Institutional Insights: UBS Turning tactically bearish next 2 months(at least-10%)

Institutional Insights: UBS Turning tactically bearish next 2 months(at least-10%)

Market Internal Weekly -

The UBS Head Of US Equities is "turning tactically bearish next 2 months(at least-10%)–IWM, XLF & HYG Hedges"

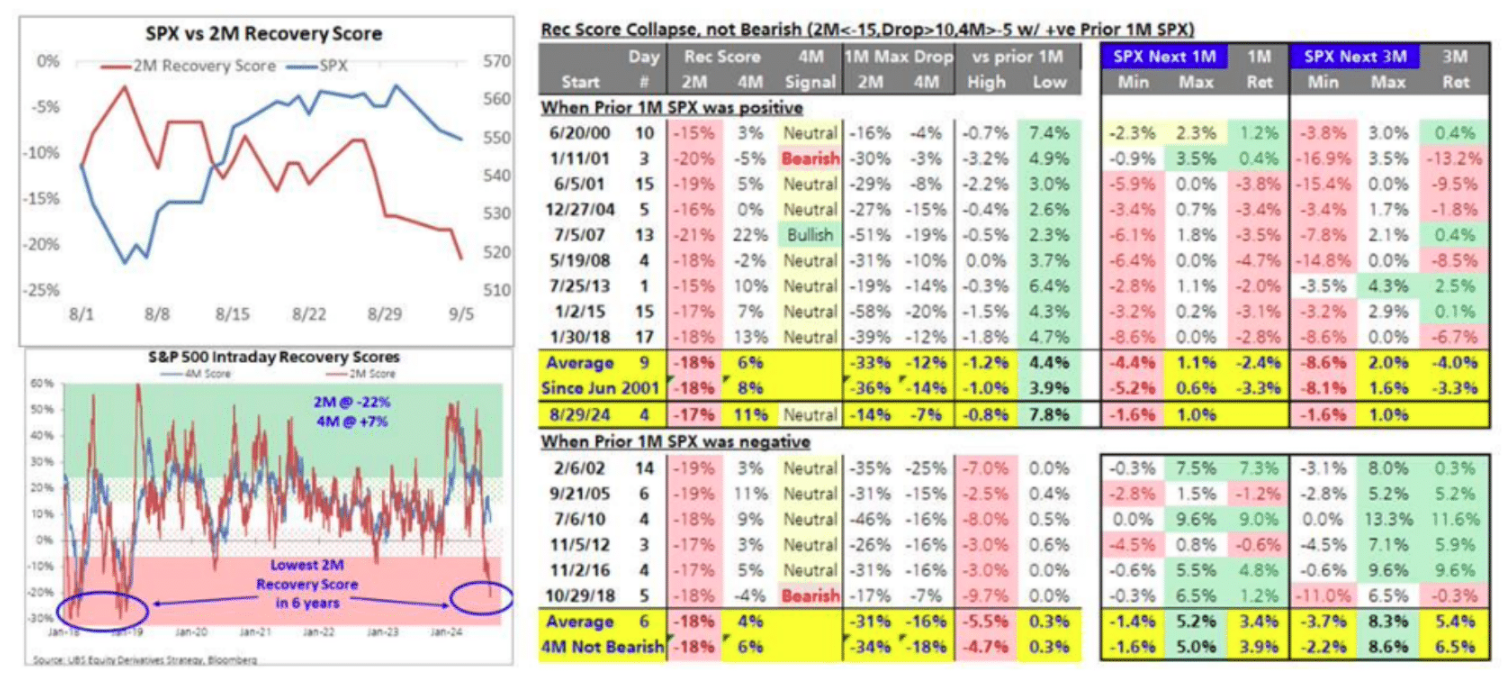

Executive Summary: Over the last two weeks, market internal has deteriorated to be the worst YTD. Current condition is also the most vulnerable in 6 years–which means any small external shock / slight disappointment of data could trigger large unwind.I amtactically bearish for the next 2 months (before Election) on the back of 2M intraday recovery score collapse to 6-year Low, RMM clients sold-the-dip and CTA sell rebalance asymmetry.

This call is more bearish than my email on Tuesday. On Tuesday, I suggested a just-in-case hedge of macro events given neutral recovery score, and I expected a choppy market. Today, I suggested a tail hedge due to 2M recovery score collapse as I expect SPX could be-10%from peak (or-8%from here) within 1 month and-15%within 2 months. However, this is NOT a long-term view unless 4 month recovery score makes a decisive shift. For now, the weak market internal bias suggests that even a slight disappointment in any of the upcoming economic releases could trigger large unwind. On no news event, moderate volume selling could continue in the market.

Investors are on the edge and are vulnerable to any bad news. Given SPX +18%at peak on 8/30 YTD, many investors have had a good year and are ready to cut some risk 2 months before election. This is why sentiment hasn’t turned bearish but the trading behavior is extremely cautious. Any disappointment in the upcoming economic releases could accelerate their modest profit taking behavior to massive unwind

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!