Retail Sales Drop Sharply

The British Pound has come under heavy selling pressure today amidst a sea of red UK data this morning. Retail Sales were seen contracting 0.7% last month, down sharply from the prior month’s reading of 0.1% and below the -0.3% the market was looking for. The decline marks the sharpest drop in retail activity in four months and coming on the back of a sharp jump in inflation over the same month, the picture for UK households looks much weaker in Q4.

UK PMI Plunge

Following this data, the latest round of UK PMI readings was also seen coming in below forecasts. The factory sector reading was seen falling to 48.6 from 49.9, despite forecasts for a lift to 50, with manufacturing activity seen moving deeper into negative territory. The services PMI was also below forecasts at 50, down from 52 prior and below the 51.9 the market was looking for.

BOE Easing Expectations

Against a backdrop of weaker UK data, the case for further BOE easing should be clear. However, the sharp uptick in October inflation muddies the outlook somewhat with the BOE keen to avoid pushing inflation up further by cutting rates again. As such, expectations for a December cut remain split. Incoming inflation data ahead of that meeting will prove key with the bank needing to see a softening of inflation before actioning a further cut. Despite this, GBPUSD risks remain skewed to the downside near-term with USD continuing to rally.

Technical Views

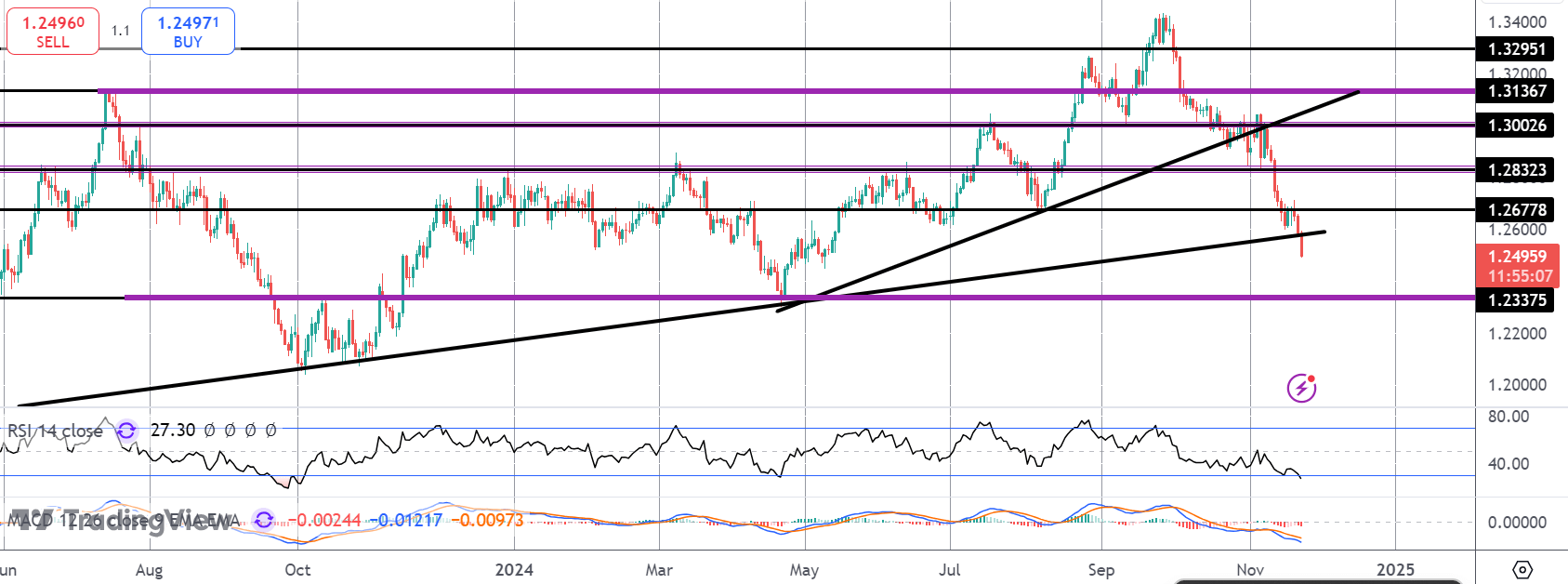

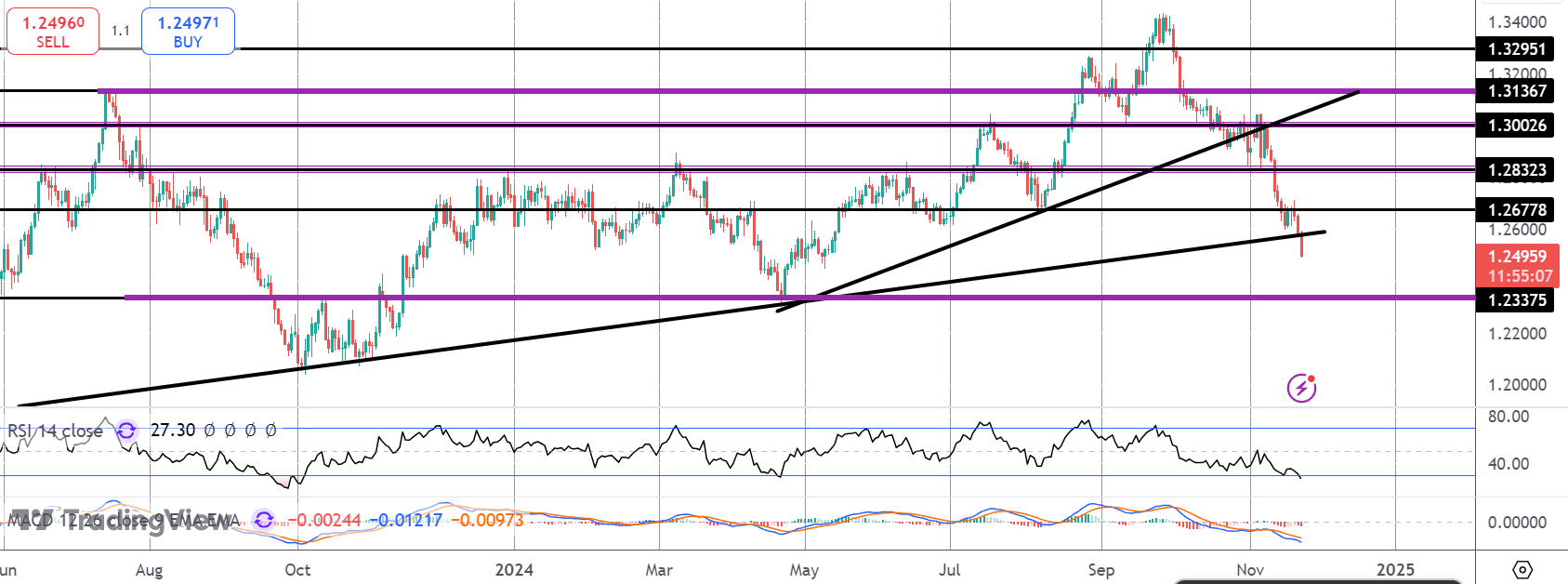

GBPUSD

The sell off has seen the market breaking down through several key support levels recently. Price is now testing below the bull trend line from 2023 lows and with momentum studies bearish, the focus is on a test of the 1.2337 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.