Institutional Insights: Deutsche Bank - Investor Flows & Positioning 10/2/25

Deutsche Bank: Navigating Cross Currents

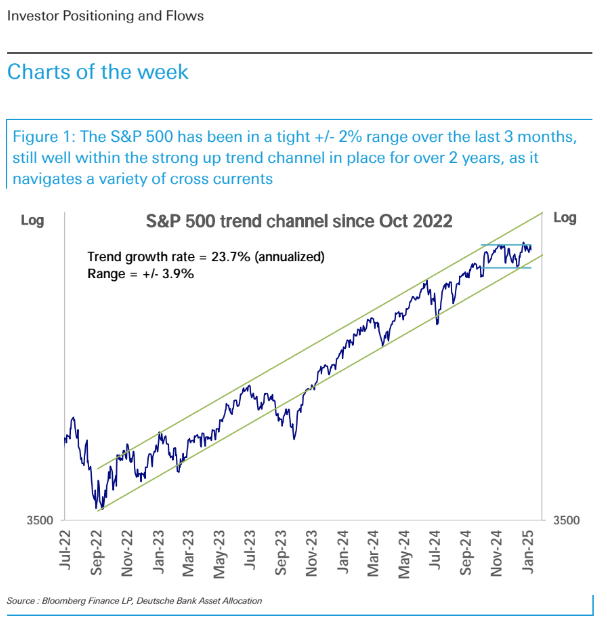

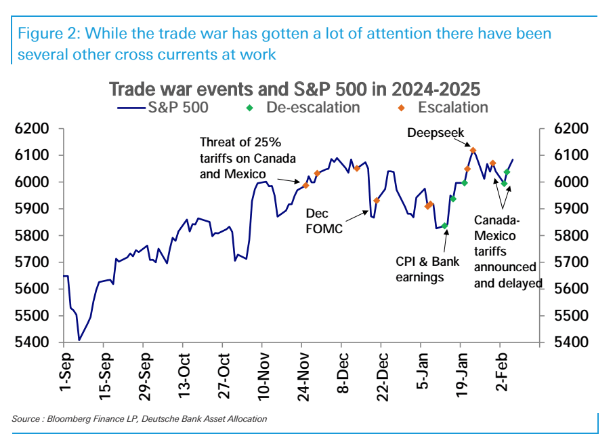

The S&P 500 has been fluctuating within a narrow range of +/- 2% for the past three months following the initial surge after the election. While developments in trade policy have captured the most attention, several other factors are impacting equities, including renewed volatility in rates due to concerns about overheating and inflation, signs of improvement in manufacturing, and strong earnings growth encountering high positioning this earnings season, particularly in mega-cap growth and technology sectors.

As we mentioned two weeks ago, there are numerous fundamental factors that have contributed to the resilience of equities amidst escalating trade tensions, but this resilience may lead to further trade escalations and potential equity pullbacks (refer to "Are Equities Complacent On Tariffs? Jan 24 2025"). We view these potential declines through the lens of a historical playbook for geopolitical shocks, which typically showcase sharp but brief selloffs, with equities often finding a bottom even while the event persists and generally recovering all losses well before any resolution has occurred. This implies that repeated catalysts elicit diminishing responses. We anticipate a de-escalation in trade if equities experience significant pullbacks (a -10% drop being a crucial threshold under Trump 1.0) or if economic data weakens, as prioritizing growth remains a key focus for the Trump administration. The economic environment has consistently triumphed over shocks, and we note that the underlying cyclical conditions still appear very favorable, with signs of improvement in manufacturing emerging as we have been anticipating.

Nonetheless, with renewed worries about overheating and the inflationary effects of tariffs coming to light once more, equities have been moving inversely with rates over the last three months. It is important to reiterate that it is the volatility of rates that has historically been crucial for equities, rather than their absolute levels. There is significant potential for rate volatility to decrease, even with rates remaining unchanged ("Higher Rates or Higher Vol? Nov 2022").

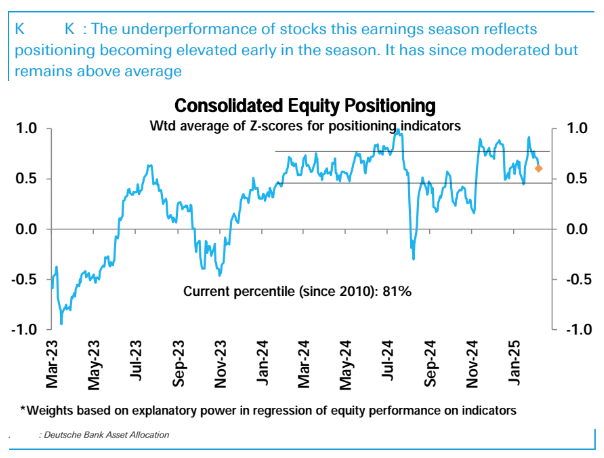

With the earnings season progressing, we observe that earnings beats have been above average, demonstrating solid growth, which has indeed reached its highest level in three years. However, stocks have experienced a marked underperformance post-reporting this season, which we attribute to extremely high equity positioning earlier in the season (in the 96th percentile), leaving limited potential for further gains. Our assessment of equity positioning has now eased, yet it remains above average (z-score of 0.60, 81st percentile). In a related note, the very high positioning of mega-cap growth and technology stocks has resulted in their lack of movement throughout this earnings season, despite delivering strong earnings reports.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!