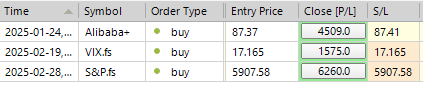

SP500 LDN TRADING UPDATE 3/03/25

WEEKLY BULL BEAR ZONE 6025/35

WEEKLY RANGE RES 6080 SUP 5836

DAILY BULL BEAR ZONE 5910/20

DAILY RANGE RES 6000 SUP 5917

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

The S&P 500 and Nasdaq 100 saw declines of 98 basis points and 338 basis points respectively last week, yet the situation felt significantly worse. Goldman Sachs' Meme Basket (GSXUMEME INDEX) fell another 679 basis points during the week (after a drop of -10.05% the previous week), and our Long Momentum Basket (GSCBHMOM INDEX) dropped 403 basis points (following an 858 basis point decline the week before). Nonetheless, there are encouraging signs for the coming week, as we wrapped up the month with promising price movements on Friday. The end-of-February pension rebalancing of +$13 billion in equities to purchase (compared to $13 billion in UST to sell) helped to offset CTA sales (around $20 billion of S&P 500 supply this week from CTAs, as medium-term momentum remains negative below 5890) and this was particularly noticeable in the final 10 minutes of trading on Friday (2/28).

Don't resist the trend. The 5-day momentum returns are in the 3rd percentile over the past decade. Current MOMO strategies are showing very favorable returns. "This is clearly a bull market! The big gains come not from minor fluctuations but from understanding the overall movements, both in the markets and in assessing the general trend." Until there's evidence that the trend in U.S. equities is about to reverse, short squeezes will keep pushing the markets. Tomorrow is likely to be a challenging short squeeze day, as risk assets are expected to rise sharply, particularly in response to crypto news from the weekend.

A new month begins tomorrow with a risk-on sentiment. BTC has increased by 20% since the lows on Friday. The markets are poised to create maximum discomfort and push for higher returns, putting the squeeze on US stock traders. Where we start matters. February kicked off with all asset classes experiencing gains, often hitting record highs. However, it concluded on a markedly different note.

- Gold, which was close to $3,000, dropped $100 in the final week.

- BTC started the month near its all-time high but saw a 15% decline over four weeks.

- US technology stocks were at their all-time highs on February 18 but fell 10% by the 28th.

- US 10-year interest rates decreased from 4.60% on February 11 to 4.20% by the end of the month.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!