Make-Or-Break for Gold

Gold on Watch

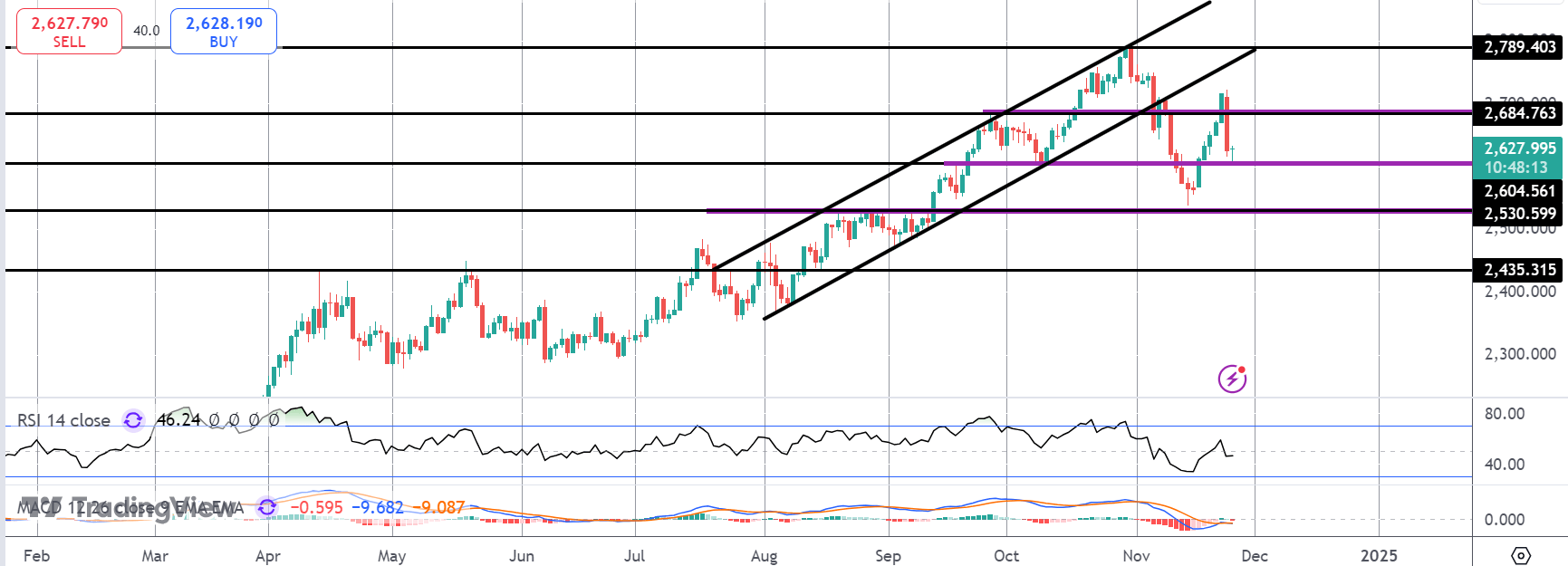

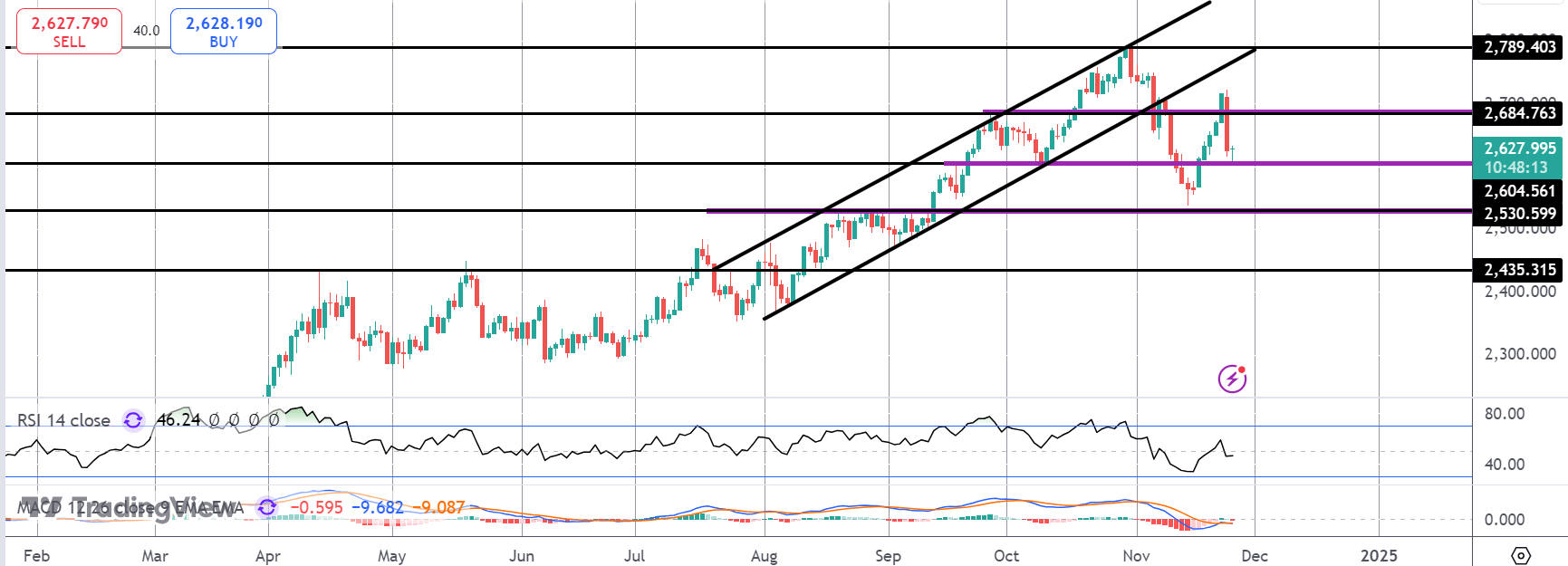

Price action in gold is looking very interesting here, with the market essentially showing a make-or-break structure. Following the sell off from all-time highs, the market has since rebounded. However, a test of the 2,684.73 level has seen a strong reaction lower with price printing a large daily outside candle, or bearish engulfing candle.

Bear View

As such, there is a chance that the recent peak marks a lower high, suggesting room for a deeper breakdown if price push below the 2,530.59 level. This could be the start of a powerful reversal lower for gold targeting at least a test of the 2,435.31 level.

Bull View

On the other hand, if prices remains above the 2,350.59 level, and can break back above 2,684.76, the outlook turns favourable once again with probabilities favouring a resumption of the bull trend and retest of YTD highs. In that scenario, the current structure simply becomes a correction within a bull trend, targeting fresh highs in the medium term.

USD Impact

The outcome for gold will likely depend on what we see next for USD. If the current selling deepens, this could allow gold to stabilise and return to higher prices. However, if we start to see USD push higher, perhaps in the instance that the Fed refrains from cutting again in December, this could lead gold prices sharply lower near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.