Institutional Insights: Credit Agricole JPY Election Scenarios

JPY: Japan election scenarios

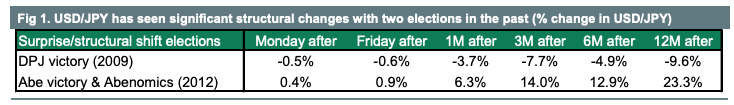

The current Lower House election offers some rare excitement for the JPY as it will act as a barometer of new PM Shigeru Ishiba’s ability to shake off LDP factional resistance to any move away from Abenomics.

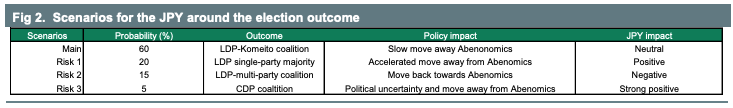

The most likely outcome (60% odds) is that the LDP will lose its singleparty majority and have to rely on Komeito to form a coalition government, which would signal a slow move away from Abenomics and have little effect on the JPY. This is the expected outcome of the market. The next likely outcome (20%) is the LDP holding onto its single-party majority, leading to an accelerated move away from Abenomics, which would be positive for the JPY.

A weak election result for the LDP (15%), ie, the LDP holding onto power only via a multiparty coalition, could lead to a shift back towards Abenomics, leading to weakening in the JPY. The strongest outcome for the JPY would be political uncertainty and a shift away from Abenomics that would be generated by a victory by the Constitutional Democratic Party of Japan. We place only a 5% probability on this outcome.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!