SP500 LDN TRADING UPDATE 12/03/25

WEEKLY BULL BEAR ZONE 5850/60

WEEKLY RANGE RES 5928 SUP 5624

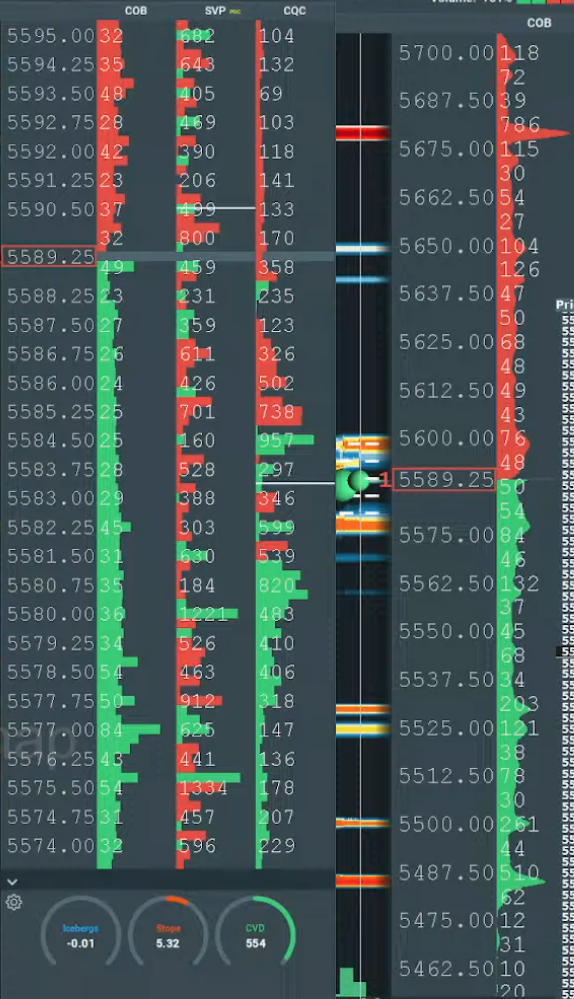

DAILY BULL BEAR ZONE 5535/45

DAILY RANGE RES 5619 SUP 5534

5550 10% COTTECTION FROM ATH’S

WEEKLY ACTION AREA VIDEO

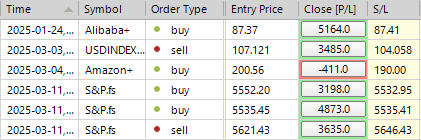

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE 5645 TARGET 5680

SHORT ON ACCEPTANCE BELOW 5525 TARGET 5500/5485

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: AHEAD OF CPI RELEASE

FICC and Equities | March 11, 2025 |

Market Recap:

- S&P 500: -65 bps, closing at 5,572 with $1B MOC to sell

- Nasdaq 100 (NDX): -28 bps, closing at 19,376

- Russell 2000 (R2K): +28 bps, closing at 2,029

- Dow Jones: -114 bps, closing at 41,433

- Volume: 19B shares traded across all U.S. equity exchanges vs. YTD daily average of 15.3B

- VIX: -3.4%, closing at 26.9

- Crude Oil: +79 bps, closing at $66.55

- U.S. 10-Year Yield: +7 bps, closing at 4.28%

- Gold: +84 bps, closing at $2,923

- DXY (Dollar Index): -48 bps, closing at 103.40

- Bitcoin: +4%, closing at $82,670

Session Overview:

The session was volatile, with notable weakness in consumer-leveraged sectors following disappointing guidance from Delta Airlines (DAL) and softer outlooks from Kohl’s (KSS) and Dick’s Sporting Goods (DKS). The slowdown is now widely acknowledged, but the debate centers on whether it is temporary (as suggested by DAL) and how much is already priced into the market. Degrossing activity over the past two days marked the largest two-day reduction in four years. However, there was some stabilization in hedge fund (HF) trading activity and performance. After a steep -190 bps decline yesterday, fundamental long/short (L/S) hedge funds rebounded slightly, gaining +42 bps today.

Key Factors to Watch:

1. CEO Roundtable Tonight: This presents an opportunity to reassure markets that the U.S. is not undergoing a regime shift away from pro-growth and pro-American manufacturing policies. The event will be open to the in-town media pool and likely televised.

2. CPI Data Tomorrow: A less-than-expected inflation print will be critical in calming market nerves. If CPI surprises to the downside and hedge fund performance stabilizes further, recent asset manager sell-offs could subside.

Market Technicals:

The S&P 500 broke below its 200-day moving average, signaling a potential for a sharp, albeit temporary, rebound.

CPI Forecast:

Our core CPI forecast is +29 bps MoM, which translates to an expected PCE forecast of +25 bps—broadly in line with consensus. A higher-than-expected print could heighten concerns about Federal Reserve constraints and the monetary policy "put," especially with inflationary pressures from tariffs looming.

Flows and Activity Levels:

- Overall activity levels were rated a 7 on a 1-10 scale.

- LOs (long-only funds) were net sellers at -$1.7B, with selling concentrated in financials and tech.

- HFs were net sellers at -$900M, with broad supply across all sectors except macro products.

Derivatives Market:

Heading into the CPI release, the volatility market reflects heightened stress, with short-dated vols above the 90th percentile on a 10-year lookback. The SPX straddle implies a breakeven move of over 1.5% for tomorrow—the highest implied move for a CPI print since March 2023. Flows today were muted, with early monetization of VIX upside followed by client demand for VIX puts and put spreads into April expirations. With elevated vol, we favor short-dated calls and call spreads to position for potential relief tomorrow.

GS Prime Brokerage Insights:

"What inning are we in during this de-grossing episode?"

Each episode is admittedly unique in terms of drivers and duration, making it challenging to pinpoint exactly where we stand in the risk unwind process. Based on our assessment through yesterday, our best estimate is that we are currently in the middle innings of this episode.

In cumulative notional terms, the combined de-grossing activity by hedge funds on Friday and Monday has been significant compared to historical trends. It marks the largest in four years and ranks among the most substantial in the past 15 years, with a Z-score of -4.5.

Gross leverage remains elevated: The overall gross leverage for the full PB book is currently in the 94th percentile compared to the past year, the 98th percentile compared to the past three years, and the 99th percentile compared to the past five years.

Net leverage has decreased: The overall net leverage for the full PB book now stands in the 35th percentile compared to the past year, the 76th percentile compared to the past three years, and the 51st percentile compared to the past five years.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!