SP500 LDN TRADING UPDATE 18/02/25

WEEKLY BULL BEAR ZONE 6060/70

WEEKLY RANGE RES 6204 SUP 6061

DAILY BULL BEAR ZONE 6140/30

DAILY RANGE RES 6176 SUP 6092

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY/WEEKLY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

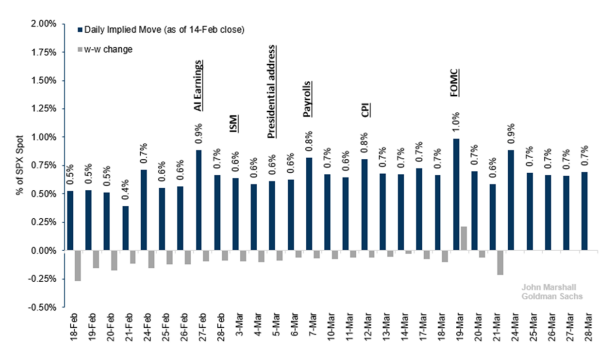

Options prices declined this week; investors are expecting volatility on AI earnings, payrolls, and FOMC. Daily SPX implied moves declined across most days this week with the exception of 19-March where investors bought volatility for the FOMC decision.

Retail investors have shown an unusual and consistent trend of buying single stocks. This significant activity began on January 29th, likely reflecting positive sentiment following the FOMC decision that afternoon. While buying slowed slightly around the February 12th CPI release, it picked up momentum again on February 14th. The buying was more pronounced in Nasdaq 100 stocks but was also evident in S&P 500 stocks.

Options volumes for individual stocks have remained relatively flat over the past quarter, maintaining elevated levels. This activity has likely contributed to the strong performance of stocks often linked to retail investors. As the earnings reports for key AI stocks approach in the coming weeks, we will closely monitor trends in these volumes. A sustained drop in activity could indicate fading enthusiasm, potentially encouraging hedge funds to ramp up their short positions. Macro investors persist in offloading positions through futures, swaps, and options. Over the past six weeks, we have frequently noted a marked decline in demand for leveraged index upside since the December FOMC meeting. While there was a two-week pause in activity following the January 15 CPI release, selling appears to have resumed in the last two weeks, albeit at a slower pace.

This ongoing decline raises concerns that a key segment of investors may be adopting a more cautious stance on equities. However, the absence of significant market drops over the past month somewhat alleviates fears of an imminent downturn in equity markets.

Call buying in Chinese equities persists. Investors are increasingly favouring call options over put options on FXI, which we view as a potential near-term headwind for FXI.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!