SP500 LDN TRADING UPDATE 21/03/25

WEEKLY & DAILY LEVELS

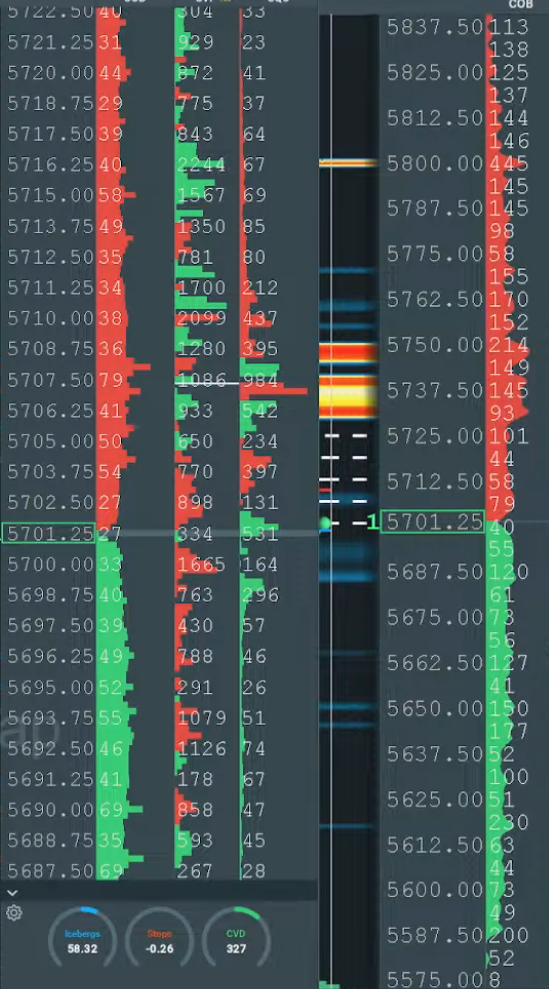

WEEKLY BULL BEAR ZONE 5650/60

WEEKLY RANGE RES 5830 SUP 5550

DAILY BULL BEAR ZONE 5750/60

DAILY RANGE RES 5759 SUP 5673

2 SIGMA RES 5852 SUP 5572

5640 MARCH CONTRACT GAP

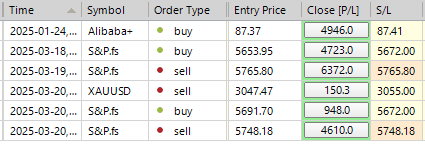

TODAY'S TRADES & TARGETS

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

SHORT ON TEST REJECT WEEKLY RANGE RES TARGET 5770/82(2 SIG)

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: UNCHANGED

**FICC and Equities | 20 March 2025 |

- S&P 500: -22bps, closed at 5,662 with MOC flows of $1.3B to BUY.

- NASDAQ 100 (NDX): -30bps, closed at 19,677.

- Russell 2000 (R2K): -66bps, closed at 2,086.

- Dow Jones: +3bps, closed at 41,953.

Market Activity:

- Total volume: 13B shares traded across all U.S. equity exchanges, below the YTD daily average of 15.5B shares.

- VIX: -50bps, closed at 19.80.

- Crude Oil: +164bps, closed at $68.26.

- 10-Year U.S. Treasury Yield: Unchanged at 4.23%.

- Gold: +38bps, closed at $3,052.

- DXY (Dollar Index): +36bps, closed at 103.79.

- Bitcoin: -114bps, closed at $84,400.

Market Overview:

Stocks fluctuated near unchanged levels as investors weighed the Fed's dovish tone alongside stronger-than-expected Philly Fed and Existing Home Sales data. Market sentiment remains cautious, with a day-by-day trading pattern prevailing until clearer insights emerge from Q1 earnings, particularly with 4/2 tariff developments and 4/4 non-farm payrolls (NFP) data on the horizon.

Flows on our desk were constructive, supported by quarter-end pension rebalancing and CTA positioning dynamics. Liquidity at the top of the book was extremely poor, averaging $1.68M versus the $13M average. Trading volumes remained suppressed for a second consecutive session, down over 60% compared to YTD averages.

Desk Activity:

- Activity level: 5/10 on our scale.

- Floor performance: Finished -716bps better for sale versus the 30-day average of -117bps.

- Long-Only (LO) flows: Net sellers of -$2B today, totaling -$8.6B for the week and -$26.5B over the past four weeks.

- Hedge Funds (HFs): Balanced flows today, ending as slight net buyers (+$600M) for the week and +$2B net buyers over the past four weeks.

Post-Market Movers:

- Nike (NKE): +2.7% on earnings.

- FedEx (FDX): -3% on earnings.

Derivatives Update:

Despite a moderate intraday range of ~140bps, fixed-strike volatility and skew declined for the second consecutive session. Flows were subdued, with the exception of some demand for NKE upside ahead of earnings. Most clients focused on cleaning up out-of-the-money index hedges. Top-of-book depth hit YTD lows, averaging $1.7M compared to the 2-year average of $13.5M. With the week’s major macro events behind us, tomorrow’s straddle is pricing in a 0.90% move.

Hedge Fund Performance:

Global Fundamental Long/Short (L/S) returns are down -0.5% for March (+1.5% YTD), recovering after the worst 14-day drawdown since May 2022. Increased market volatility has intensified focus on risk reduction within the hedge fund space. This episode appears to be more “net down” than “gross down,” with U.S. Fundamental L/S net leverage now at two-year lows, a sharper decline than global peers. The aggregate Long/Short ratio (MV terms) has fallen to its lowest level in over five years.

Key U.S. Themes:

1. Net exposure in Cyclicals (GSXUCYCL) vs. Defensives (GSXUDEFS) has dropped to its lowest level since January 2024.

2. Gross exposure in TMT stocks is near five-year lows.

3. Mega-cap tech, once the “Magnificent 7,” is now dubbed the “Maleficent 7” as net exposure continues to decline, hitting two-year lows.

4. Factor exposure to medium-term momentum has seen only a modest decrease, despite elevated factor volatility and a sharp selloff in momentum winners.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!