Institutional Insights - Credit Agricole October Month End Model

Institutional Insights - Credit Agricole October Month End Model

Neutral month-end & corporate EUR buying

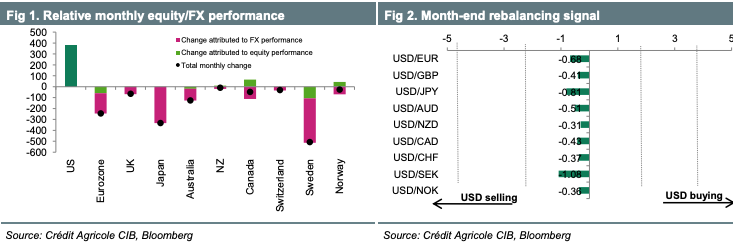

Global equity markets were somewhat mixed in October. In FX, the USD has outperformed across the board on the month. Overall, the moves in equity markets, when adjusted for market capitalisation and FX performance this month, suggest month-end portfolio-rebalancing flows are likely to be neutral across the board with the strongest sell signal in the case of the USD vs SEK. Our corporate flow model is pointing to EUR buying at the end of the month. However, in the absence of a signal from the month-end rebalancing model, there is no trade recommendation this month.

We derive signals from the net corporate EUR-flows by examining corporate EUR buying and selling in the days before month-end. In particular, under the trading strategy, evidence of net EUR-buying would constitute a buy signal while indications of net EUR-selling would trigger a sell signal ahead of month-end. We combine the monthly signal from our corporate EUR-flows with the signals from our month-end rebalancing model. To this end, when the signal from the flow data corroborates the EUR/USD signal from the month-end rebalancing model, we allocate the full portfolio weight to buying or selling EUR/USD at monthend. When the signals diverge, we revert to the original month-end rebalancing model, using the different portfolio weights to place trades on the G10 USDcrosses.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!