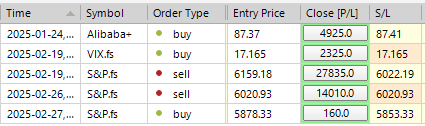

SP500 LDN TRADING UPDATE 28/02/25

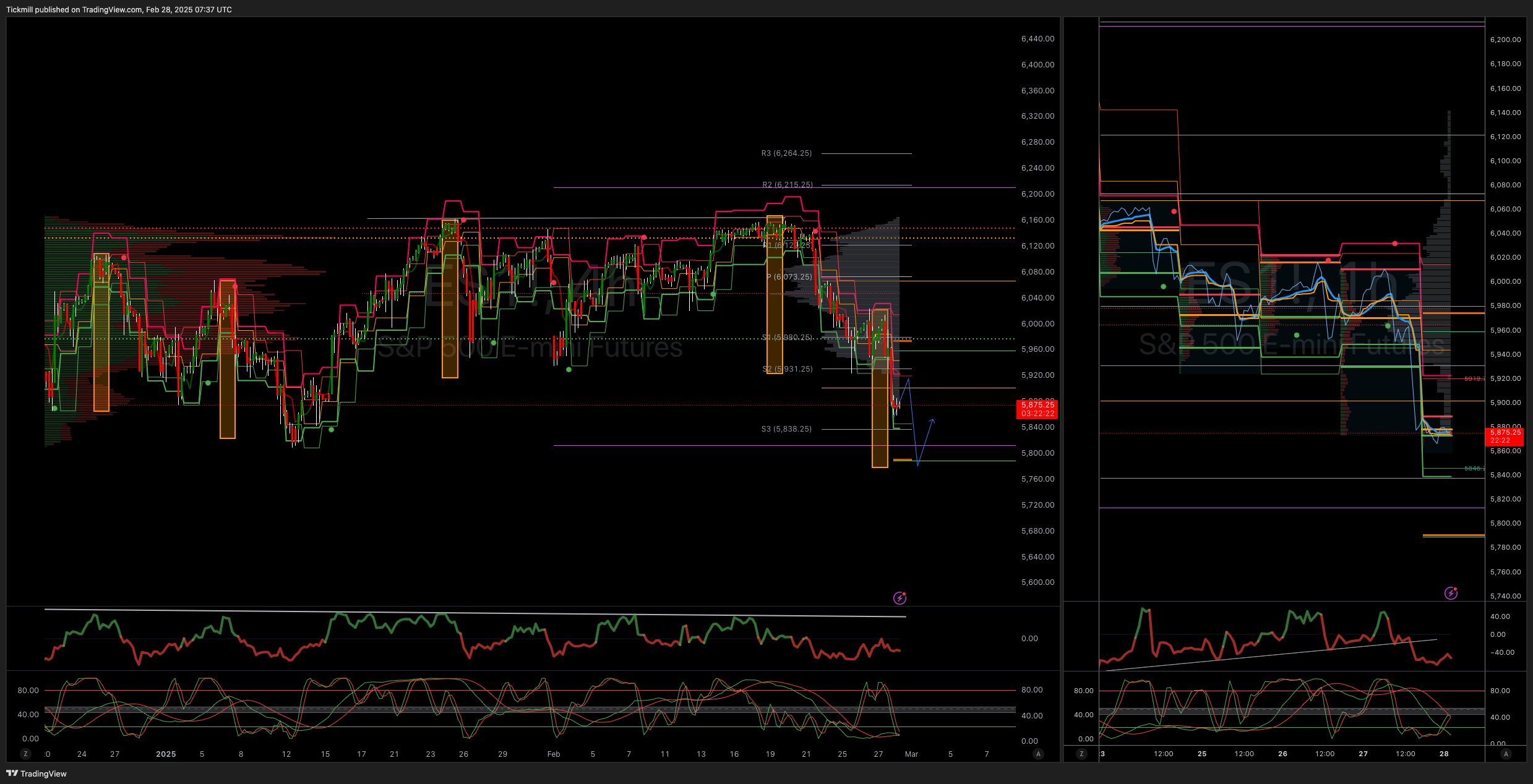

WEEKLY BULL BEAR ZONE 6060/70

WEEKLY RANGE RES 6142 SUP 5916

DAILY BULL BEAR ZONE 5920/30

DAILY RANGE RES 5922 SUP 5839

5858 5% CORRECTION LEVEL FROM ATH

5809 JANUARY LOW

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON TEST/REJECT OF DAILY RANGE SUPPORT TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW THE WEEKLY ACTION AREA VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

FICC and Equities

27 February 2025 |

*SPX: 5861, -1.6%. CTA supply is likely to accelerate in the US.

*NDX: 20550, -275bps. Broke key levels.

*RTY: 2141, -152bps.

*WTI Crude: $70.14, +2.2%. OPEC+ hesitant on April output hike due to sanctions/tariffs; Russia, UAE involved.

*Bitcoin: 83593. Retail pain epicenter.

*10-Yr Yields: 4.2714.

*VIX: 21.20, +35% over last five sessions.

*MOC: $1.3B to sell—lighter than expected given late-day price action.

*Volumes: 15.8B shares across all exchanges. SPX volumes: +10% d/d, +7% vs. 20dma.

*Tariffs: Trump announces tariffs on Mexico, Canada, and China effective March 4.

*PCE Tomorrow: Core PCE inflation expected at 0.25% MoM (2.59% YoY); headline PCE at 0.30%.

- GS Desk Activity:

- Floor: Finished - 10% vs +73bps 30-day avg. LOs: Finished.

- $4bn net sellers led by macro trades in tech/healthcare. HFs balanced overall but net sellers in healthcare/staples; buyers in tech/comm services.

- Current Sentiment:

- Market eyeing a bounce, but looming tariffs, positioning, and technicals complicate strategy.

- Momentum (GSCBHMOM) down 4% today.

- No capitulatory flows observed, suggesting retail investors haven't given up, indicating a potential bottom may be near.

We are currently in the supply zone in the US. We have closed beneath the crucial Medium Term level in SPX (5980), so the supply is expected to increase. The positioning is already full, and over the coming week, $31 billion will flow out of the US in a declining market despite a rising trend.

