Institutional Insights: Societe Generale Monday Briefing

Risk on, UST yields and dollar retreat, 2s/10s curve reinverts after President-elect Trump picks Scott Bessent as Treasury Secretary. Bessent advocates cutting budget deficit to 3%, pursuing GDP growth of 3% through deregulation, produce additional 3mn oil bpd. DXY -0.5% to 107.01. 10y UST -7bp to 4.32%, support 4.26%, resistance 4.39%. S&P futures +0.5%.

Week ahead: FOMC minutes on Tuesday, PCE inflation on Wednesday, US markets closed on Thursday for Thanksgiving. Euro flash CPI and German unemployment on Friday, France ratings review by S&P. RBNZ rate decision on Wednesday. CPI for Australia, Poland. South Korea forecast to keep rates on hold.

CFTX weekly FX positions: Euro shorts jump to 6.5%, JPY shorts cut to 18.5%, GBP longs drop to 18.3%, AUD longs steady at 17.4%, CAD shorts trimmed to 52.7% and CHF shorts raised to 44.9%, MXN longs cut to 10.0%.

Nikkei +1.3%, EUR 10y IRS -1bp at 2.26%, Brent crude -0.7% at $74.6/b, Gold -1.8% at $2,667/oz.

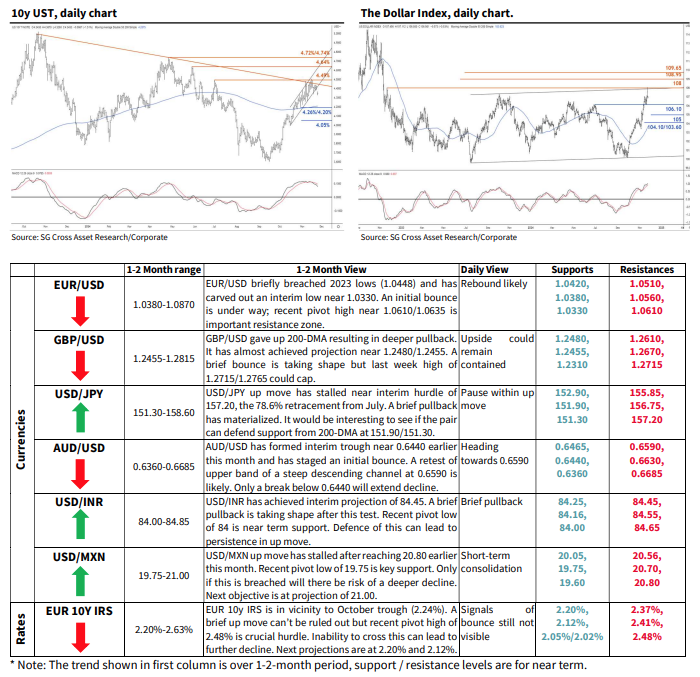

EUR/USD: 1.0429 - 1.0501 overnight range. Short covering follows retracement in US yields on pick of Bessent as Treasury Sec. Risk still skewed to the downside on ECB/Fed, French budget. Support 1.0420, resistance 1.0560. Option expiry at 1.0470-85 (€2.2bn).

USD/JPY: 153.55 - 154.51 overnight range. Spot offered as 10y UST/JGB narrows to 325bp on US Treasury pick. Support 152.90, resistance 155.85. Scale of Yen short covering this week contingent on FOMC minutes and US PCE. Tokyo CPI on Thursday.

GBP/USD: 1.2570 - 1.2607 overnight range. Cable rebound runs out of steam near 1.2600. No first-tier UK data this week, focus on BoE speakers. Support 1.2535, resistance 1.2670. EUR/GBP consolidates at bottom end of range above 0.8300, support 0.8260.

AUD/USD: 0.6507 - 0.6550 overnight range. Spot bid in Asia but quickly run into profit taking, back to unchanged on the day. Support 0.6465, resistance 0.6590. October CPI due on Wednesday. RBNZ likely to cut key rate by 50bp to 4.25% on Wednesday

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!