PPI In Focus

Ahead of the November US CPI release next week and of course, the December FOMC, today’s US PPI release will be closely watched. The reading will be interpreted as an indicator of how CPI is likely to print next week with a strong reading raising the chances of a bounce back in November inflation and a weak reading increasing the chances of November inflation having cooled further.

Fed Up Next Week

October CPI dropping to 7.7% from the prior month’s 8.2% reading sparked a wave of USD selling as traders adjusted their expectations towards a Fed pivot in December. With the November FOMC and subsequent slew of Fed commentary having essentially confirmed this view, the only remaining sticking point is this final inflation reading.

Rate Projections

However, even if we see a fresh jump in inflation, the Fed is likely to push ahead with a smaller hike though the guidance will likely shift towards projecting a longer duration of tightening. So, the stage is set then for today’s PPI release with the market expecting a 0.2% jump, meaning 7.2% annually which would be a slow-down from the prior month. Anything above that is likely to heighten uncertainty ahead of next week, dragging USD lower near term as growth fears balloon.

Technical Views

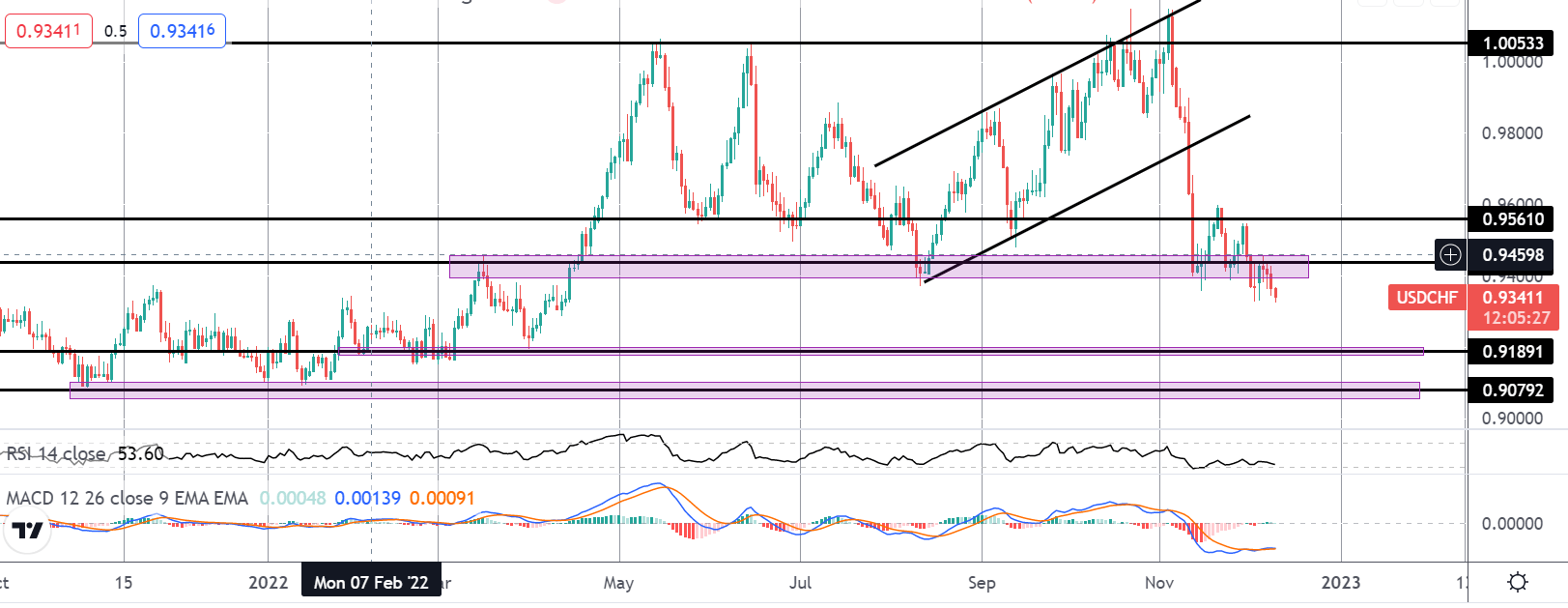

USDCHF

The breakdown out of the bull channel has seen the market extending sharply lower. Following some consolidation around the .9439 level, swissy is now pushing lower again and looks vulnerable to a deeper break towards the next support areas around .9189 and .9079 unless bulls can get back above .9561.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.