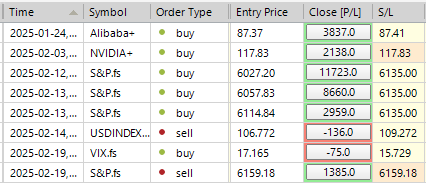

SP500 LDN TRADING UPDATE 20/02/25

FYI, I WILL BE OFFLINE FROM THE NY CLOSE TODAY. COMMENTARY WILL RESUME LDN OPEN 25th

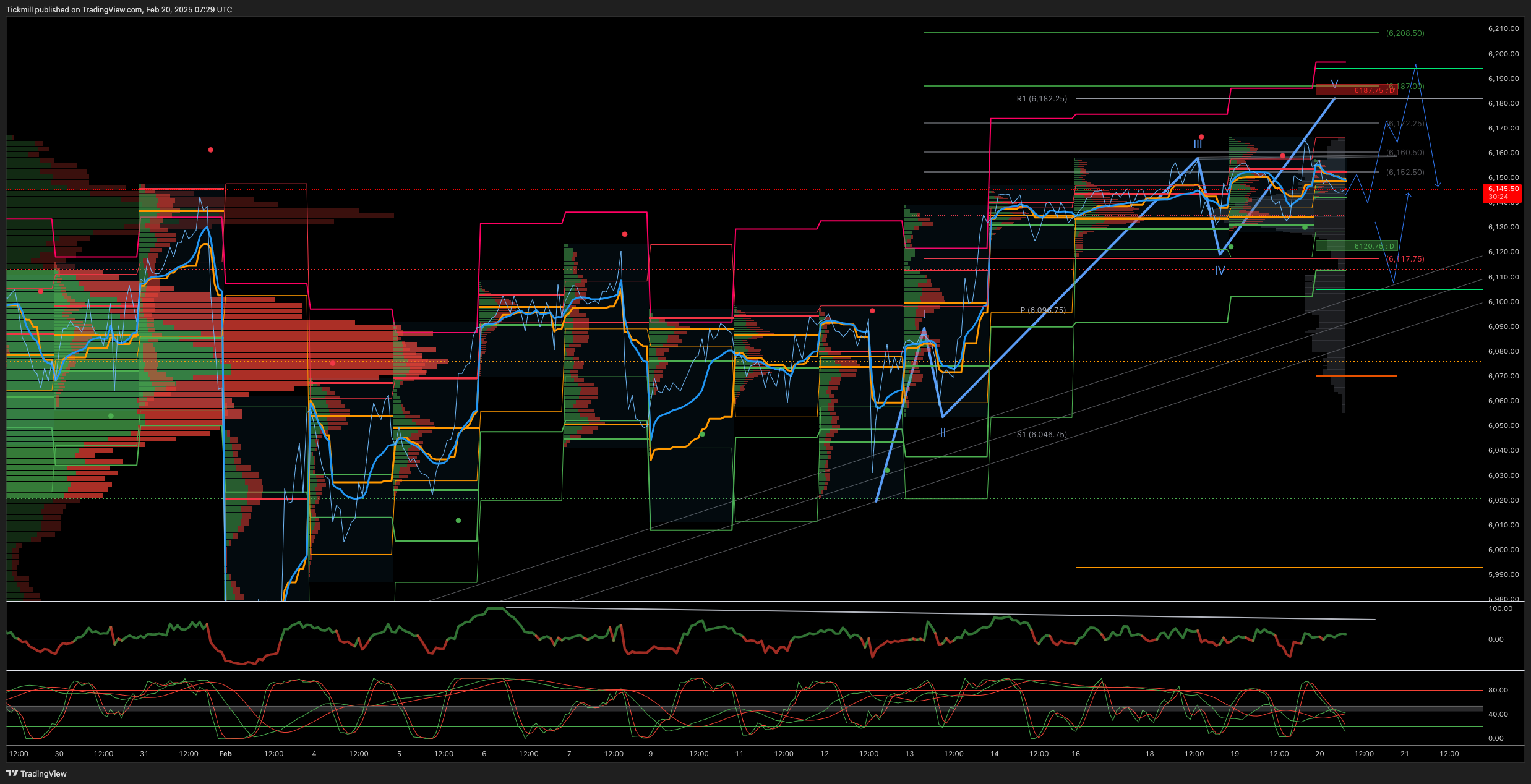

WEEKLY BULL BEAR ZONE 6060/70

WEEKLY RANGE RES 6204 SUP 6061

DAILY BULL BEAR ZONE 6100/10

DAILY RANGE RES 6196 SUP 6113

(ADJUST LEVELS BY -22 POINTS FOR EQUIVALENT CASH US500)

