SP500 LDN TRADING UPDATE 14/02/25

WEEKLY BULL BEAR ZONE 6114/24

WEEKLY RANGE RES 6114 SUP 5918

DAILY BULL BEAR ZONE 6120/10

DAILY RANGE RES 6174 SUP 6090

TODAY'S TRADE LEVELS & TARGETS

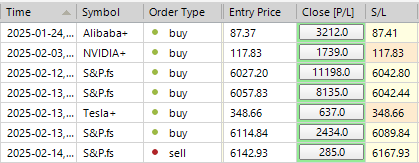

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET WEEKLY/DAILY RANGE RES

SHORT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: STRONG GAINS

FICC and Equities | 13 February 2025

Market Overview:

- S&P 500: +1.04% closing at 6115 with a Market-on-Close (MOC) $590mm to BUY.

- Nasdaq 100 (NDX): +1.43% at 22030.

- Russell 2000 (R2K): +1.17% at 2282.

- Dow Jones Industrial Average: +0.77% at 44711.

Trading Volume & Volatility:

- Total volume: 15.38bn shares traded across all U.S. equity exchanges (vs. YTD daily average of 16bn).

- VIX: -4.97% at 15.10.

Commodities & Other Markets:

- Crude Oil: +0.04% at $71.40.

- U.S. 10-Year Treasury Yield: -9bps at 4.53%.

- Gold: +0.85% at $2928.

- DXY (Dollar Index): -0.78% at 107.09.

- Bitcoin: -1.23% at $96,468.

Key Drivers:

Stocks rallied as investors processed a mixed PPI report (headline beat, but softer underlying PCE details), alongside easing 10-year yields (-9bps to 4.53%) and speculation about a potential Ukraine ceasefire. Our economists revised their January PCE forecast lower by 5bps to 0.30% MoM, below pre-CPI release levels.

Short sellers faced a tough session, with our most-shorted basket (GSCBMSAL) surging +3.39%. Retail activity appeared elevated, evidenced by Non-Profitable Tech stocks (+5.28%) and Meme stocks (+4.60%). Consumer names with high short interest, such as CROX, MGM, and TAP, spiked +10% to +20%, driven by positioning imbalances (positioning score: 3/10).

Sector Highlights:

- Semiconductors: A challenging day, with INTC climbing another +8% (now +28% WTD), spurring "gross-down" flows across the chip sector. AVGO/TSM traded lower, while NVDA, MBLY, and WOLF moved higher.

- Tech, Media, and Telecom (TMT): This week’s notional de-grossing in U.S. TMT stocks is on track to be the largest since July.

Performance Metrics:

- Preliminary Prime Brokerage (PB) data: Fundamental L/S funds gained +42bps, while Systematic L/S funds fell -82bps (a -1.8 sigma move vs. the past year).

- Overall executed flow: +150bps, above the +70bps 30-day average.

- Net buyers: Long-Only funds (+$2.5bn) and Hedge Funds (+$740m), primarily driven by overlapping demand in tech, discretionary, and macro products. Both groups were marginal net sellers in industrials.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!