SP500 LDN TRADING UPDATE 03/04/25

WEEKLY & DAILY LEVELS

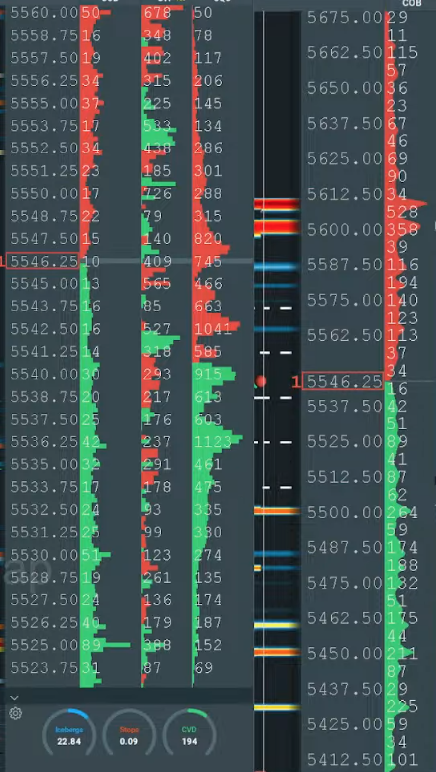

WEEKLY BULL BEAR ZONE 5550/60

WEEKLY RANGE RES 5746 SUP 5458

DAILY BULL BEAR ZONE 5580/90

DAILY RANGE RES 5627 SUP 5541

2 SIGMA DAILY RES 5726 SUP 5442

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – -40 POINTS)

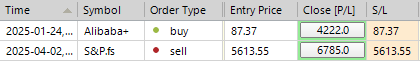

TRADES & TARGETS

LONG ON TEST/REJECT OF WEEKLY RANGE SUP TARGET 5584.50

LONG ON ACCEPTANCE ABOVE DAILY BB ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: "KIND" TARIFFS

FICC and Equities | 2 April 2025

Market Performance:

- S&P 500: +67bps, closing at 5,670 with MOC flows totaling $1.5B to BUY.

- Nasdaq 100 (NDX): +75bps, ending at 19,581.

- Russell 2000 (R2K): +157bps, closing at 1,988.

- Dow Jones: +56bps, finishing at 42,225.

A total of 16.2 billion shares traded across U.S. equity exchanges, surpassing the YTD daily average of 15.4 billion shares.

Key Indicators:

- VIX: -119bps, closing at 21.51.

- Crude Oil: +17bps, ending at $71.35.

- U.S. 10-Year Yield: -4bps, at 4.12%.

- Gold: +147bps, closing at $3,191.

- DXY: -41bps, at 103.83.

- Bitcoin: -1bp, finishing at $85,299.

Session Overview:

A quiet trading session as investors awaited this afternoon's scheduled tariff announcement, which remained the focal point. Activity levels on the floor were rated a 3 out of 10, with investors largely frozen. However, the floor finished +600bps versus the 30-day average of -157bps. Long-only (LO) and hedge fund (HF) managers were slight net buyers, with "squeezy pockets" leading gains.

Post-market action showed indigestion, with the S&P and Nasdaq sinking over 2% following President Trump's announcement: "RECIPROCAL RATE WILL BE HALF THEIR TARIFF RATE" with a minimum baseline tariff of 10% across the board. This baseline begins at midnight tonight, while higher reciprocal rates will be implemented starting April 9.

Notable Positive: Canada and Mexico are excluded from reciprocal tariffs, for now.

Key Levels to Watch:

- S&P intra-day low: 5,488.

- S&P closing low: 5,521.

Tomorrow’s focus will include Eurozone services PMI & PPI for February, U.S. services ISM, jobless claims, and earnings reports (pre-market: AYI, CAG, LW, MSM; post-market: GES).

Derivatives Update:

A subdued session heading into the tariff announcement saw flows primarily centered on unwinding and monetizing hedges rather than adding new risk. Macro-focused clients showed demand today, stepping in to buy May-expiry upside. Long/short managers also purchased weekly calls to hedge short positions that faced squeezes.

The desk notes a significant gamma shift following yesterday's $4B swing, anticipating increased dealer length on any rally before hitting support levels. Despite modest realized moves, the intraday range was ~2.20%, marking the third consecutive day above 150bps. As of today’s close, SPX straddles for the remainder of the week (including NFP) are pricing in a breakeven move of 2.0%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!