Institutional Insights: Goldman Sachs Tactical Flow of Funds 13/12/24

.jpeg)

GS Tactical Flow-of-Funds: The Twelve Days of Flows

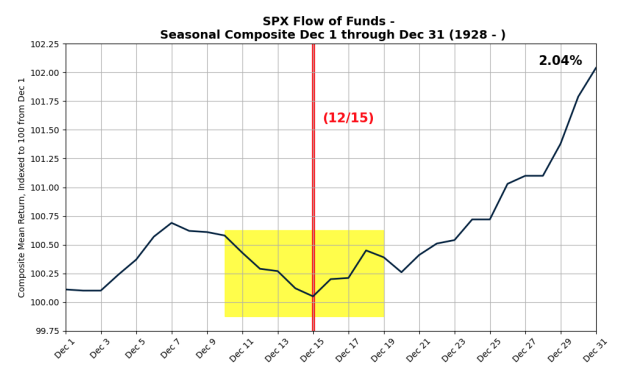

a. We are entering the best seasonals of the year for US equities, and the bar for being bearish right now remains high with 12.5 days to trade.

b. The flow story has been the major driver in 2024. Below is a rundown of supply and demand.

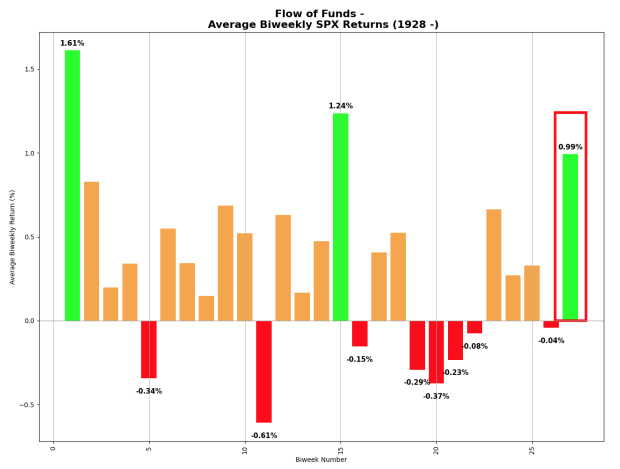

c. I am looking to fade the equity market in the second half of January as the risk of overshooting remains high. S&P Lookback Put trade ideas available.

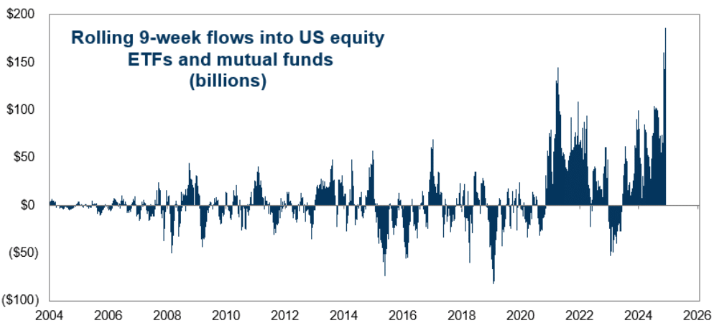

Eleven Trillion passive flow-ing: Current Passive AUM = $11.773 Trillion. US equities logged +$186 Billion worth of inflows over the last 9 weeks, the largest inflow on record. Money is flowing into US equities since the 2024 election. This is the largest 9-week inflow since $144 Billion since February 2021.

Liquidity is also super strong right now, with top book liquidity ~$34M, heading into quarterly roll period.

Current assets under management in money markets is $ 9 Trillion. Money Markets saw +$992 Billion worth of inflows YTD, best on the board. Does any cash, any at all, move? If a mere (ZZZ) ~1% moves out of money markets, that’s $90 Billion worth of rotational flow.

We are entering the 3rd best two-week period of the year since 1928 (DEC 2H) Followed by the best two-week period of the year since 1929 (JAN 1H).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!