Institutional Insights: Goldman Sachs Tactical Flow Of Funds

According to Goldman Sachs flow desk 'Tactical Flow-of-Funds: Positive Technical Equity Dynamics

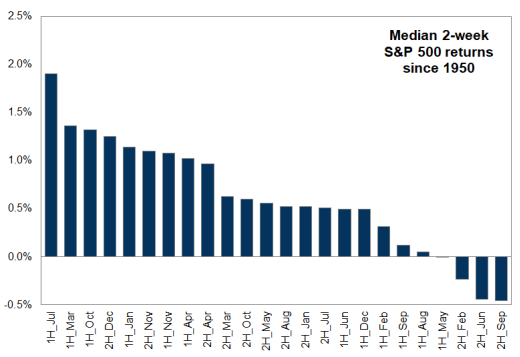

1. There is a very positive 4-week equity trading window until September

16th. This is a no rules market.

2. The pain trade for equities is higher as global two-week vacations started

on Friday at 4pm. The bar for being bearish at the beach into a Labor Day

BBQ party is high. This is new.

3. US equities have acted like a bunch of RINO’s (Recession In Name ONLY)

since the August 5th vol/carry event. $VIX has declined by 61.78% over the

last 9 trading days, the biggest 9-day volatility decline in history.

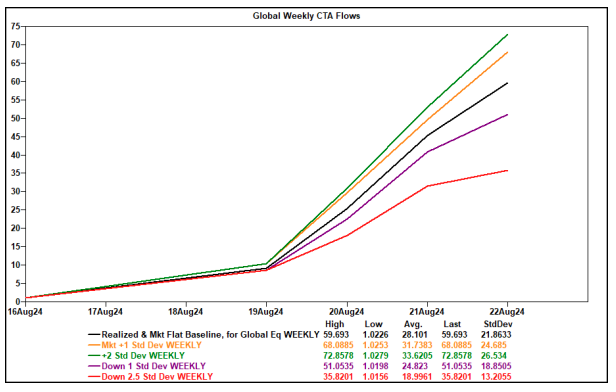

4. CTA releveraging, Target Vol / Vol Control, unwinding of puts, and

corporate demand will act as a tailwind as sellers are out of ammo forcing

fundamental investors in higher. $ flow of funds demand will have a larger

IMPACT when adjusted for August liquidity.

5. Dealer gamma will now act as a market buffer again as index desks get

longer from vol sellers and buying the dip in QIS / carry strategies (we like

this trade).

Bottom line on the direction of travel from here:

1. There is a short-term window to buy the dip as technical pressure eases.

2. Late 2H September will be a tricky trading environment (especially preelection).

3. SPX $6K - new highs in Q4, led by November and December months.

4. BONUS

"Straight Cash Homie"

Global Money Markets AUM = $8.8 Trillion

US Money Market AUM = $7.3 Trillion

Money market yields are starting to materially decline.

"Cash" on the sidelines has started to peak.

My view is that this mountain will start to get deployed elsewhere after the

US election.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!