SP500 LDN TRADING UPDATE 07/04/25

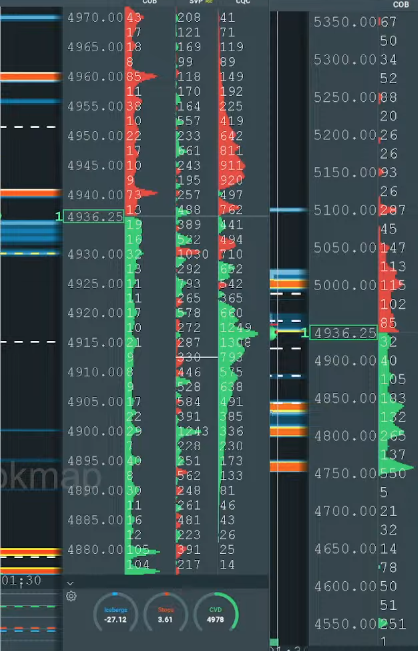

WEEKLY BULL BEAR ZONE 5050/60

WEEKLY RANGE RES 5443 SUP 4749

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

Unforgettable

Equities and FICC

"Anyone can hold the helm when the sea is calm."

Syrus Publilius

We knew going into last week that it may be wild, and it surpassed all of our expectations in that regard. We received -908bps, whereas the vol market was pricing in an absolute move for the S&P 500 of 260bps on the week. Thursday's (4/3) S&P loss of -484 bps was the worst trading session since 6/11/20 (-589 bps), and yesterday's (597 bps) loss was the worst day since 3/16/20, when the index fell 11.98% during the COVID shutdown.

Some of the most severe derisking and PNL destruction within the HF community that I have ever seen (in such a short amount of time) occurred between March 7 and March 10.

The stage was prepared for much cleaner positioning into 4/2 by this decline. In the weeks preceding 4/2, the long-only community mainly sat on their hands. It was hoped that the market would be more clear and that investors would be free to trade and possibly commit some offence once the tariff announcement was over. A strategy is not hope. With 26.6 billion shares trading across all US equity exchanges yesterday—breaking the previous record of 23.67 billion shares achieved on 1/27/21 during the GME mayhem—it was clear that investors were free to trade (all defence, no offence).

According to shares moved, Thursday, April 3, and Friday, April 4, will also be remembered as the busiest two days in GS's history of one delta trading. HF PnL was generally good on 4/3, but yesterday saw a significant decline (-270bps for basic L/S HFs—the poorest day of performance since 1/27/21). Due to short sells and, to a much lesser extent, long sales, HFs net sold the most global shares in our data set's history (since 2010), according to our PB data from last week, which does not even cover trading from yesterday (8 to 1). The biggest notional short selling we have ever seen occurred last week. HFs Net sold global financials at the second-fastest pace on our record (since 2016) and the fastest pace since January 21. As HFs aggressively increased hedges during the market selloff, US Macro Products (Index + ETF) had the highest notional short selling on our record.

The long-only community saw strong sales yesterday (more irregular and in bigger waves with some requests for cash) and on Thursday (wire to wire and systematic in nature).

Fins, industrials, and technology accounted for a large portion of the supply. According to our data, MFs are aggressively buying fins going into this year and holding a record-low amount of cash (1.5% of total AUM). Prepare for more supplies from this community as a result.

The market will continue to fluctuate, and the index level's near- and medium-term lows are probably still ahead of us. Through 4/24, corporates are still in their buyback blackout period. Yesterday, the S&P E-mini top of book depth fell to $2mm, which is roughly as low as this statistic will go (historical average = $13mm). Scale buying by institutions will begin below the S&P 500k-5k.

The market was already quite cautious before the event, and the reciprocal tariffs were far worse than anticipated. According to our experts, the US effective tariff rate will increase by 19 percentage points (from 3% to 21%) as a result of the announced duties today.

The positive view is that the government adopted a "kitchen sink" strategy and that talks with trading partners will ultimately result in tariff rates that are marginally lower than those that were just announced. Trump already stated in a number of tweets on Friday that nations wish to engage in negotiations and reduce their present tariffs on the US to zero.

With yesterday being the market's greatest volume day ever and our sentiment index falling to -2.5, certain capitulatory signals are emerging. In our data set's history, the average forward two-week return of the S&P 500 is +125bps and has a 70% positive hit rate when our sentiment indicator falls this low. Below are charts on this.