Options Expiration (OPEX) on February 21 – Volatility Risk

The positioning of 6,200 call options on SPX indicates a level of resistance, while the positioning of 6,000 put options could provide support in the event of a pullback. Anticipate heightened volatility as we approach OPEX, with the possibility of abrupt movements prior to a repositioning.

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY/WEEKLY RANGE RES

SHORT ON TEST/REJECT DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: PINNED

FICC and Equities | February 19, 2025

Market Overview:

- S&P 500: +24bps, closing at 6,144 with a Market-on-Close (MOC) buy imbalance of $850mm.

- Nasdaq 100 (NDX): +5bps, ending at 22,175.

- Russell 2000 (R2K): -34bps, closing at 2,282.

- Dow Jones: +16bps, finishing at 44,627.

- Volume: 14.75bn shares traded across all U.S. equity exchanges, below the YTD daily average of 16bn shares.

- Volatility Index (VIX): -52bps, settling at 15.27.

Commodities and Other Assets:

- Crude Oil: +68bps, closing at $72.34.

- U.S. 10-Year Yield: -1bps, finishing at 4.53%.

- Gold: -5bps, ending at $2,934.

- Dollar Index (DXY): +11bps, at 107.17.

- Bitcoin: +147bps, surging to $96,409.

Session Highlights:

A quiet trading session overall, with the S&P 500 silently achieving another all-time high (ATH) close at 6,144, marking its sixth ATH this year. Underlying moves were largely idiosyncratic:

- Semiconductors: Strong performance in analog semis, led by ADI (+10%) on a solid earnings beat and guidance above expectations—the first in its group to do so.

- Payments Sector: FOUR dropped -17% after a disappointing guidance report, with positioning ahead of Visa’s (V) investor day tomorrow (11 AM ET). While crowded long, no significant surprises are expected.

- Consumer Names: CELH surged +15% ahead of earnings and CAGNY. Market speculation tied to message boards drove excitement, though no concrete catalysts emerged.

Health Care Sector:

Health Care books faced intense pressure throughout the week, with unwinds likely to persist. Notable movers included:

- HIMS: +17%

- CRL: +7%

- Others: GRAL +11%, Medicaid stocks MOH/CNC +3%, and Gene Therapy/Editing stocks also showed squeezy price action.

GS Prime Brokerage Data (courtesy of Vincent Lin):

- U.S. Health Care gross/net exposures (as % of total U.S. book): 9th/7th percentiles vs. the past year, and 37th/60th percentiles vs. the past five years.

- Long/short ratio: 2.33, in the 72nd percentile for the past year but 27th percentile over five years.

- Subsector trends: Biotech and Pharma long/short ratios increased YTD, while Life Sciences Tools & Services and HC Providers & Services declined.

- Hedge funds have been covering Biotech and Pharma shorts YTD, but short flows in Life Sciences Tools & Services and HC Providers & Services have risen by double digits this year.

Flows and Activity Levels:

- Overall activity: Rated 5/10. Skews benign.

- Executed flow: +390bps vs. +162bps 30-day average.

- Long-Only (LO) Funds: Net buyers (+$850mm), driven by tech, financials, and industrials, offset by supply in staples and communication services.

- Hedge Funds (HFs): Net sellers (-$500mm), with supply in tech, communication services, and materials.

Derivatives Market:

Another subdued day in the index volatility space, as dealer long gamma kept markets pinned despite the S&P 500 nearing another ATH. Key observations:

- SPX volatility remained unchanged across tenors. Short-dated topside vols stayed in the single-digit range. The desk sees little value in shorting vol here, given low realized volatility and steep skew.

- NDX volatility contracted slightly at the front end. The desk views owning NDX vol as attractive, especially with spreads narrowing to SPX ahead of NVDA earnings.

- Flows were as muted as price action, with a quiet event calendar leading up to options expiration (opex)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!