SP500 LDN TRADING UPDATE 03/01/25

WEEKLY BULL BEAR ZONE 5900/5890

WEEKLY RANGE RES 6086 SUP 5878

DAILY BULL BEAR ZONE 5995/85

WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO TO FOLLOW: NOTE: WE HAVE GAPPED LOWER OPENING THE ASIAN SESSION AT 5982 VERSUS A CLOSE OF 6067

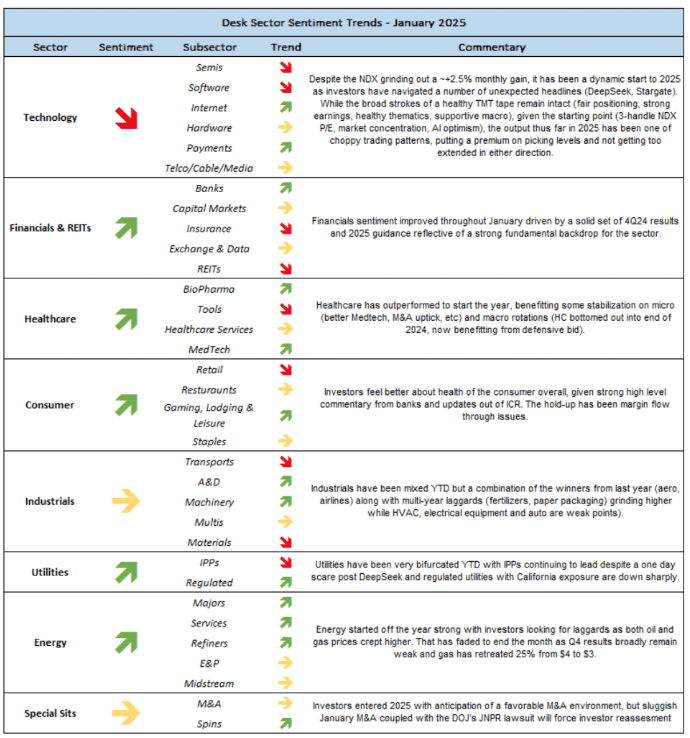

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: WEEKLY REVIEW...

FICC and Equities

31 January 2025 | 9:27PM UTC

It was a tough and lengthy week. Over the week, SPX was down 1% (EW - 54bps), NDX decreased by 1.4%, and RTY dropped 87bps, while the 10YR Treasury yield eased by 7bps to 4.54%. Prior to the Tariff news this afternoon, which announced that tariffs on Canada, Mexico, and China would commence on February 1, equities appeared poised to end the week either unchanged or with slight gains. The week was marked by: 1) Tariff Fatigue 2) Deep Seek 3) Positive earnings outcomes despite high expectations. Our desk experienced offsetting flows, with Long Only funds ending as net buyers of +$1b, while Hedge Funds were net sellers at -$1.5b. Our trading floor saw improvements in buying across the following sectors: Discretionary, Technology (notably Software), Industrials, Energy, and Healthcare (in that order). No sector significantly stood out on the sell side, despite the volatility.

Top performers of the week:

Expensive Software, Secular Growth contributors, Obesity Drugs up 2-3%, along with China ADRs and Regional Banks both up 1.5% //

Worst performers of the week:

Bitcoin down 10%, Natural Gas down 6.5%, and both Copper and Infrastructure down 5%.

Key technical flow dynamics noted (ty Bartlett):

1) The highest velocity of supply occurred on Monday, with selling pressure gradually easing.

2) Most are still in "fact-gathering" mode, but there is growing conviction that the AI trade remains strong.

3) Buyers are active at higher levels (i.e., price can influence sentiment in these thematic areas).

4) Micro data points are shaping shifts in sentiment (AVGO surpassing NVDA).

5) Leveraged ETFs are amplifying price movements.

The earnings expectation is elevated this quarter: an 8% year-over-year growth for the S&P 500 (compared to a 3% consensus heading into the 3Q24 results). So far, things look promising, with Q4 currently tracking at 9%. More companies are exceeding expectations, while fewer are falling short than is typically seen. Positive earnings surprises are being rewarded, whereas those that miss are facing significant consequences.

14% of S&P market capitalization is set to report this week, with a focus on Consumer Staples, Healthcare, and Materials. We'll be closely monitoring statements from the Fed as they emerge from the blackout following this week’s FOMC. On the macroeconomic front, we have US Manufacturing ISM (Monday), US JOLTs (Tuesday), US Services ISM (Wednesday), BOE decision (Thursday; a 25bps rate cut is anticipated), and NFP (Friday).

PB Trading Flows:

Hedge funds have net sold US equities for the fifth consecutive week (-1.3 standard deviations compared to the past year), largely driven by short sales and, to a lesser extent, long sales (1.8 to 1). The Industrials sector was one of the worst performing US sectors this week, experiencing its highest net selling in over five months (-1.4 SDs), driven by both short and long sales (~7 to 1). Energy stocks have seen heightened shorting activity in each of the last five sessions and have been net sold for a fifth consecutive week (6 out of the last 7, -1.8 SDs), also driven by both short and long sales (4 to 1).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!