During the five trading sessions leading up to NVDA’s release last night, our PB data indicates that fundamental L/S HFs experienced a decline of over 250bps in their year-to-date performance, bringing their 2025 performance to +160bps (this marks the worst five-day period since last August and the second worst in the last two years). The pain was particularly severe for TMT and HC L/S managers. Hedge funds have significantly reduced their TMT risk, with February’s notional degrossing in US TMT on track to become the second largest month on record (only behind January ’21 amid the meme stock frenzy).

NVDA delivered its usual upside for EPS/revenue in FQ4, with Jensen expressing optimism about the enduring demand for AI infrastructure. Overall, I believe the report from last night was strong enough to stabilize the market and bring an end to this particular momentum drawdown (positioning and sentiment prior to NVDA's announcement was the most favorable it has been in two years). Nevertheless, HF Gross/net exposures continue to be near three-year highs, and US economic policy uncertainty has reached levels not seen in 30 years. These factors lead me to believe that we will witness more of these momentum unwinds than we have been used to in the coming months. Drawdowns are likely to be more severe until overall positioning becomes more balanced. The real money community was NOT part of the recent drawdown, and their cash reserves are at an all-time low. The most significant flow trend observed yesterday was a reduction in supply across Semis, AI, and Momentum Longs, coupled with a noticeable increase in demand as signs of stabilization emerged. This institutional demand is expected to pick up momentum today, setting the stage for the retail community to return to the market as buyers. I am still monitoring for the Russell 2000 to outperform the S&P 500 and Nasdaq 100 as we head into the second quarter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!