SP500 LDN TRADING UPDATE 12/02/25

WEEKLY BULL BEAR ZONE 6114/24

WEEKLY RANGE RES 6114 SUP 5918

DAILY BULL BEAR ZONE 6050/40

DAILY RANGE RES 6132 SUP 6049

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF WEEKLY/DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGETING 6147/61

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

.U.S. EQUITIES UPDATE: RELATIVELY STABLE

FICC and Equities

11 February 2025 | 10:47PM UTC

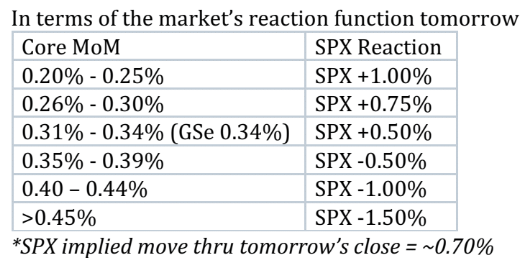

S&P up 3bps closing at 6068 with a market-on-close buy of $500 million. NDX down 29bps at 21693, R2K down 53bps at 2275, and Dow up 28bps at 44593. A total of 15.57 billion shares changed hands across all U.S. equity exchanges, compared to a year-to-date daily average of 16 billion shares. VIX increased by 133bps to 16.02, Crude rose by 115bps to 73.15, US 10-year yield up 3bps to 4.53, gold down 35bps to 2898, DXY fell 37bps to 107.92, and Bitcoin decreased by 147bps to 95,987. It was a noisy day that felt more negative than the overall flat market suggested, with significant fluctuation beneath the surface due to uncertainty surrounding policies and earnings. AI stocks experienced declines today, while traditionally favored semiconductor stocks like GFS, INTC, ON, and HPQ were up, notably with ALAB gaining 4% after a beat and raise. Additionally, ongoing 25% tariffs on all steel and aluminum imports continue to boost metal stocks. Excluding specific movers, overall activity on individual stocks appeared subdued ahead of the CPI report. For tomorrow, GIR anticipates a 0.34% rise in January core CPI (against 0.3% consensus), leading to a year-over-year rate of 3.19% (compared to 3.1% consensus).

Our floor rating was a 5 on a scale of 1-10 regarding overall activity levels. Total executed flow ended at 183bps as compared to an average of +88bps over the last 30 days. LOs concluded with balance amid supply surges in tech, macro products, and communication services, while demand was seen in discretionary sectors and industrials. Hedge funds were net sellers by $500 million, driven by limited supply in macro products and sporadic sales in discretionary sectors, particularly airlines.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!