Institutional Insights: Goldman Sachs FX & Gold Morning Calls

.jpeg)

Bottom Line: The pause in reciprocal tariffs on April 9 helped alleviate the tightening of financial conditions, pulling the US economy back from the brink of a recession. We believe there is still potential for re-evaluating the risk and reward of Dollar assets, and we expect the USD to continue its decline over time.

We maintain that the risk of a recession is underestimated relative to our views and that markets are susceptible to any news indicating rising risks. In the event of a full-blown recession, we anticipate the S&P 500 could trade around 4600, high-yield credit spreads could exceed 600 basis points, and shorter maturity yields could drop below 3%. We also believe that any significant increase in the unemployment rate would prompt the Fed to take decisive action, potentially resulting in 200 basis points of cuts in a relatively short period.

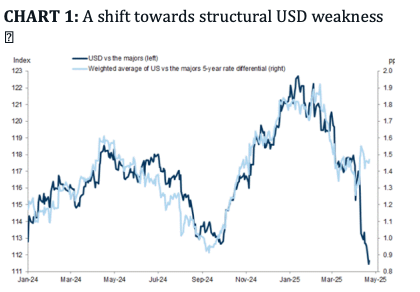

FX: The weakening of the Dollar, alongside the strengthening of safer G9 currencies like the Japanese Yen, Swiss Franc, and Euro, has surpassed cyclical changes, indicating a broader desire to reduce US allocations. USD weakness has become disconnected from interest rate differentials, with the 10-year forward EUR/USD rate appreciating alongside the spot rate, suggesting a deeper structural shift. The recent unusual 'EM-style correlations' (USD down, equities down, yields higher) may resemble the unwinding of an 'EM-style carry trade,' where leveraged investors, long on US assets and FX-unhedged, are compelled by political events to rapidly reassess their return and quality prospects, shifting towards more diversified portfolios. Even if foreign investors do not sell their US assets, there is ample room for hedge ratios to increase.

Typical portfolio hedges, such as longer-dated US Treasuries and USD longs, have recently failed to protect against equity risk. Although implied volatility has retreated from extreme levels, it remains high relative to historical standards across most assets, making options protection expensive. We see value in a broader set of hedges—German bonds and, to a lesser extent, UK bonds have offered more effective protection than Treasuries through April. Traditional non-Dollar safe havens like JPY, CHF, and gold continue to perform well. Positioning for further USD weakness, at least against the G10, should hedge against the risks of sustained reallocation away from US assets, especially as a change in Fed leadership comes into focus.

COMMODITIES RESEARCH – Gold: An Attractive Entry Point

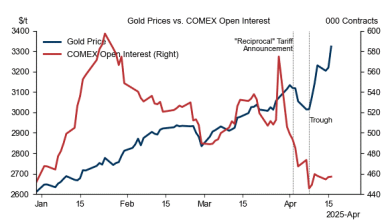

BOTTOM LINE: Although Gold has experienced a significant rally in recent weeks, data indicates that this movement has occurred without a substantial return of speculative flows (Chart 1). COMEX open interest has largely remained stable, and we estimate that speculative re-entry has contributed to only about 1 percentage point of the 7% rally. The timing and structure of the sharpest price movements, particularly on April 9, 10, and 16, suggest that the majority of the rally was driven by Asian official sector buying.

We consider current levels as a tactically attractive entry point and believe this supports the upside risk to our $3,700/toz year-end forecast. We recommend expressing this view through the following trades:

- 6m EURUSD > 1.20 XAUUSD > 3600 at 10.75% USD

- Individual rates are 20.75% and 26.15% respectively, 10.5 dfm

- Spot reference: 1.1385 and 3320

- 6m USDCNH > 7.35 XAUUSD > 3600 at 8.75% USD

- Individual rates are 26.4% and 26.15% respectively, 6.5 dfm

- Spot reference: 7.2935 and 3320

CHART 1: Despite the Rebound, Speculative Traders have Not Significantly Re-Entered the Market

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!