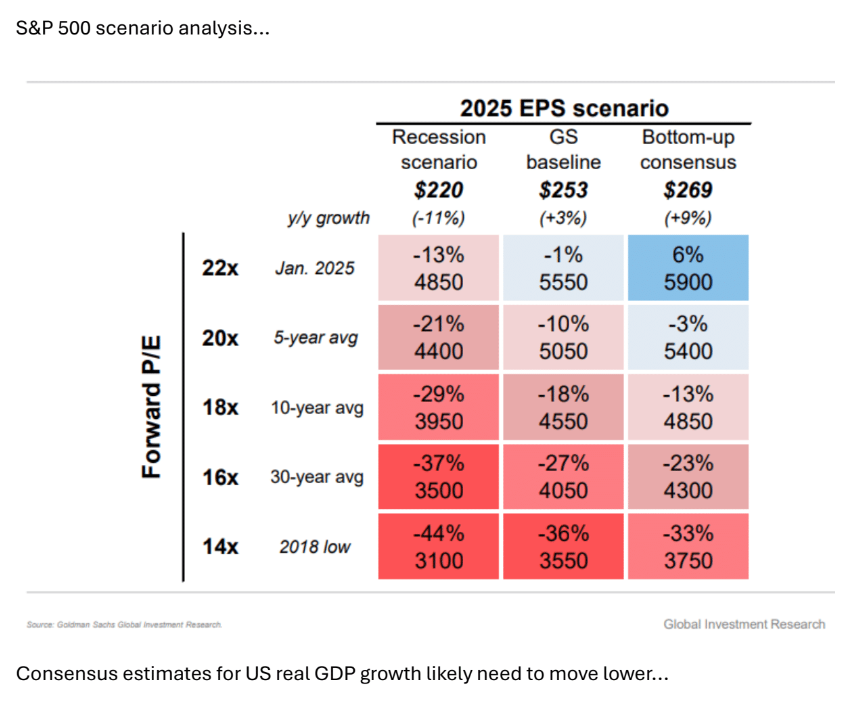

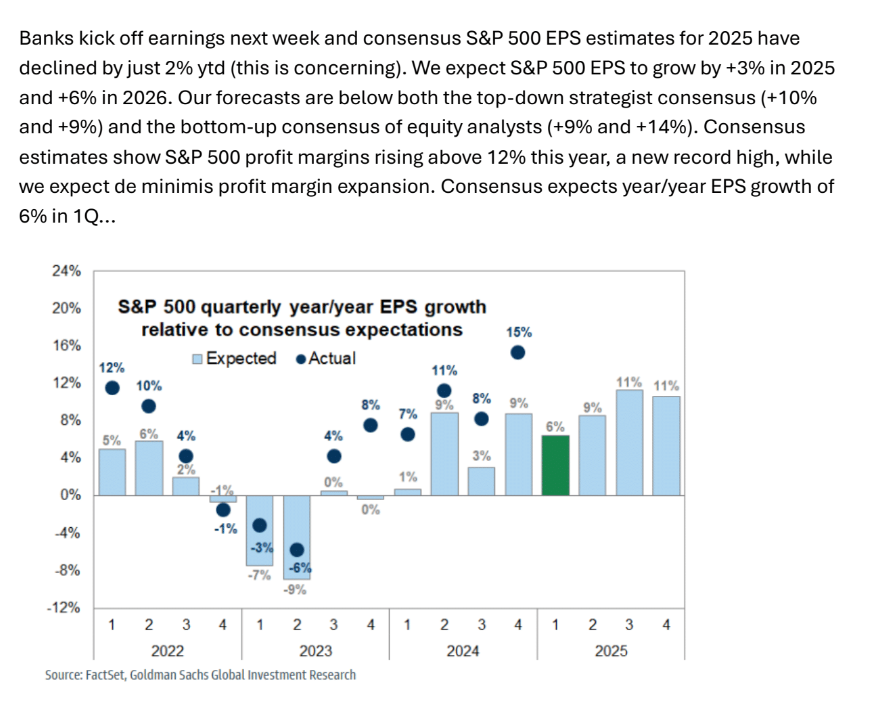

Even if/when we see encouraging developments on the negotiation front, I am concerned that after 4/2 it will be extremely difficult to "put the toothpaste back in the tube." What was done is probably going to have an impact on GDP and EPS growth as well as raise inflation. The street hasn't adjusted its projections, and I anticipate that consensus on GDP and EPS growth will go considerably lower. The likelihood of a recession right now is 35%. At the moment, the S&P 500 is trading at 20x forward P/E. The average P/E multiple for a recession is 16 times the 30-year norm.

Every 100 basis points change in US GDP growth is equivalent to roughly 3-4% of S&P 500 EPS growth in our macro earnings model, and every 5 basis points increase in the average tariff rate lowers our EPS prediction by 1% to 2%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!