Goldman Sachs - Back to Bullish: Fear levels are excessively high compared to the near-term catalyst trajectory.

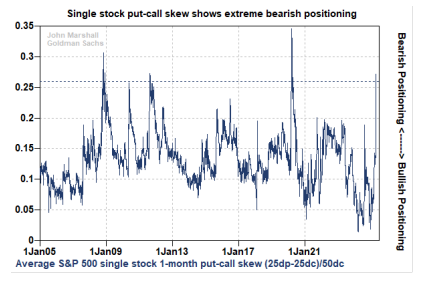

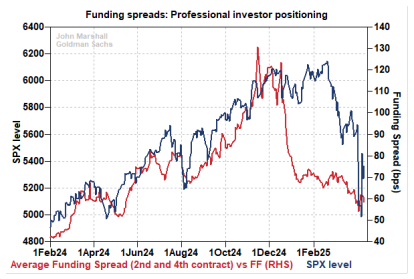

The sharp decline in futures funding spreads during December and January served as a significant warning that macro investors in futures, swaps, and options were reducing their exposure. This selling was likely driven by the belief that Fed policy would no longer support equity markets in the upcoming year. However, we are now witnessing a strong bullish signal from derivatives markets; both the VIX and put-call skew are at extreme levels, similar to those observed in 2008 and 2020. For the past two weeks, we have been in a state of constant anticipation regarding globally significant catalysts, which could be either positive or negative and might reverse rapidly. As of Friday, the combination of a 90-day pause on reciprocal tariffs and China's announcement to "ignore further tariff hikes" indicates that negative developments are less likely in the coming weeks. The easing of tariffs on smartphones, computers, and other electronics announced on Saturday demonstrates that de-escalations are possible, even with China. Without a steady stream of negative catalysts, the VIX and put-call skew are expected to decline significantly from current levels, potentially leading to direct and indirect equity buying as put hedges are removed.

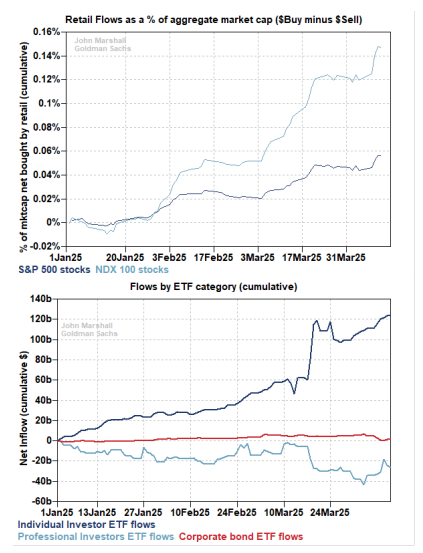

Individual investors are consistently purchasing equities. On Wednesday and Thursday, they notably increased their holdings in NDX and SPX single stocks. Their steady investment in ETFs also continues. We believe that individual investors' decisions to buy equities are more influenced by their employment status rather than their outlook on the equity market. We do not anticipate any near-term selling from individual investors, as job losses would need to occur first before any significant selling takes place.

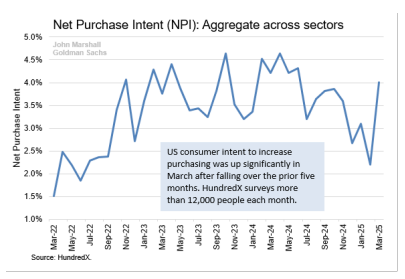

The US consumer is performing better than expected, according to data from HundredX. Despite bearish investors frequently citing uncertainty as a factor negatively impacting US consumer spending and sentiment, recent data tells a different story. The University of Michigan's Sentiment data released on Friday showed a decline greater than anticipated. However, through our partnership with HundredX, we assess net purchase intent (NPI) among over 12,000 respondents monthly, offering a broader perspective than other surveys. After five consecutive months of declining purchase intent, March showed a rebound to levels surpassing those seen before the election. This recovery was evident across all major sectors, challenging the notion that tariff uncertainty has already made US consumers more cautious.

Investor positioning has stabilized somewhat over the past week. This key chart influenced our cautious outlook in late December. As discussed last week, the equity market has aligned with this cautious signal. We no longer view this as a bearish indicator for equities and will now focus on other metrics, such as put-call skew, to assess incremental shifts in sentiment.

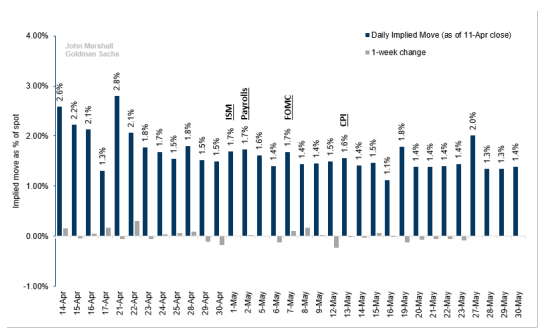

SPX options prices have increased across the curve. Without a steady stream of news, maintaining large daily equity price movements will be challenging. There is potential for easing in volatility markets across various assets. Although options prices have slightly decreased, there remains significant potential for further relaxation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)