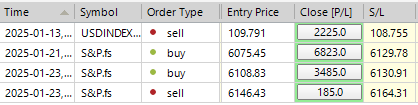

SP500 LDN TRADING UPDATE 24/01/25

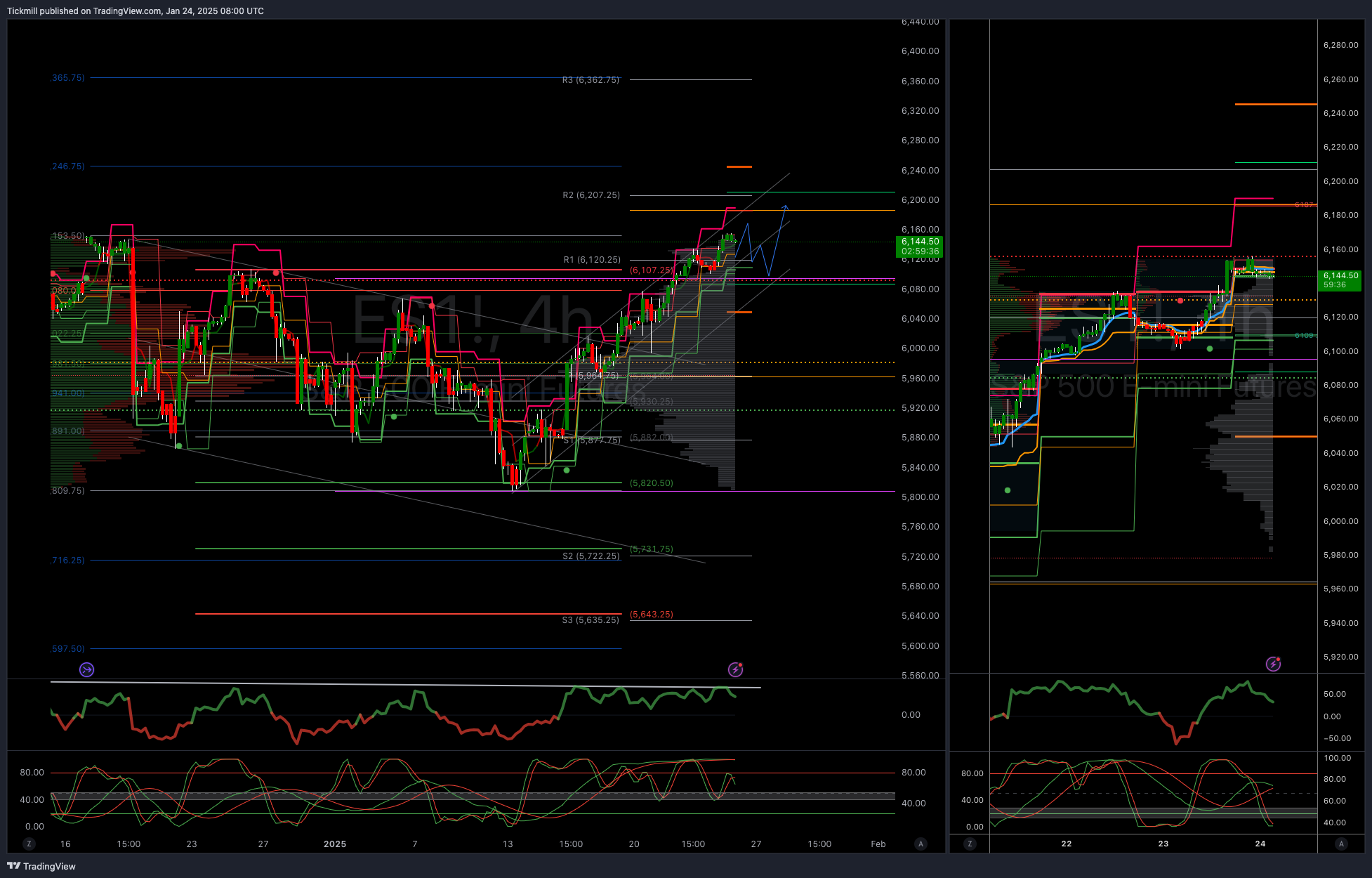

WEEKLY BULL BEAR ZONE 6070/80

WEEKLY RANGE RES 6119 SUP 5945

DAILY BULL BEAR ZONE 6130/20

DAILY RANGE RES 6190 RANGE SUP 6106

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON ACCEPTANCE BELOW DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON TEST REJECT 6090/95 TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

SPX +53bps, closing at 6118 with a MOC of $3bn to buy. NDX up 22bps at 21900, R2K up 30bps at 2310, and Dow up 92bps at 44565. A total of 13.3bn shares were traded across all US equity exchanges, compared to a year-to-date daily average of 16bn shares. VIX down 73bps at 14.99, Crude down 156bps at 74.27, US 10-year yield up 3bps at 4.64, gold down 11bps at 2753, DXY down 5bps at 108.11, and Bitcoin down 124bps at 102760.

The S&P 500 reached a new all-time high close today (6118) in a relatively quiet day, characterised by a wait-and-see approach ahead of earnings. Market volumes were muted, running at 16% of the 20-day moving average. ETFs accounted for 27% of the tape, below the historical average, as earnings began to dominate trading activity.

There are some very favorable seasonal trends for the rest of the month, and our sentiment indicator along with PB data still indicate lighter positioning. The bar for earnings is indeed higher this period (+8% S&P 500 YoY EPS growth compared to 3% in the previous quarter), but so far, so good. We will learn much more next week as 41% of the S&P’s market cap is set to report. The BoJ meeting is overnight, with markets pricing in a 95% chance of a 25bps hike.

Headlines included: President Trump expects the Fed to heed his advice on interest rates; He is open to discussing interest rates with Powell; *TRUMP announces he will sign an action to declassify JFK files. There were numerous movers in Biotech, with some resembling a growth spurt in names like JANX, BMY, BPMC, etc., while there was significant selling pressure in others (MRNA/vax).

Corporates will exit their blackout period tomorrow, which typically leads to a ~30% increase in daily notional executed on our buyback desk. CTAs are now a tailwind with $11bn of demand for US equities at these levels over the next five sessions. Hedge funds are dominating trading flow, primarily covering macro products, while long-only funds are tactically selling earnings winners, with NFLX being a prime example on our desk.

Our trading floor was rated a 6 on a 1-10 scale in terms of overall activity levels. The floor ended with a +4.5% buy skew, totaling approximately $2.5B in net demand. Long-only funds drove most of the buying across the floor, with Discretionary, Healthcare, and Financials being the standout sectors. Long-only funds sold Tech and Macro Products, while hedge funds were net sellers, mainly in Tech, Financials, and Discretionary sectors, but they bought Macro Products and Healthcare.

DERIVATIVES:

It was a quieter day on the volatility desk after a busy session yesterday. We are beginning to see single-digit volatility levels again, with the February 6350 calls priced at a 9-handle. In terms of flows, there has been consistent buying of VIX upside over the last two sessions through outright calls and spreads extending to April. Additionally, we are back in a phase of longer dealer gamma (estimated at $5.5bn), which is reflected in near-dated implied moves. To wrap up the week, the Friday PM straddle is priced at just 0.40%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!