Institutional Insights: Goldman Sachs CPI Scenario Analysis SP500 & FX

.jpeg)

Goldman Sachs: CPI PREVIEW

FICC and Equities

From GS Research: We anticipate a 0.25% rise in December core CPI (compared to a 0.2% consensus), leading to a year-over-year rate of 3.27% (against a 3.3% consensus); link.

• We project a 0.40% increase in December headline CPI (versus a 0.3% consensus), driven by a 0.35% rise in food prices and a 2.3% increase in energy prices. Our prediction aligns with a 0.21% rise in CPI core services excluding rent and owners’ equivalent rent and a 0.18% increase in core PCE for December.

• We emphasise three significant component-level trends we expect to observe in this month’s report:

We predict a 1.0% increase in used car prices, reflecting a rise in auction prices.

We foresee another 1.0% rise in airfares, influenced by seasonal distortions.

We expect a slight acceleration in the car insurance category (+0.3%) due to ongoing, though slowing, increases in premiums in our online dataset.

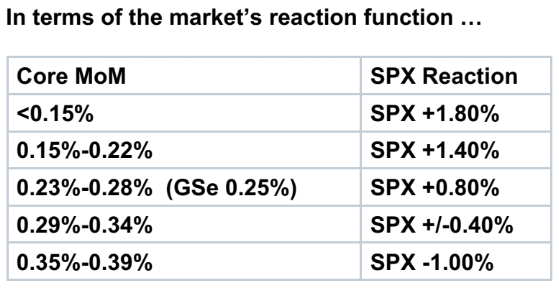

• Looking ahead, we anticipate further disinflation in the pipeline over the next year due to rebalancing in the auto, housing rental, and labour markets, although this may be countered by an escalation in tariff policy. We project a year-over-year core CPI inflation of 2.7% and core PCE inflation of 2.4% in December 2025.*SPX expected movement by today’s close is approximately 1.15%

SPX

While our baseline forecast for the US remains positive for equities and credit, we have recently pointed out that the combination of high growth expectations and a more hawkish Federal Reserve complicates the local risk environment. US equities may require clear signs of relief from hawkish policies to achieve a sustained upward movement. Although we anticipate this to be the eventual outcome, the market may need to gather substantial evidence before reaching that point, and we believe equities could stay more vulnerable until the perception that the Fed's support is now "lowered" is reversed. Our prediction for the December Consumer Price Index (CPI) does not provide an obvious source of relief: we are forecasting a headline CPI of 0.4%, which is above consensus, and our core CPI forecast (25 basis points month-over-month, 3.3% year-over-year) aligns closely with current consensus estimates. Following today’s Producer Price Index (PPI), this would lead to a core Personal Consumption Expenditures (PCE) forecast of 22 basis points. The positive aspect is that the market is already pricing in only one full rate cut over the next few years, indicating that the Fed is perceived to be close to a hold, and this adjustment has already impacted US stocks since the December Federal Open Market Committee (FOMC) meeting. Consequently, the threshold for a significant hawkish surprise has increased. This may create some potential for short-term relief in both rates and equities if the actual number does not exceed expectations significantly. However, we still believe that the near-term macro environment for equities could remain unclear, especially with the incoming administration's policies coming into sharper focus after the inauguration next week. Implied volatility for the S&P 500 (SPX) has risen significantly since the lows in early December, but it is still not at unusually high levels, particularly for longer tenors, meaning that options still present some value given the broad range of possible policy outcomes.

FX

This CPI report is set to impact already delicate markets that are grappling with the increase in US real rates due to higher expectations for terminal/neutral rates. In the foreign exchange market, we've noticed sporadic signs of more volatile movements recently in currencies sensitive to interest rates, such as the GBP. Consequently, a surprising upside in the data could provoke a stronger reaction as it would affect these vulnerable areas. I believe that the markets would find only limited reassurance in a significant gap between CPI and PCE, as the Fed must monitor both indicators, even if it favours the PCE. With the Fed linking the increased projections to another inflation forecast that "collapsed," a genuinely stronger CPI reading would add to the challenges facing the UK, while we've also observed recent underperformance in other interest rate-sensitive currencies like SEK, INR, and IDR. Conversely, a weaker CPI reading would provide much-needed relief and ease some concerns. However, it would require a substantial downside surprise to significantly advance the likelihood of rate cuts, particularly with the uncertain price adjustments at the beginning of the year approaching.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!