Biden Offers Reassurance Over China

Perhaps the key takeaway from the G20 meetings so far has been the subtle scaling back of tensions between the US and China. Given the geopolitical tensions linked to the Russia-Ukraine conflict as well as the situation between China and Taiwan, this development has come at a good time and has been welcomed by markets.

No “New Cold War”

On the back of the first in-person meeting since Biden took office, Biden offered reassurance that he did not believe China would invade Taiwan. Speaking with reporters, "I absolutely believe there need not be a new Cold War. I have met many times with Xi Jinping and we were candid and clear with one another across the board. I do not think there is any imminent attempt on the part of China to invade Taiwan.” He went on to say: "I made it clear we want to see cross-strait issues to be peacefully resolved and so it never has to come to that. And I'm convinced that he understood what I was saying, I understood what he was saying."

China on Side

While there is a long history of such moments of better relations between the two superpowers failing quickly, the comments have been welcomed for now and are adding to a better risk backdrop this week. Encouragingly, it seems China is enthusiastic too with Xi saying "we need to chart the right course for the China-US relationship.” He went on to say too that "China-US relations should not be a zero-sum game in which you rise and I fall… the wide Earth is fully capable of accommodating the development and common prosperity of China and the United States".

Technical Views

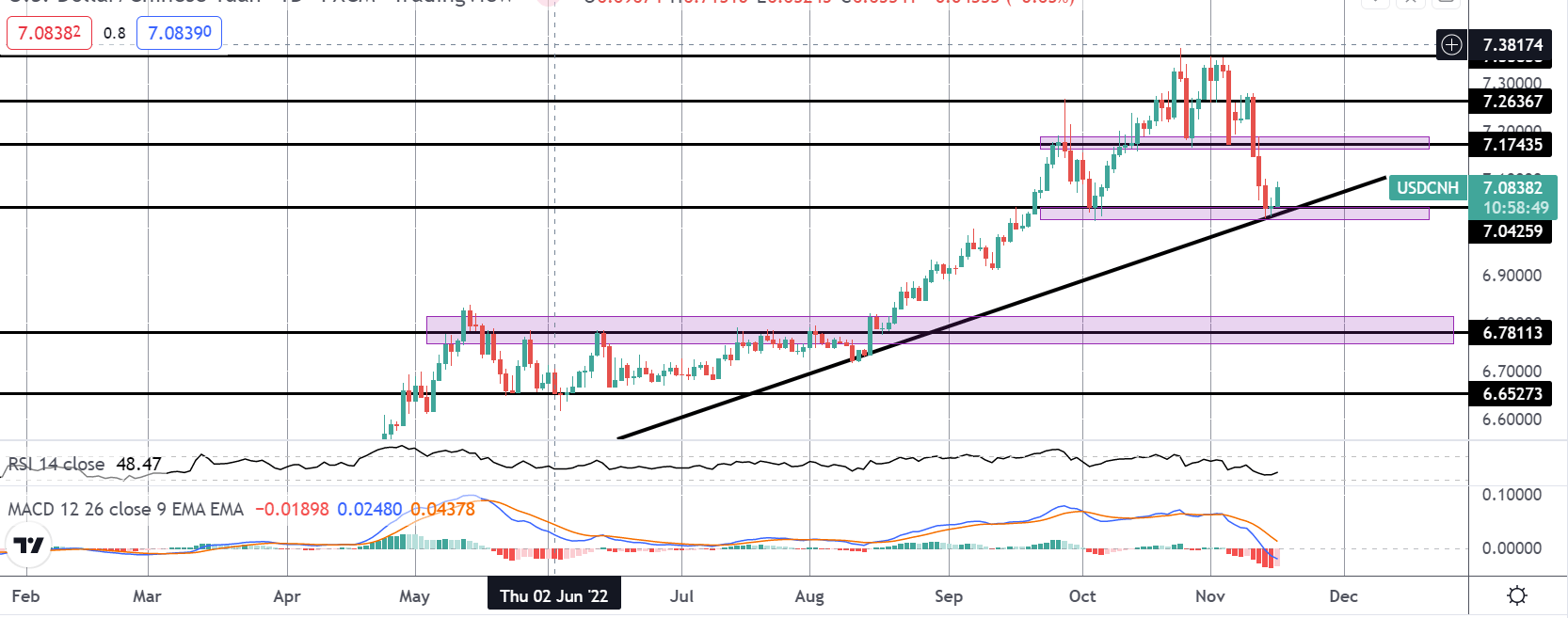

USDCNH

The sell-off in USDCNH has seen the market trading back down to test support at the 7.0425 level, with the rising trend line from YTD lows underpinning the market here also. This is a key area for the pair and a break here will be firmly bearish opening the way for a move down to 7.0425 next. Should we rally from here, however, the next level to watch will be the 7.1743 area which might prove to be the right shoulder of a developing head and shoulders pattern if it holds.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.