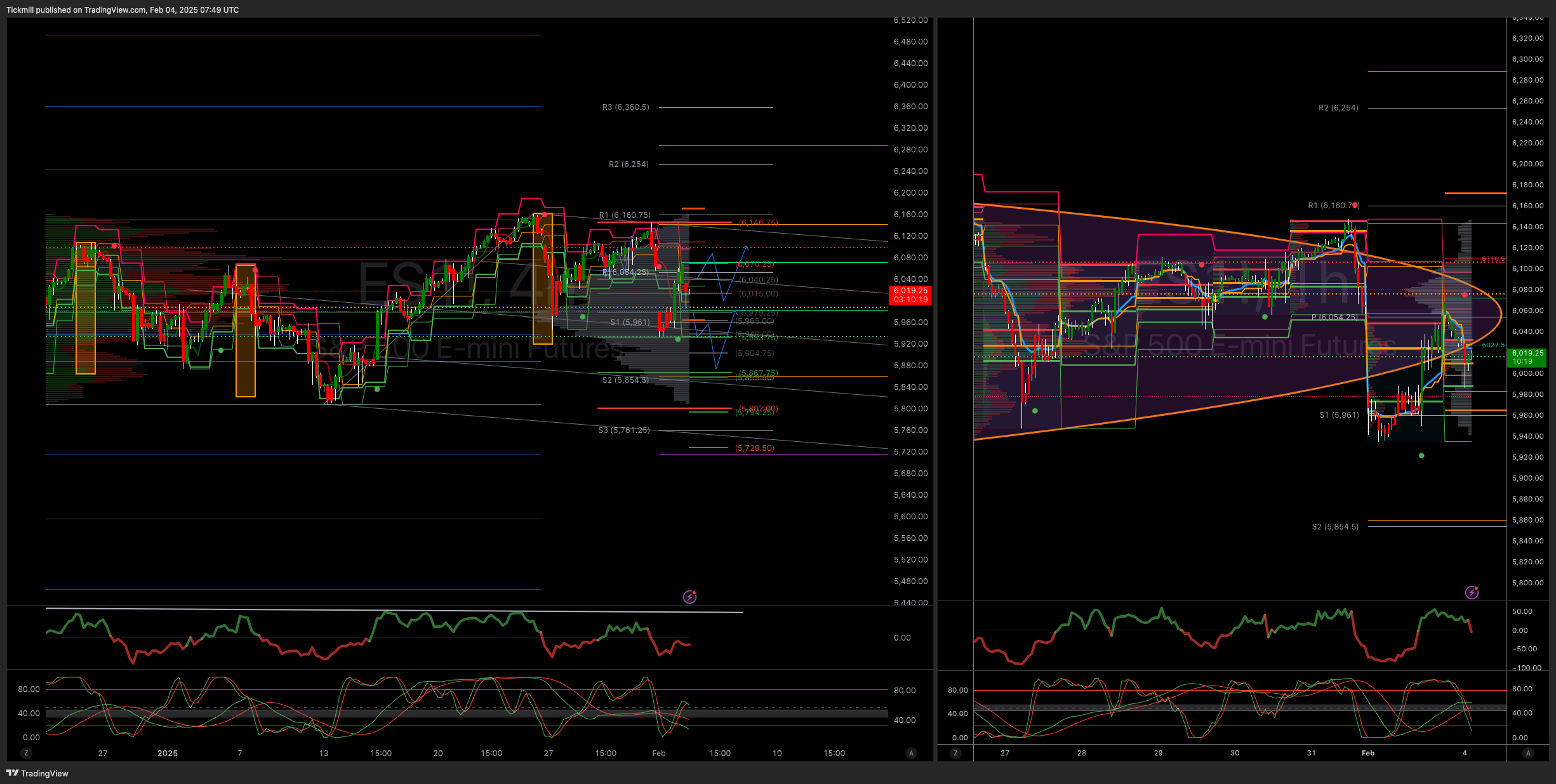

WEEKLY BULL BEAR ZONE 5900/5890

WEEKLY RANGE RES 6086 SUP 5878

DAILY BULL BEAR ZONE 6040/30

DAILY RANGE RES 6097 RANGE SUP 6013

TODAY'S TRADE LEVELS & TARGETS

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF WEEKLY/DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT WEEKLY RANGE SUP TARGET DAILY RANGE SUP FROM BELOW

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

The U.S. equities market faced a challenging Monday as S&P recorded a 76 basis points decrease, closing at 5994 with a significant $3.3 billion to sell at the market close. The NDX dropped 84 basis points to 21297, the R2K fell 128 basis points to 2258, and the Dow decreased by 28 basis points to 44421. Market saw 16.35 billion shares exchanged across U.S. equity exchanges, close to the year-to-date daily average of 16 billion shares.

The VIX surged 1315 basis points to 18.59, crude oil increased by 52 basis points to $72.91, the US 10-year remained unchanged at 4.53, gold rose by 59 basis points to $2814, the dollar index increased by 49 basis points to 108.90, and Bitcoin surged by 432 basis points to $101,170. Tariffs initiated by President Trump on imported goods from Mexico, Canada, and China caused turbulence across global macro assets.

Additionally, the ISM Manufacturing report surpassed expectations, demonstrating improvements in new orders, production, and employment, indicating a positive outlook for short-cycle industrials. Amid concerns about the impact of tariffs, key data releases and Federal Reserve communication are being closely monitored.

In terms of trading activity, overall activity levels were moderate, with single-stock activity relatively slower. Liquidity was challenging, and gamma was shorter, with leveraged ETF volumes significant and one-day events driving trading flow. Various market participants showed differing behaviors, with macro products and tech driving selling pressure while demand persisted in healthcare, communication services, and industrials.

Post-market, Palantir Technologies rose by 12% on positive revenue guidance, whereas NXP Semiconductors reported flat sequential results for the fourth quarter and decreased revenue guidance for the next quarter. Despite tariff-related uncertainties, the derivatives market experienced a quiet start to the week, with a focus on index hedges monetization and shifting demand for different sectors indicating ongoing market dynamics and volatility expectations.The realized volatility is beginning to increase as the intraday band stood at 165 basis points. With dealer gamma positioning remaining relatively unchanged, the straddle for the remainder of the week still suggests a movement of 1.75%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!