Institutional Insights: HSBC FX Tactician

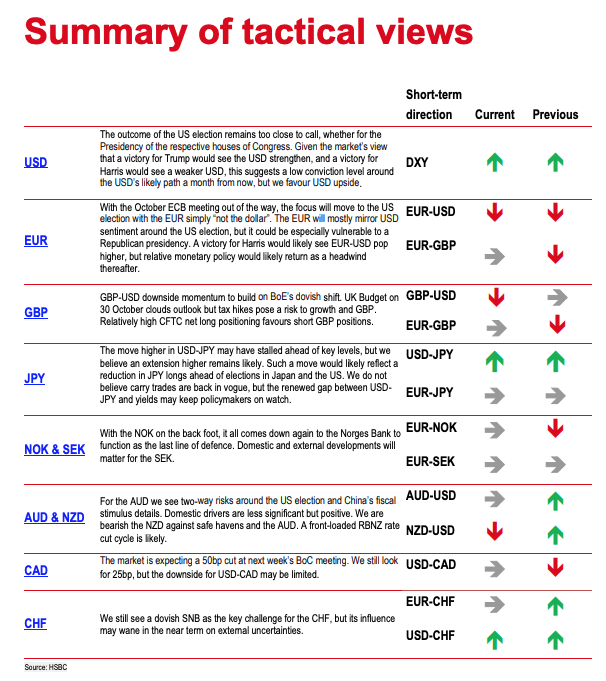

◆ Depending on the results of the US election, the USD could rally or weaken; given the close polls, it is best avoided

◆ While we expect the USD to extend its rally up to the 5 November election day, our conviction level thereafter is low

◆ While the EUR will simply do the opposite of the USD, GBP may see independent weakness; we play it vs the AUD

The USD continues to be dominated by the outlook for relative interest rates, enjoying a strong October so far on the back of retreating expectations for the likely scale of policy rate cuts by the Fed, against dovish moves elsewhere. But the coming few weeks are likely to be dominated more by politics than monetary policy, with the US elections looming on 5 November. Opinion polls suggest the races for the White House, Senate and House of Representatives remain too close to call. This is a problem for the FX market as the implications for the USD of different results are varied. In its simplest characterisation, we believe a victory for Donald Trump would boost the USD initially, while a victory for Kamala Harris would likely see it weaken. While we are confident that the USD may rally in the run-up to election day as investors de-risk amid this uncertainty, our conviction level on the USD’s direction for the immediate aftermath of the election is low. If the election outcome is a coin toss, so is the direction for the USD. It is best avoided.

Open a trade idea to sell GBP-AUD @ 1.9440, target 1.9080, stop 1.9665 Instead, we look to the crosses, and particularly ones which strip out risk appetite. For the weak leg of our cross, we turn to GBP. On the monetary policy front, we expect the dovish momentum around the BoE to continue, aided by the downturn in headline UK inflation, and likely to be fostered further should services inflation decelerate as we expect. The 30 October budget will add a fiscal headwind to growth. Loose monetary and tight fiscal policy is rarely a currency positive. On the other side of the equation sits the AUD. While it is exposed to the US election result through the implications for US-China trade (notably in steel), we believe a high-forlonger narrative from the RBA should provide some offset. The AUD also looks cheap relative to recent improvements in China-related sentiment. That said, we keep a relatively tight stop just above 1.96. Elsewhere, the EUR is likely to simply mirror USD sentiment in the run-up to the election, and in the weeks after the result. Beyond politics, we think the relative monetary policy narratives still favour more EUR-USD downside. We see some upside for USD-JPY, with resistance at 150 and 152 likely to be breached. We remain cautious on the NZD, but look for relative stability in the NOK, SEK and CAD. The CHF may be caught between local headwinds and external supports

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!