Market Spotlight: EUR Soaring On Hawkish ECB Comments

ECB Hawks Out In Force

The Euro is seeing a renewed wave of buying this week in response to further hawkish ECB comments made yesterday. Several members of the ECB were seen commenting in support of continued tightening in order to bring inflation back down to target. ECB’s Schnabel said that it was too early to declare victory on inflation, despite the recent declines, a message which was echoed by Irish ECB member Makhlouf who noted that it was premature for the ECB to consider pausing its tightening program. ECB’s Villeroy then went on to say that the ECB needed to deliver at least “a few more hikes” in order to help tame inflation and achieve its CPI target.

These comments are consistent with the message from the bank last time around and subsequent comments made by ECB chief Lagarde who recently noted that inflation was still too high in the eurozone. In light of these comments, we saw EURUSD breaking back above 1.10 with strong gains made elsewhere. For now, EUR looks likely to remain in favour particularly against risk currencies which are currently falling sharply amidst a pull-back in stocks and commodities.

Technical Views

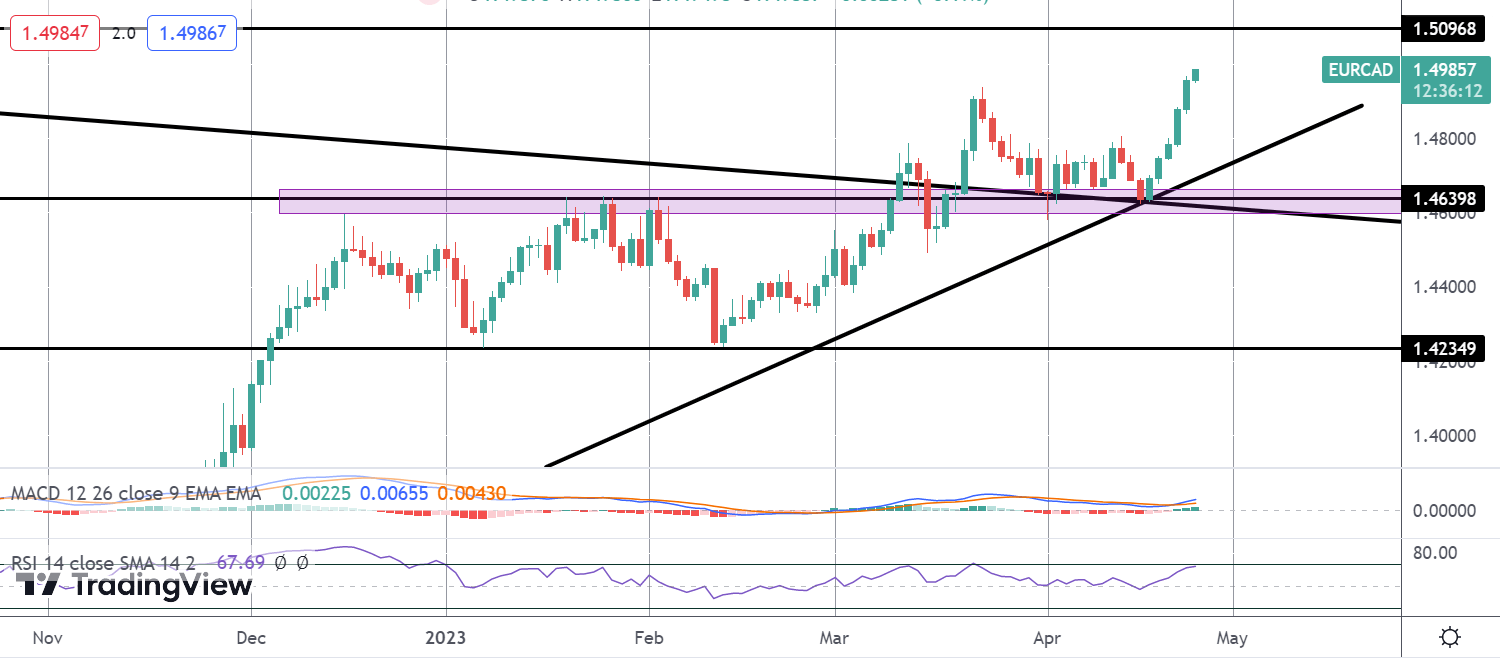

EURCAD

The retest of the broken bear trend line and the local bull trend line alongside structural support at the 1.4639 level has seen strong demand kicking in. EURCAD has since turned sharply higher again and has now broken out to fresh highs for the year. With momentum studies bullish, the focus is on a further push higher and a test of the 1.5096 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.