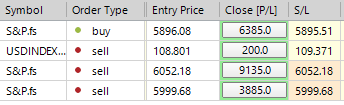

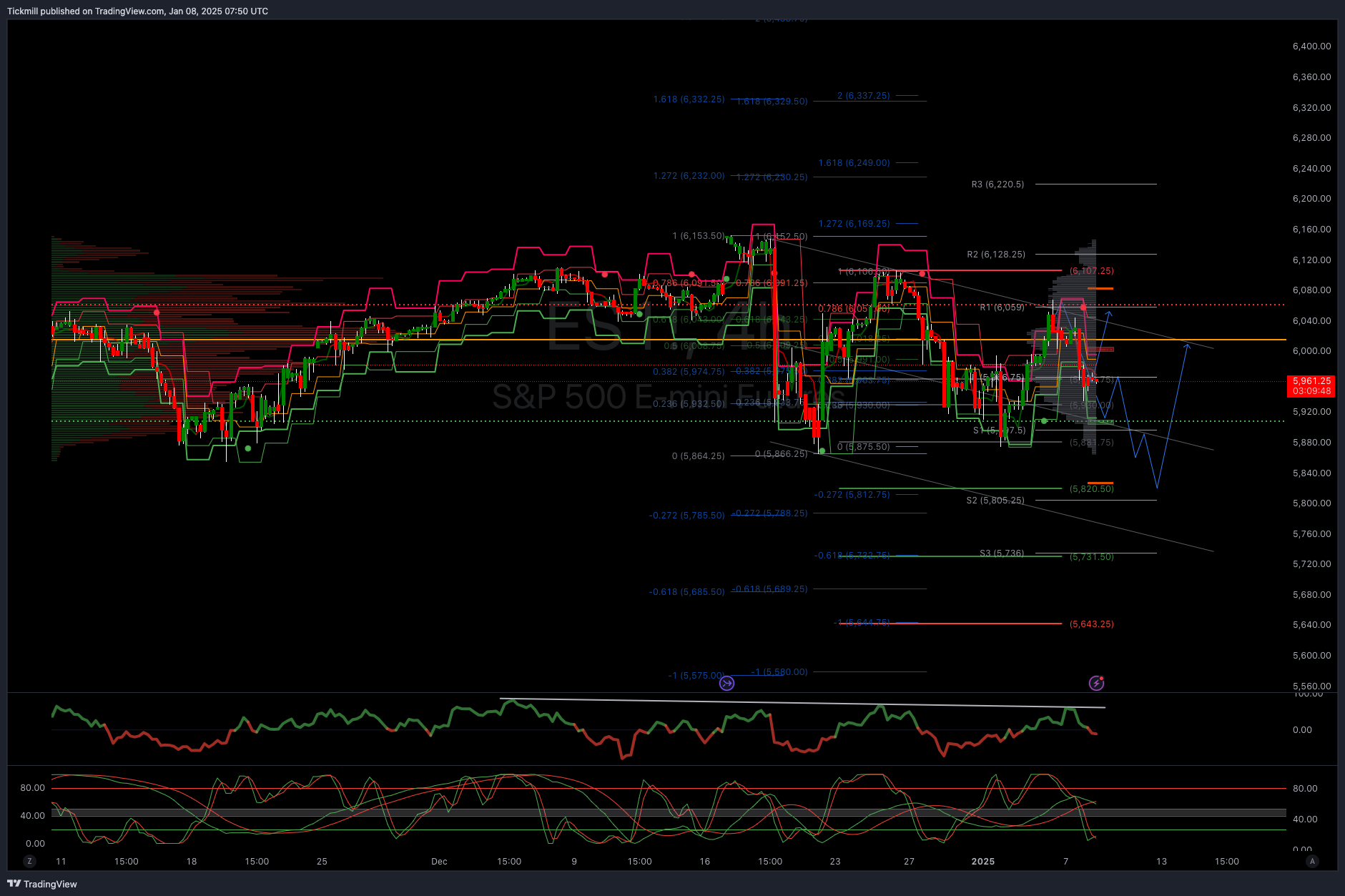

#SP500 LDN TRADING UPDATE 08/01/25

WEEKLY BULL BEAR ZONE 6050/60

WEEKLY RANGE RES 6077 SUP 5911

DAILY BULL BEAR ZONE 5940/50

DAILY RANGE RES 5996 RANGE SUP 5913

BUYER ON TEST/REJECT WEEKLY/DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

SELLER BELOW 5911 TARGET 5865> *5820* CORRECTIVE OBJECTIVE AGAINST 6107 SWING HIGH

YOU CAN REVIEW THE WEEKLY ACTION AREAS & PRICE OBJECTIVES HERE

Goldman Sachs Trading Desk View

Today marked the first day of somewhat heightened activity on the desk following a quiet start to the year. The flows have leaned towards purchasing options, and we are observing a gradual increase in volatility across the surface, with a steepening skew in SPX. We maintain the view that there isn't much gamma present, particularly to the downside, while dealers are becoming longer gamma on the upside. We've noticed buyers of SPX downside and VIX calls today, even though volatility is starting from a significantly higher level compared to the lows experienced in 2024. The desk continues to favour put spreads as a preferred method for short delta implementation to take advantage of an elevated skew level without incurring excessive outright volatility. Specifically, QQQ put spreads extending to the end of January or early February appear appealing, as the spread to SPX is relatively low, allowing for the capture of the majority of tech earnings

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!