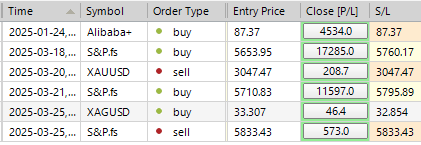

SP500 LDN TRADING UPDATE 26/03/25

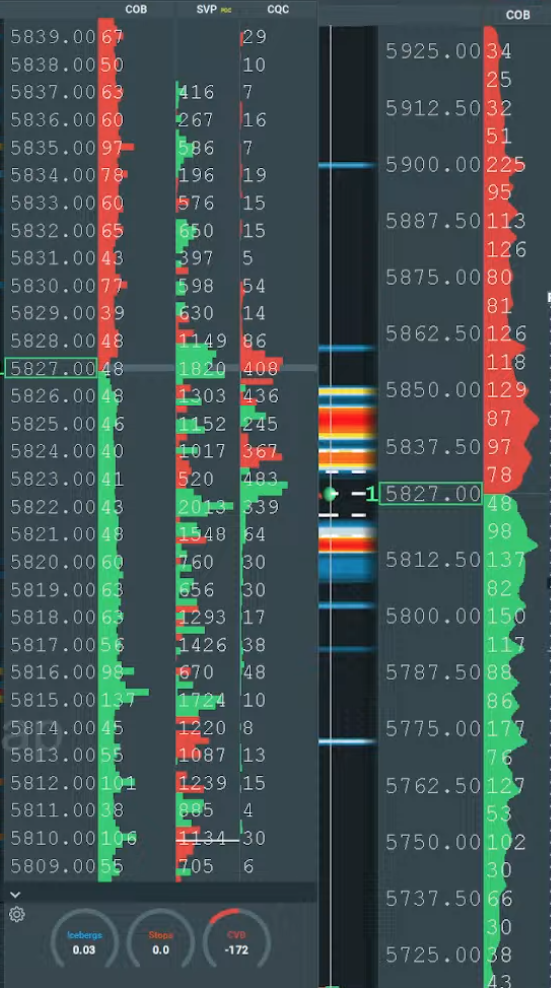

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5690/5700

WEEKLY RANGE RES 5850 SUP 5590

DAILY BULL BEAR ZONE 5780/90

DAILY RANGE RES 5875 SUP 5788

2 SIGMA RES 5980.5 SUP 5672.5

5837 50% RETRACE FROM ATH’S

5640 MARCH CONTRACT GAP

5912 ABC CORRECTION TARGET

TODAY'S TRADES & TARGETS

LONG ON TEST/REJECT DAILY BB ZONE TARGET DAILY/WEEKLY RANGE RES

LONG ON ACCEPTANCE ABOVE WEEKLY RANGE RES TARGET 5912

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET 5837

SHORT ON TEST/REJECT OF 5912 TARGET DAILY RANGE RES > 5837

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES SUMMARY: LOW ACTIVITY DAY

EVENT: FICC and Equities | 25 March 2025

Market Performance:

- S&P 500: +16bps, closing at 5,776 with Market-On-Close (MOC) flows of $650M to SELL.

- Nasdaq 100 (NDX): +53bps, closing at 20,287.

- Russell 2000 (R2K): -56bps, closing at 2,113.

- Dow Jones (Dow): +1bp, closing at 42,587.

Volume and Volatility:

- Total shares traded: 12.85B across all U.S. equity exchanges, marking the lowest volume session of the year (vs YTD daily average of 15.5B).

- VIX: -1.9%, closing at 17.15.

Commodities and Other Markets:

- Crude Oil: +7bps, closing at $69.15.

- U.S. 10-Year Treasury Yield: +2bps, closing at 4.31%.

- Gold: +35bps, closing at $3,054.

- DXY (Dollar Index): +4bps, closing at 104.22.

- Bitcoin: +50bps, closing at $88,319.

Market Commentary:

It was a quiet session with subdued trading activity as macro clarity remained low. The spring break period and high out-of-office responses contributed to the reduced engagement. Heads are down as participants prepare for Q1 earnings season and upcoming tariff/NFP updates next week. Price action showed healthier trends today, with leadership shifting toward Software, Megacap, and Secular Growth stocks. Momentum longs and most shorts underperformed. Mixed data included Consumer Confidence returning to January 2021 levels, while New Home Sales came in line with expectations. The S&P 500’s top-of-book depth improved to $12.64M (vs $5.95M on Friday and the YTD average of $9.25M).

Sector Highlights:

- Pharma saw notable weakness, with ABBV and MRK both down 4%. Concerns centered on tariff risks, particularly EU tariffs and Ireland-exposed companies, following Trump’s comments about potential pharma tariffs in the “near future.” Market participants are closely monitoring the April 2nd update.

Flows and Activity Levels:

- Overall activity on the floor was rated a 3 out of 10.

- LOs (Long-Only funds) and HFs (Hedge Funds) were net sellers, with -$1.5B and -$500M, respectively.

- LO supply was concentrated in Tech, Financials, Industrials, and Healthcare, while HF supply focused on macro products.

Derivatives Market:

- Following Monday’s rally, the daily straddle heading into Tuesday was 0.55%, one of the lowest levels in the past month.

- Volatility markets continued to reset lower. Notable activity included monetization of VIX downside and re-striking of VIX upside hedges, such as a buyer of 160K VIX Apr 22 calls.

- New downside hedges were established ahead of next week’s tariff announcements via short-dated puts and put spreads on RUT and SPX.

- Dealer gamma increased, leading to noticeable effects as the market chopped around. Short-dated vol continued its decline, and the market is likely to remain choppy until greater clarity on tariffs emerges on April 2.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!