US CPI Up Next

Today’s US CPI release will be the main attraction for markets, stealing attention back from the ongoing US midterms results. On the back of the latest .75% hike by the Fed in November, markets are now looking for signs that the Fed will slow the pace of hikes. Chairman Powell mentioned that this might be appropriate within the next couple of meetings. With this in mind, today’s release has clear two-way risk for USD and broader markets.

Market Reaction

In terms of gauging market reaction to today’s release, if inflation is seen holding at record levels last month or spiking higher, USD will likely trade higher as traders price in a larger .75% hike in December. In this scenario, gold prices are likely to come off. However, with traders clearly keen to pick a top in USD, any softening of inflation will no doubt skew pricing in favour of a smaller .5% hike in December, pulling USD lower near-term and allowing gold prices to breakout.

Technical Views

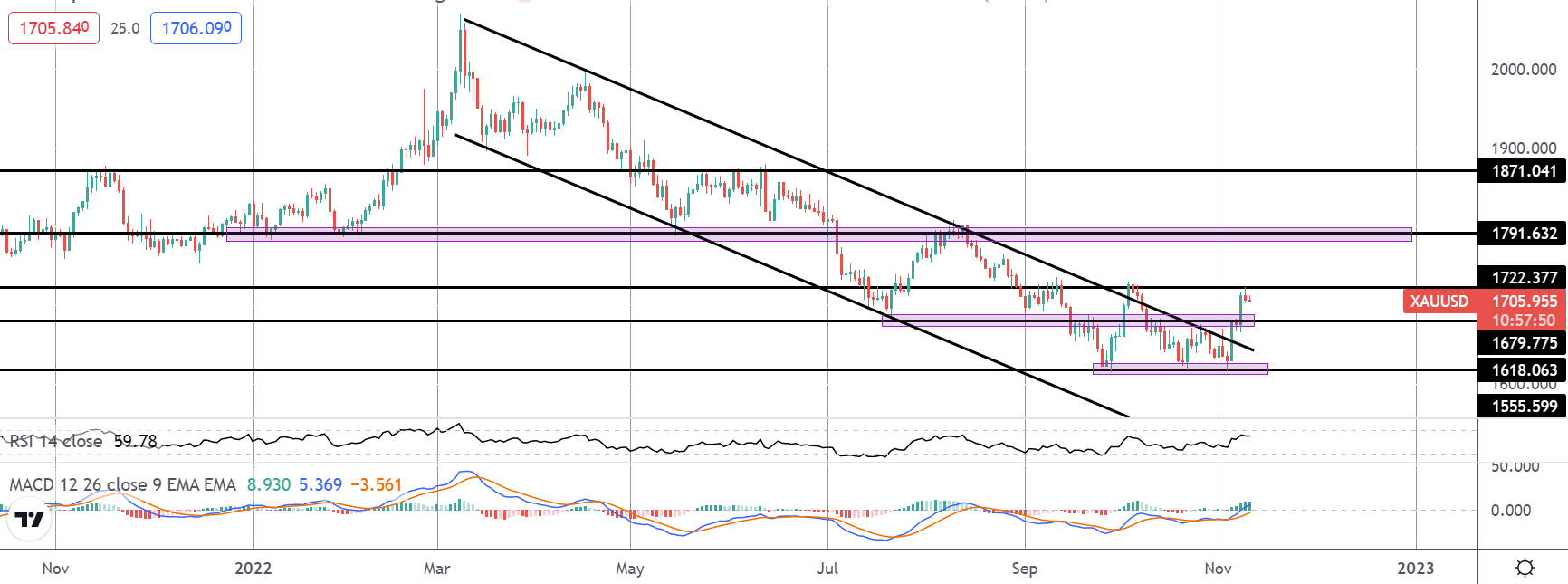

Gold

Following the breakout above the bearish trend line from YTD highs, gold prices have subsequently stalled at a test of the 1722.37 level resistance. However, with momentum studies bullish here, the focus remains on an eventual break higher while the 1679.77 level holds as support. Above 1722.37 and 1791.63 will be the next big hurdle for bulls. Only a shift back below the 1679.77 level negates the current bullish view, with 1618.06 the main support to watch for now.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.