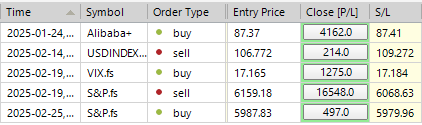

SP500 LDN TRADING UPDATE 25/02/25

WEEKLY BULL BEAR ZONE 6050/60

WEEKLY RANGE RES 6142 SUP 6061

DAILY BULL BEAR ZONE 6020/30

DAILY RANGE RES 6067 SUP 5963

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF WEEKLY RANGE SUP TARGET DAILY BULL BEAR ZONE

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF THE NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

”If a major question coming into the week was whether the S&P could successfully break out of a 3-month trading range, the response was a definitive NO. Looking ahead, the underpinning of the US market continues to be one of sustainable growth, relatively accommodating financial conditions, and an impressive surge in innovation. That said, the tactical landscape is poised to become more complex: capital inflows are likely to decelerate, the local seasonal trends are unfavorable, and major capital allocators are seeking opportunities elsewhere. Thus, I'm maintaining this fundamental approach: long on US equities -- at a conviction level that's moderately aligned -- combined with high-quality portfolio hedges. For instance, engaging in the VIX index by selling puts to finance call spreads is an effective setup; specific strategies are available.

DESK ACTIVITY... From a flow standpoint, hedge funds (HFs) accounted for a significant portion of the activity on our desk, ending up as net sellers of $2.5 billion due to de-risking in the tech and consumer sectors while selectively increasing short positions in retail-exposed stocks. Asset Managers concluded the week with a balanced approach, largely remaining on the sidelines and not purchasing any of the market dislocations as of yet. Looking ahead to next week: the S&P 500 implied move for 2/28 is 1.27%. There is a favorable mix of macroeconomic indicators (US Consumer Confidence on Tuesday, GDP on Thursday, and PCE on Friday) and micro events (retail earnings + NVDA on Wednesday being the key highlights).

PB UPDATE... US equities experienced modest net selling, primarily driven by Macro Products that have been net sold for the eighth consecutive week. Hedge Funds significantly unwound their positions in Technology, Media, and Telecommunications (TMT) stocks once again, with a combination of long sales and short covers; the scale of recent de-risking in TMT is now roughly comparable to what we observed last July and stands among the most substantial in the last five years. Concurrently, managers net purchased Cyclicals for the third straight week while continuing to offload Consumer Discretionary stocks, which have now been net sold for nine consecutive weeks and remain the most net sold sector year-to-date.

SPX...

Friday marked the worst day of the year for US equities—a result of a sharp reversion in the momentum factor, a high U-M inflation reading, and concerns regarding “pandemic potential.

Over the weekend, macroeconomic news centered on the German elections, where the center-right coalition secured the highest number of votes, led by Friedrich Merz (as anticipated, they now need to establish a coalition). On the micro front, BRK/B rose by 1.5% due to robust earnings (with cash holdings at a record high), NVDA also increased by 1.5% ahead of its earnings report on Wednesday, while AAPL fell by 1% after announcing plans to hire 20,000 new employees and manufacture AI servers in the United States. In Asia, markets closed lower with minimal news aside from additional US/China updates (Reuters mentioned that Trump instructed CFIUS to limit Chinese investments in key sectors such as semiconductors, AI, and quantum). European markets showed mixed results, with Germany outperforming on a relief rally after the elections, as Merz has pledged pro-growth strategies.

According to Mike Cahill on the German Election:

The recent German election results present a mixed bag for the markets. A CDU/CSU-SPD coalition appears likely, which simplifies negotiations compared to alternate scenarios, although the coalition-building process may take several months. On the downside, the AfD and Die Linke could obstruct debt brake reforms, thereby impeding fiscal spending. The Euro and associated currencies seem to already factor in optimistic outlooks concerning European spending and peace negotiations, suggesting limited further upsides. Potential changes in US policy, especially regarding tariffs, present a more considerable risk to foreign exchange markets than the results of the German elections. The outcome emphasizes that significant changes in fiscal policy are unlikely, exposing the divergent opinions on policy execution within Germany and the European Union.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!