Institutional Insights: Goldman Sachs Flow of Funds Update 16/01/25

GS Tactical Flow of Funds: Quick Update FICC and Equities | January 2025

GS Tactical Flow of Funds: Quick Equity Update Flow of Funds

Checklist: Beyond CPI - this operates in both directions I've received more inquiries this morning following CPI than I can recall. Here are the key client themes:

a. Significant current equity short position

b. High systematic fixed income short

c. Short equity index gamma

d. Decrease in sentiment and leverage

e. Corporate blackout period concludes next week

f. Positive 2H Seasonals

Bottom Line: This is a positive outlook. Equity flow of funds appears favorable for a short-term rally, which was paused at the beginning of 2025. These are the 10 factors.

1. The largest macro ETF shorting activity since 2021 has been observed at GS PB. The current macro discretionary equity short position at GS PB is notably high. ETF shorts have increased by 24% over the past month, marking the quickest rise since February 2021, during the meme stock phenomenon. The proportion of ETFs within the GS Prime US short book has reached its highest point since December 2023.

2. Systematic Short in Global Fixed Income

The systematic short positioning in global fixed income is currently high, and equity investors are closely monitoring the bond market.

In the upcoming week...DV01

a. Flat market: Sellers at $20.16 million ($0.90 million out of the US)

b. Rising market: Sellers at $15.67 million ($1.53 million into the US)

c. Declining market: Sellers at $23.65 million ($2.24 million out of the US)

In the next month...DV01

d. Flat market: Sellers at $25.40 million ($0.74 million out of the US)

e. Rising market: Buyers at $93.56 million ($34.05 million into the US)

f. Declining market: Sellers at $7.91 million ($5.52 million into the US)

3. Today, we are short on index gamma and expect to ease off on gamma as we approach OpEx on Friday. For the first time in 2025, index gamma is currently short (-$700m), marking the highest short position since December 30, 2024, and September 18, 2024. Our model indicates that gamma positioning increases during downward moves and decreases during upward rallies.

4. De crease in overall market leverage

Reduction in leverage among both professional and systematic investors.

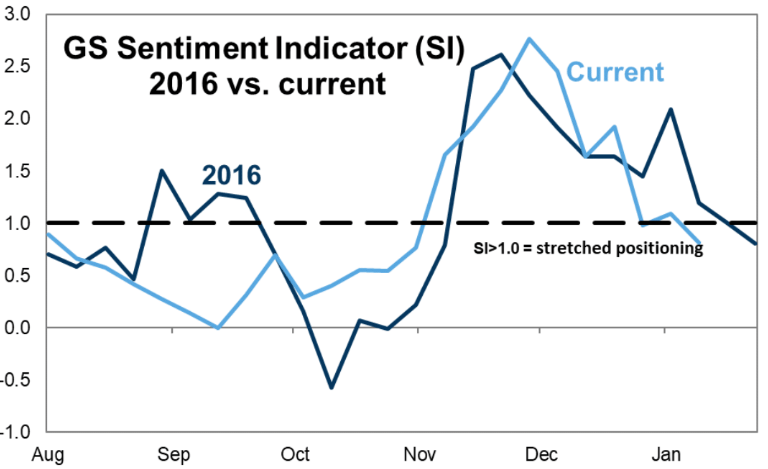

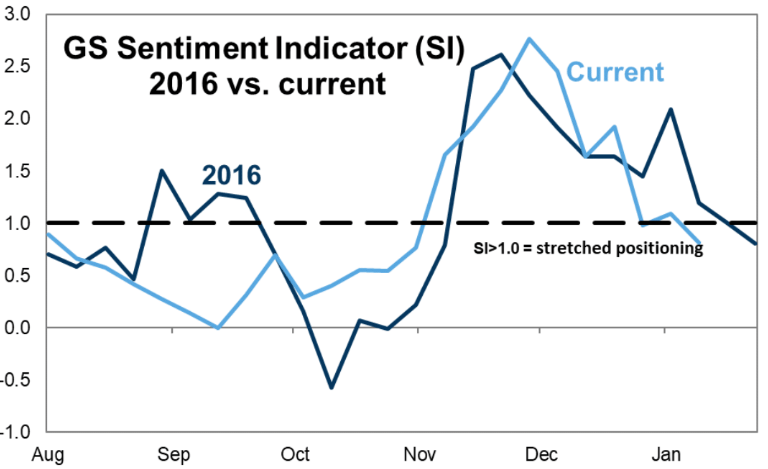

5. Sentiment Un-Stretched and fairly typical during Trump 1.0.

The sentiment is no longer heightened and is similar to the post-election sentiment seen during Trump 1.0.

6. Money Markets

Global money market funds experienced an inflow of +$143.3 billion last week.

This marks the highest weekly inflow since March 25, 2020 (during the COVID period).

That's just cash, my friend.

The key takeaway is that the capital is shifting and poised to invest in equities once the news (and prices) begin to stabilize.

7. Current Peak Corporate Blackout

Just a reminder, the GS US portfolio strategy anticipates $1 Trillion in demand by 2025, starting next week. The corporate repurchase window will open on January 24th, with 45% of the S&P market capitalization set to re-enter the market. We are currently in the midst of the peak blackout period.

8. Liquidity continues to be low and under pressure (affecting both sides).

9. The options market

The CPI straddle was high.

The straddle on the S&P that reflects today’s CPI report suggests a market movement of 1.15%.

This is the highest CPI straddle observed since March 2023. We believe there is greater potential for stock gains than losses.

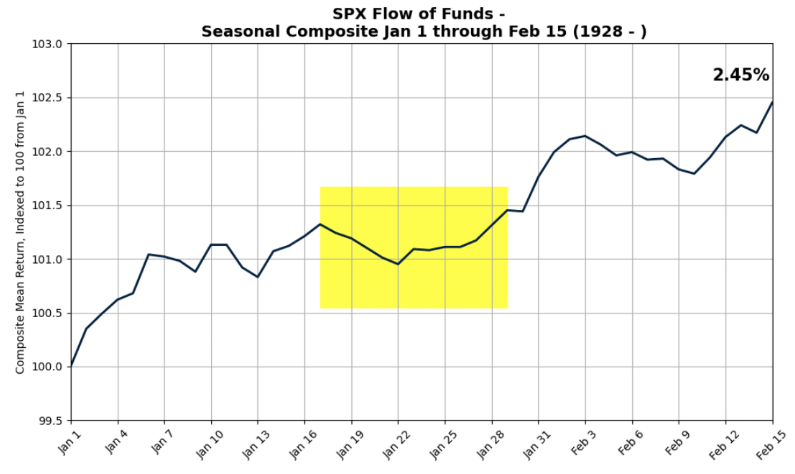

10. Seasonals

S&P 500 is entering a period of seasonal consolidation, hitting a low locally around January 22 nd before moving higher into mid-February.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!