The art of trade wars

Sun Tzu advised, “Let your plans be dark and impenetrable as night, and when you move, fall like a thunderbolt”. He also said, “When you surround an army, leave an outlet free. Do not press a desperate foe too hard”. Donald Trump’s naturally chaotic style has him following the first piece of advice and his willingness to negotiate the second.

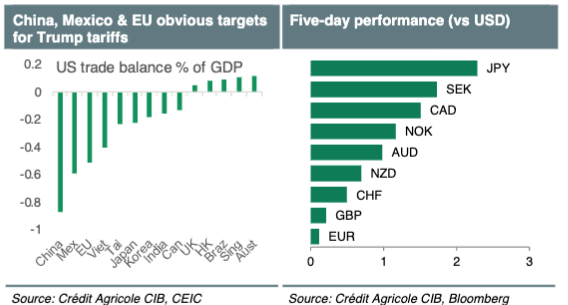

The goals of Trump’s trade wars are multiple. He expressed a desire to lower bilateral trade deficits and boost revenues to repair public finances. While China, Mexico and the EU are obvious targets, Canada is not.

But as the episode with Colombia showed, Trump is willing to use tariffs to further non-economic aims. Indeed, Mexico and Canada negotiated 30-day tariff reprieves on pledges of tougher border enforcement and actions to curb the flow of fentanyl into the US.

China chose to meet Trump’s extra tariffs with measured responses such as 10% tariffs on US crude oil and 15% tariffs on US coal and LNG, an anti-trust probe into Google and by adding US companies PVH and Illumina to its unreliable entities list.

China also lodged a complaint against the US at the WTO. Trump said he is in no rush to meet with President Xi Jinping and has left the 10% additional tariffs in place.

The implications for G10 FX are: (1) higher FX volatility; (2) the EUR lagging the G10 rebound vs the USD due to the lingering threat of US tariffs; (3) the AUD and NZD being held back by the ratchetting up of US-China trade tensions; and, (4) while the CAD has rebounded, 30 days is not a lot of time to deliver results on border control and fighting Fentanyl trafficking. Emboldened by early wins, Trump’s demands could grow.

Investors will remain sensitive to further tariff headlines in the coming week, but markets will also refocus on fundamentals, especially rates. US non-farm payrolls later today as well as inflation and retail sales data and FOMC Chair Jerome Powell’s semi-annual testimony next week will be important for US rates.

EZ and UK GDP data as well as BoE speak following its dovish cut this week will be important for the EUR and GBP. In Norway, a brighter outlook for the oil and gas sector could overshadow the January CPI prints. A meeting between Japan’s PM Shigeru Ishiba and President Trump later today will determine if the JPY remains immune to Trump tariffs and an outperformer among G10.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!