Institutional Insights: Goldman Sachs Tactical Flow-of-Funds: Year-End FOMO

GS Tactical Flow-of-Funds: Year-End FOMO

There are 18.5 days left to trade in 2024. The US equity market has hit 55 new ATH’s on pace for 56 this morning and higher in 10 out of the last 11 trading sessions. Cyber Monday deals keep getting extended and the US equity market rally is no different. These are the most important dynamics in the market place to close out

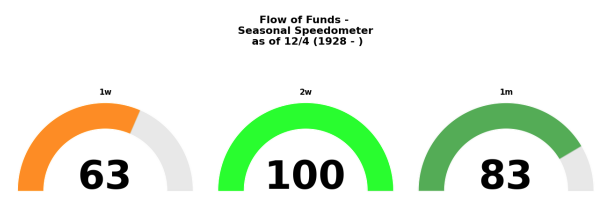

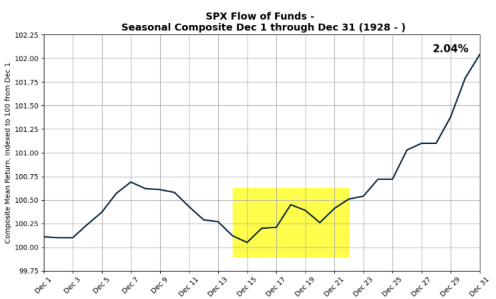

Seasonals are strong, best of the year. Since 1928, the S&P 500 median monthly return for December is +2.04%. These positive seasonals are led by the second half of December into a low liquidity trading environment.

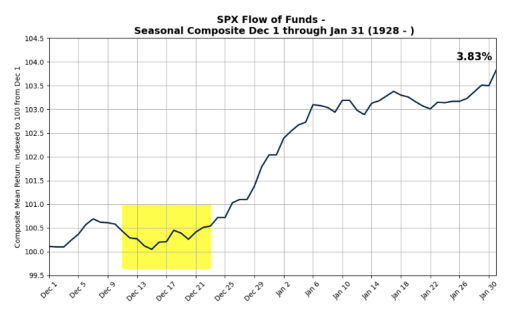

The January effect is when the largest capital in the world gets deployed into the US equity market during the first few weeks of the year. Since 1928, the S&P 500 median monthly return for December and January is +3.83%.b. Record inflows into US stocks.

Daily passive “index” demand: There are more buyers than sellers. US Equities saw a whopping +$141.08 Billion worth of inflows over the last 4 weeks - the largest monthly inflows on record by far. All other equity funds ex-US saw outflows of $8 Billion during the last month.

Retail traders are back: Retail traders unite at the town watering hole. GS Equity Panic Index has taken out new lows and we are seeing retail activity to pick up. This can also been seen in record call options (largest on record) and high-flying names.

Liquidity = Good right now S&P 500 top book liquidity, or the ability to move risk quickly, is $21M today. This is the highest level in 6 months. Liquidity tends to decline during the last two weeks of the year, and we should expect to see larger market moves and more impact from trading

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!